Handbook for Self-employed Persons - National Insurance Scheme

Handbook for Self-employed Persons - National Insurance Scheme

Handbook for Self-employed Persons - National Insurance Scheme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

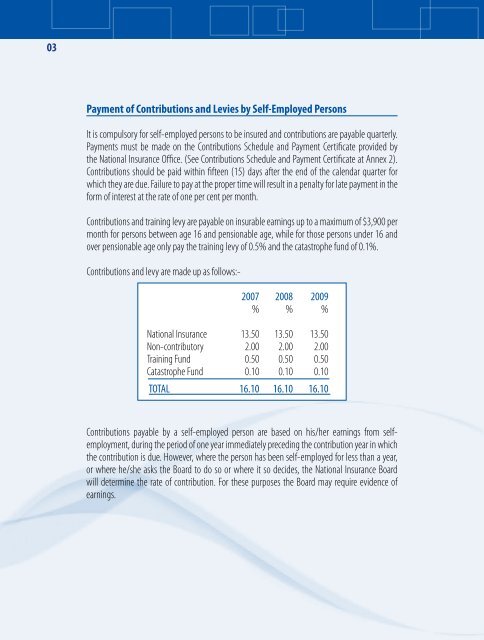

03Payment of Contributions and Levies by <strong>Self</strong>-Employed <strong>Persons</strong>It is compulsory <strong>for</strong> self-<strong>employed</strong> persons to be insured and contributions are payable quarterly.Payments must be made on the Contributions Schedule and Payment Certificate provided bythe <strong>National</strong> <strong>Insurance</strong> Office. (See Contributions Schedule and Payment Certificate at Annex 2).Contributions should be paid within fifteen (15) days after the end of the calendar quarter <strong>for</strong>which they are due. Failure to pay at the proper time will result in a penalty <strong>for</strong> late payment in the<strong>for</strong>m of interest at the rate of one per cent per month.Contributions and training levy are payable on insurable earnings up to a maximum of $3,900 permonth <strong>for</strong> persons between age 16 and pensionable age, while <strong>for</strong> those persons under 16 andover pensionable age only pay the training levy of 0.5% and the catastrophe fund of 0.1%.Contributions and levy are made up as follows:-2007 2008 2009 % % % <strong>National</strong> <strong>Insurance</strong> 13.50 13.50 13.50Non-contributory 2.00 2.00 2.00Training Fund 0.50 0.50 0.50Catastrophe Fund 0.10 0.10 0.10TOTAL 16.10 16.10 16.10 Contributions payable by a self-<strong>employed</strong> person are based on his/her earnings from self-employment, during the period of one year immediately preceding the contribution year in whichthe contribution is due. However, where the person has been self-<strong>employed</strong> <strong>for</strong> less than a year,or where he/she asks the Board to do so or where it so decides, the <strong>National</strong> <strong>Insurance</strong> Boardwill determine the rate of contribution. For these purposes the Board may require evidence ofearnings.