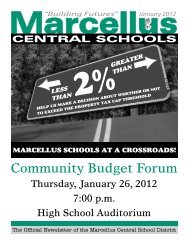

Community Budget Forum II - Marcellus Central School District

Community Budget Forum II - Marcellus Central School District

Community Budget Forum II - Marcellus Central School District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4CHORUSDRAMA & THEATREUnderstanding the PUZZLE of tBackground Information from the New York State <strong>School</strong> BoardsAssociation publication entitled The New 3 R’s: Reducing, Restructuringand Redesigning—<strong>School</strong> <strong>District</strong>s in the Tax Levy Cap Era“Reducing, Restructuring, and Redesigning” have become the New 3 Rsas school leaders work to preserve educational programs under New YorkState’s new property tax levy cap.TRANSPORTATIONThe New 3 Rs include many of the familiar budget strategies that schoolleaders have adopted over the past three years—drawing on reserves,cutting personnel, negotiating salary freezes, and using attrition andretirements to reduce costs. They also represent a move beyond theseone– or two-year savings toward actions that will yield more long-termsustainable cost-savings. These actions include reducing non-mandatedprograms, restructuring school buildings and grade configurations,and redesigning programs by sharing teachers and administrators withother districts. One school administrator summarized the New 3Rs as“finding a different way to do business as we move forward.”The reasons for the paradigm shift are clear. <strong>School</strong> districts and thetax levy cap are on a collision course. Projected expenditures forhealth insurance, and pensions alone for all school districts wouldexceed the maximum allowable tax levy increase under the levy capby $103 million in 2012-13. In fact, an analysis of 121 school districtsover the past two years clearly demonstrated the following:<strong>Marcellus</strong> <strong>Central</strong> <strong>School</strong>sVARSITYATHLETICS1. Nearly three-quarters of these districts would not have been able to raiseenough property tax revenues to make up for increased expenditures anddecreased state and federal revenues without going above the propertytax cap and requiring 60 percent voter approval. (For the current fiscal yearin the <strong>Marcellus</strong> CSD, even though the district cut 21.7 positions, reduced thebudget by $866,178, and used $1,463,812 in reserves to balance the budget,the school district STILL had to raise the local property tax levy 3.9% - anumber which would have exceeded the property tax cap if it was in existencefor the current year.)MODIFIEDATHLETICSCOMPTECHN