PDF, 2,03 Mo - Groupe Casino

PDF, 2,03 Mo - Groupe Casino

PDF, 2,03 Mo - Groupe Casino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

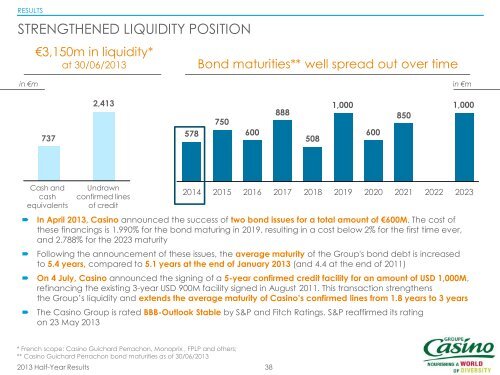

RESULTSSTRENGTHENED LIQUIDITY POSITION€3,150m in liquidity*at 30/06/2013Bond maturities** well spread out over timein €min €m7372,413 1,000 1,000888 850750578600 600508Cash andcashequivalentsUndrawnconfirmed linesof credit2014 2015 2016 2017 2018 2019 2020 2021 2022 2023In April 2013, <strong>Casino</strong> announced the success of two bond issues for a total amount of €600M. The cost ofthese financings is 1.990% for the bond maturing in 2019, resulting in a cost below 2% for the first time ever,and 2.788% for the 2023 maturityFollowing the announcement of these issues, the average maturity of the Group's bond debt is increasedto 5.4 years, compared to 5.1 years at the end of January 2013 (and 4.4 at the end of 2011)On 4 July, <strong>Casino</strong> announced the signing of a 5-year confirmed credit facility for an amount of USD 1,000M,refinancing the existing 3-year USD 900M facility signed in August 2011. This transaction strengthensthe Group’s liquidity and extends the average maturity of <strong>Casino</strong>’s confirmed lines from 1.8 years to 3 yearsThe <strong>Casino</strong> Group is rated BBB-Outlook Stable by S&P and Fitch Ratings. S&P reaffirmed its ratingon 23 May 2013* French scope: <strong>Casino</strong> Guichard Perrachon, <strong>Mo</strong>noprix , FPLP and others;** <strong>Casino</strong> Guichard Perrachon bond maturities as of 30/06/20132013 Half-Year Results38