PDF: 7881 KB - Bureau of Infrastructure, Transport and Regional ...

PDF: 7881 KB - Bureau of Infrastructure, Transport and Regional ...

PDF: 7881 KB - Bureau of Infrastructure, Transport and Regional ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

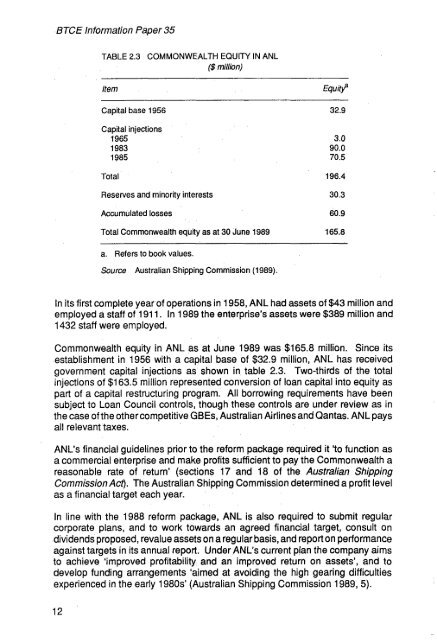

BTCE Information Paper 35TABLE 2.3 COMMONWEALTH EQUITY IN ANL($ million)ItemEquitfCapital base 1956Capital injections1965198319853.090.070.5Total 196.4Reserves <strong>and</strong> minority 30.3 interestsAccumulatedlossesTotal Commonwealth equity as 30 June at 1989 165.8a. Refers to book values.Source Australian Shipping Commission (1989).In its first complete year <strong>of</strong> operations in 1958, ANL had assets <strong>of</strong> $43 million <strong>and</strong>employed a staff <strong>of</strong> 1911. In 1989 the enterprise’s assets were $389 million <strong>and</strong>1432 staff were employed.Commonwealth equity in ANL as at June 1989 was $165.8 million. Since itsestablishment in 1956 with a capital base <strong>of</strong> $32.9 million, ANL has receivedgovernment capital injections as shown in table 2.3. Two-thirds <strong>of</strong> the totalinjections <strong>of</strong> $1 63.5 million represented conversion <strong>of</strong> loan capital into equity aspart <strong>of</strong> a capital restructuring program. All borrowing requirements have beensubject to Loan Council controls, though these controls are under review as inthe case <strong>of</strong> the other competitive GBEs, Australian Airlines<strong>and</strong> Qantas. ANL paysall relevant taxes.ANL‘s financial guidelines prior to the reform package required ‘to it function asa commercial enterprise <strong>and</strong> make pr<strong>of</strong>its sufficient pay to the Commonwealth areasonable rate <strong>of</strong> return’ (sections 17 <strong>and</strong> 18 <strong>of</strong> the Australian ShippingCommission Act). The Australian Shipping Commission determined a pr<strong>of</strong>it levelas a financial target each year.In line with the 1988 reform package, ANL is also required to submit regularcorporate plans, <strong>and</strong> to work towards an agreed financial target, consult ondividends proposed, revalue assets on a regular basis, <strong>and</strong> report on performancagainst targets in its annual report. Under ANL‘s current plan the company aimsto achieve ‘improved pr<strong>of</strong>itability <strong>and</strong> an improved return on assets’, <strong>and</strong> todevelop funding arrangements ‘aimed at avoiding the high gearing difficultiesexperienced in the early 1980s’ (Australian Shipping Commission 1989, 5).12