You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

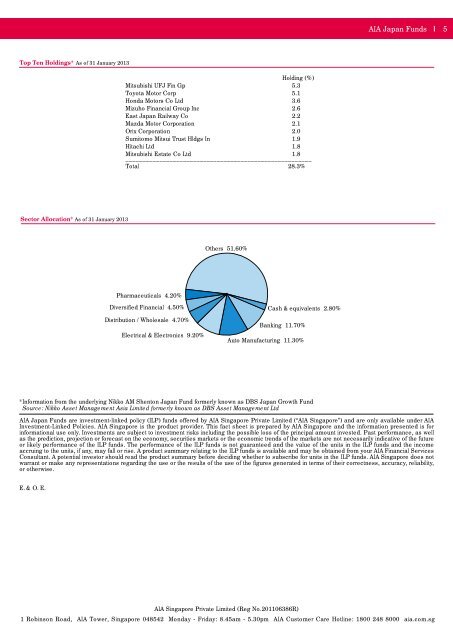

<strong>AIA</strong> <strong>Japan</strong> <strong>Funds</strong> 5Top Ten Holdings* As of 31 January 2013Holding (%)Mitsubishi UFJ Fin Gp 5.3Toyota Motor Corp 5.1Honda Motors Co Ltd 3.6Mizuho Financial Group Inc 2.6East <strong>Japan</strong> Railway Co 2.2Mazda Motor Corporation 2.1Orix Corporation 2.0Sumitomo Mitsui Trust Hldgs In 1.9Hitachi Ltd 1.8Mitsubishi Estate Co Ltd 1.8_______________________________________________________Total 28.3%Sector Allocation* As of 31 January 2013Others 51.60%Pharmaceuticals 4.20%Diversified Financial 4.50%Distribution / Wholesale 4.70%Electrical & Electronics 9.20%Banking 11.70%Auto Manufacturing 11.30%Cash & equivalents 2.80%*Information from the underlying Nikko AM Shenton <strong>Japan</strong> Fund formerly known as DBS <strong>Japan</strong> Growth FundSource: Nikko Asset Management Asia Limited formerly known as DBS Asset Management Ltd<strong>AIA</strong> <strong>Japan</strong> <strong>Funds</strong> are investment-linked policy (ILP) funds offered by <strong>AIA</strong> <strong>Singapore</strong> Private Limited (“<strong>AIA</strong> <strong>Singapore</strong>”) and are only available under <strong>AIA</strong>Investment-Linked Policies. <strong>AIA</strong> <strong>Singapore</strong> is the product provider. This fact sheet is prepared by <strong>AIA</strong> <strong>Singapore</strong> and the information presented is forinformational use only. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance, as wellas the prediction, projection or forecast on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the futureor likely performance of the ILP funds. The performance of the ILP funds is not guaranteed and the value of the units in the ILP funds and the incomeaccruing to the units, if any, may fall or rise. A product summary relating to the ILP funds is available and may be obtained from your <strong>AIA</strong> Financial ServicesConsultant. A potential investor should read the product summary before deciding whether to subscribe for units in the ILP funds. <strong>AIA</strong> <strong>Singapore</strong> does notwarrant or make any representations regarding the use or the results of the use of the figures generated in terms of their correctness, accuracy, reliability,or otherwise.E. & O. E.<strong>AIA</strong> <strong>Singapore</strong> Private Limited (Reg No.201106386R)1 Robinson Road, <strong>AIA</strong> Tower, <strong>Singapore</strong> 048542 Monday - Friday: 8.45am - 5.30pm <strong>AIA</strong> Customer Care Hotline: 1800 248 8000 aia.com.sg