Product Overlay Matrix - SWMC.com - Sun West Mortgage Company ...

Product Overlay Matrix - SWMC.com - Sun West Mortgage Company ...

Product Overlay Matrix - SWMC.com - Sun West Mortgage Company ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

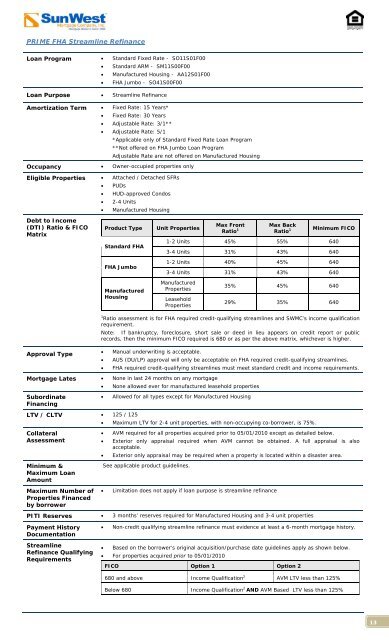

PRIME FHA Streamline RefinanceLoan Program • Standard Fixed Rate - SO11S01F00• Standard ARM - SM11S00F00• Manufactured Housing - AA12S01F00• FHA Jumbo - SO41S00F00Loan Purpose • Streamline RefinanceAmortization Term • Fixed Rate: 15 Years*• Fixed Rate: 30 Years• Adjustable Rate: 3/1**• Adjustable Rate: 5/1*Applicable only of Standard Fixed Rate Loan Program**Not offered on FHA Jumbo Loan ProgramAdjustable Rate are not offered on Manufactured HousingOccupancy • Owner-occupied properties onlyEligible Properties • Attached / Detached SFRs• PUDs• HUD-approved Condos• 2-4 Units• Manufactured HousingDebt to In<strong>com</strong>e(DTI) Ratio & FICO<strong>Matrix</strong><strong>Product</strong> TypeStandard FHAFHA JumboUnit PropertiesMax FrontRatio 1Max BackRatio 1Minimum FICO1-2 Units 45% 55% 6403-4 Units 31% 43% 6401-2 Units 40% 45% 6403-4 Units 31% 43% 640ManufacturedHousingManufacturedPropertiesLeaseholdProperties35% 45% 64029% 35% 6401 Ratio assessment is for FHA required credit-qualifying streamlines and <strong>SWMC</strong>’s in<strong>com</strong>e qualificationrequirement.Note: If bankruptcy, foreclosure, short sale or deed in lieu appears on credit report or publicrecords, then the minimum FICO required is 680 or as per the above matrix, whichever is higher.Approval Type• Manual underwriting is acceptable.• AUS (DU/LP) approval will only be acceptable on FHA required credit-qualifying streamlines.• FHA required credit-qualifying streamlines must meet standard credit and in<strong>com</strong>e requirements.<strong>Mortgage</strong> Lates • None in last 24 months on any mortgage• None allowed ever for manufactured leasehold propertiesSubordinateFinancing• Allowed for all types except for Manufactured HousingLTV / CLTV • 125 / 125• Maximum LTV for 2-4 unit properties, with non-occupying co-borrower, is 75%.CollateralAssessmentMinimum &Maximum LoanAmountMaximum Number ofProperties Financedby borrower• AVM required for all properties acquired prior to 05/01/2010 except as detailed below.• Exterior only appraisal required when AVM cannot be obtained. A full appraisal is alsoacceptable.• Exterior only appraisal may be required when a property is located within a disaster area.See applicable product guidelines.• Limitation does not apply if loan purpose is streamline refinancePITI Reserves • 3 months’ reserves required for Manufactured Housing and 3-4 unit propertiesPayment HistoryDocumentationStreamlineRefinance QualifyingRequirements• Non-credit qualifying streamline refinance must evidence at least a 6-month mortgage history.• Based on the borrower’s original acquisition/purchase date guidelines apply as shown below.• For properties acquired prior to 05/01/2010FICO Option 1 Option 2680 and above In<strong>com</strong>e Qualification 2 AVM LTV less than 125%Below 680 In<strong>com</strong>e Qualification 2 AND AVM Based LTV less than 125%13