Annual Report - 2008 - Colombo Stock Exchange

Annual Report - 2008 - Colombo Stock Exchange

Annual Report - 2008 - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

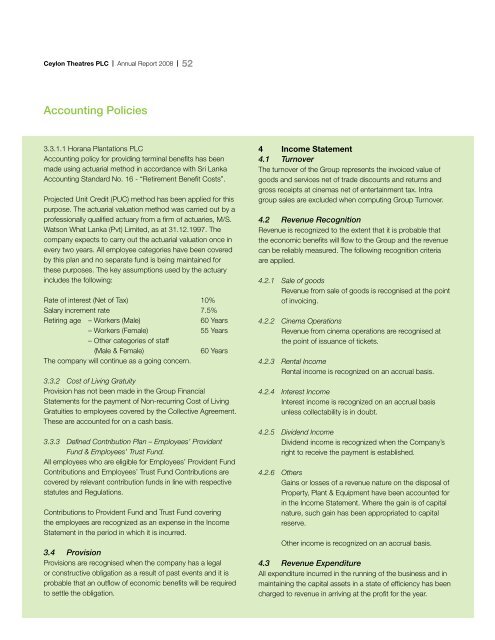

Ceylon Theatres PLC | <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | 52Accounting Policies3.3.1.1 Horana Plantations PLCAccounting policy for providing terminal benefits has beenmade using actuarial method in accordance with Sri LankaAccounting Standard No. 16 - “Retirement Benefit Costs”.Projected Unit Credit (PUC) method has been applied for thispurpose. The actuarial valuation method was carried out by aprofessionally qualified actuary from a firm of actuaries, M/S.Watson What Lanka (Pvt) Limited, as at 31.12.1997. Thecompany expects to carry out the actuarial valuation once inevery two years. All employee categories have been coveredby this plan and no separate fund is being maintained forthese purposes. The key assumptions used by the actuaryincludes the following:Rate of interest (Net of Tax) 10%Salary increment rate 7.5%Retiring age – Workers (Male)60 Years– Workers (Female) 55 Years– Other categories of staff(Male & Female)60 YearsThe company will continue as a going concern.3.3.2 Cost of Living GratuityProvision has not been made in the Group FinancialStatements for the payment of Non-recurring Cost of LivingGratuities to employees covered by the Collective Agreement.These are accounted for on a cash basis.3.3.3 Defined Contribution Plan – Employees’ ProvidentFund & Employees’ Trust Fund.All employees who are eligible for Employees’ Provident FundContributions and Employees’ Trust Fund Contributions arecovered by relevant contribution funds in line with respectivestatutes and Regulations.Contributions to Provident Fund and Trust Fund coveringthe employees are recognized as an expense in the IncomeStatement in the period in which it is incurred.3.4 ProvisionProvisions are recognised when the company has a legalor constructive obligation as a result of past events and it isprobable that an outflow of economic benefits will be requiredto settle the obligation.4 Income Statement4.1 TurnoverThe turnover of the Group represents the invoiced value ofgoods and services net of trade discounts and returns andgross receipts at cinemas net of entertainment tax. Intragroup sales are excluded when computing Group Turnover.4.2 Revenue RecognitionRevenue is recognized to the extent that it is probable thatthe economic benefits will flow to the Group and the revenuecan be reliably measured. The following recognition criteriaare applied.4.2.1 Sale of goodsRevenue from sale of goods is recognised at the pointof invoicing.4.2.2 Cinema OperationsRevenue from cinema operations are recognised atthe point of issuance of tickets.4.2.3 Rental IncomeRental income is recognized on an accrual basis.4.2.4 Interest IncomeInterest income is recognized on an accrual basisunless collectability is in doubt.4.2.5 Dividend IncomeDividend income is recognized when the Company’sright to receive the payment is established.4.2.6 OthersGains or losses of a revenue nature on the disposal ofProperty, Plant & Equipment have been accounted forin the Income Statement. Where the gain is of capitalnature, such gain has been appropriated to capitalreserve.Other income is recognized on an accrual basis.4.3 Revenue ExpenditureAll expenditure incurred in the running of the business and inmaintaining the capital assets in a state of efficiency has beencharged to revenue in arriving at the profit for the year.