Capital Investments for Higher Education Institutions - NACUBO

Capital Investments for Higher Education Institutions - NACUBO

Capital Investments for Higher Education Institutions - NACUBO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

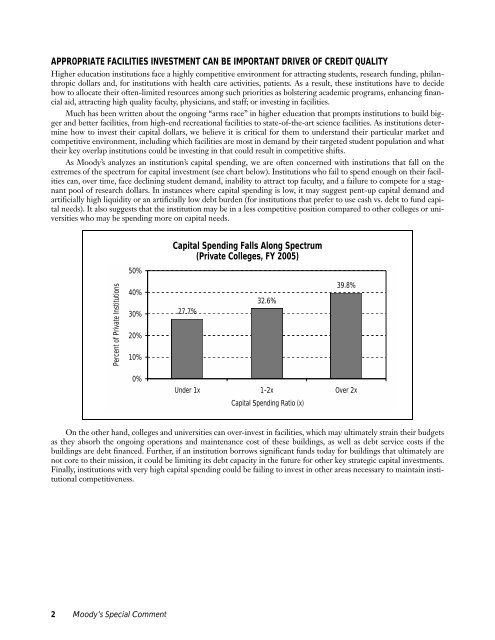

APPROPRIATE FACILITIES INVESTMENT CAN BE IMPORTANT DRIVER OF CREDIT QUALITY<strong>Higher</strong> education institutions face a highly competitive environment <strong>for</strong> attracting students, research funding, philanthropicdollars and, <strong>for</strong> institutions with health care activities, patients. As a result, these institutions have to decidehow to allocate their often-limited resources among such priorities as bolstering academic programs, enhancing financialaid, attracting high quality faculty, physicians, and staff; or investing in facilities.Much has been written about the ongoing “arms race” in higher education that prompts institutions to build biggerand better facilities, from high-end recreational facilities to state-of-the-art science facilities. As institutions determinehow to invest their capital dollars, we believe it is critical <strong>for</strong> them to understand their particular market andcompetitive environment, including which facilities are most in demand by their targeted student population and whattheir key overlap institutions could be investing in that could result in competitive shifts.As Moody’s analyzes an institution’s capital spending, we are often concerned with institutions that fall on theextremes of the spectrum <strong>for</strong> capital investment (see chart below). <strong>Institutions</strong> who fail to spend enough on their facilitiescan, over time, face declining student demand, inability to attract top faculty, and a failure to compete <strong>for</strong> a stagnantpool of research dollars. In instances where capital spending is low, it may suggest pent-up capital demand andartificially high liquidity or an artificially low debt burden (<strong>for</strong> institutions that prefer to use cash vs. debt to fund capitalneeds). It also suggests that the institution may be in a less competitive position compared to other colleges or universitieswho may be spending more on capital needs.50%<strong>Capital</strong> Spending Falls Along Spectrum(Private Colleges, FY 2005)Percent of Private <strong>Institutions</strong>40%30%20%10%27.7%32.6%39.8%0%Under 1x 1-2x Over 2x<strong>Capital</strong> Spending Ratio (x)On the other hand, colleges and universities can over-invest in facilities, which may ultimately strain their budgetsas they absorb the ongoing operations and maintenance cost of these buildings, as well as debt service costs if thebuildings are debt financed. Further, if an institution borrows significant funds today <strong>for</strong> buildings that ultimately arenot core to their mission, it could be limiting its debt capacity in the future <strong>for</strong> other key strategic capital investments.Finally, institutions with very high capital spending could be failing to invest in other areas necessary to maintain institutionalcompetitiveness.2 Moody’s Special Comment