Financial Aid Guide - Briar Cliff University

Financial Aid Guide - Briar Cliff University

Financial Aid Guide - Briar Cliff University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

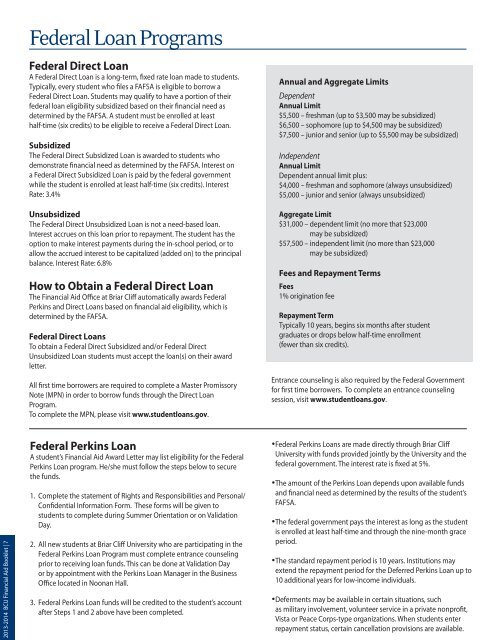

Federal Loan ProgramsFederal Direct LoanA Federal Direct Loan is a long-term, fixed rate loan made to students.Typically, every student who files a FAFSA is eligible to borrow aFederal Direct Loan. Students may qualify to have a portion of theirfederal loan eligibility subsidized based on their financial need asdetermined by the FAFSA. A student must be enrolled at leasthalf-time (six credits) to be eligible to receive a Federal Direct Loan.SubsidizedThe Federal Direct Subsidized Loan is awarded to students whodemonstrate financial need as determined by the FAFSA. Interest ona Federal Direct Subsidized Loan is paid by the federal governmentwhile the student is enrolled at least half-time (six credits). InterestRate: 3.4%UnsubsidizedThe Federal Direct Unsubsidized Loan is not a need-based loan.Interest accrues on this loan prior to repayment. The student has theoption to make interest payments during the in-school period, or toallow the accrued interest to be capitalized (added on) to the principalbalance. Interest Rate: 6.8%How to Obtain a Federal Direct LoanThe <strong>Financial</strong> <strong>Aid</strong> Office at <strong>Briar</strong> <strong>Cliff</strong> automatically awards FederalPerkins and Direct Loans based on financial aid eligibility, which isdetermined by the FAFSA.Federal Direct LoansTo obtain a Federal Direct Subsidized and/or Federal DirectUnsubsidized Loan students must accept the loan(s) on their awardletter.All first time borrowers are required to complete a Master PromissoryNote (MPN) in order to borrow funds through the Direct LoanProgram.To complete the MPN, please visit www.studentloans.gov.Annual and Aggregate LimitsDependentAnnual Limit$5,500 – freshman (up to $3,500 may be subsidized)$6,500 – sophomore (up to $4,500 may be subsidized)$7,500 – junior and senior (up to $5,500 may be subsidized)IndependentAnnual LimitDependent annual limit plus:$4,000 – freshman and sophomore (always unsubsidized)$5,000 – junior and senior (always unsubsidized)Aggregate Limit$31,000 – dependent limit (no more that $23,000may be subsidized)$57,500 – independent limit (no more than $23,000may be subsidized)Fees and Repayment TermsFees1% origination feeRepayment TermTypically 10 years, begins six months after studentgraduates or drops below half-time enrollment(fewer than six credits).Entrance counseling is also required by the Federal Governmentfor first time borrowers. To complete an entrance counselingsession, visit www.studentloans.gov.2013-2014 BCU <strong>Financial</strong> <strong>Aid</strong> Booklet | 7Federal Perkins LoanA student’s <strong>Financial</strong> <strong>Aid</strong> Award Letter may list eligibility for the FederalPerkins Loan program. He/she must follow the steps below to securethe funds.1. Complete the statement of Rights and Responsibilities and Personal/Confidential Information Form. These forms will be given tostudents to complete during Summer Orientation or on ValidationDay.2. All new students at <strong>Briar</strong> <strong>Cliff</strong> <strong>University</strong> who are participating in theFederal Perkins Loan Program must complete entrance counselingprior to receiving loan funds. This can be done at Validation Dayor by appointment with the Perkins Loan Manager in the BusinessOffice located in Noonan Hall.3. Federal Perkins Loan funds will be credited to the student’s accountafter Steps 1 and 2 above have been completed.• Federal Perkins Loans are made directly through <strong>Briar</strong> <strong>Cliff</strong><strong>University</strong> with funds provided jointly by the <strong>University</strong> and thefederal government. The interest rate is fixed at 5%.• The amount of the Perkins Loan depends upon available fundsand financial need as determined by the results of the student’sFAFSA.• The federal government pays the interest as long as the studentis enrolled at least half-time and through the nine-month graceperiod.• The standard repayment period is 10 years. Institutions mayextend the repayment period for the Deferred Perkins Loan up to10 additional years for low-income individuals.• Deferments may be available in certain situations, suchas military involvement, volunteer service in a private nonprofit,Vista or Peace Corps-type organizations. When students enterrepayment status, certain cancellation provisions are available.