- Page 1 and 2: Investor Day10 September 201308:15

- Page 3 and 4: Ivan GlasenbergCEO

- Page 5 and 6: Sector overview

- Page 7 and 8: Commodity prices reflect too much c

- Page 9 and 10: Merger update

- Page 11 and 12: Merger highlights• Integration co

- Page 13 and 14: Synergies of at least $2bn in 2014

- Page 15 and 16: Glencore Xstrata today - a leading

- Page 17 and 18: Low cost production base with high

- Page 19 and 20: Our philosophy and parameters on ca

- Page 21 and 22: Board reconstruction has begunAntho

- Page 23 and 24: Investor Day10 September 201308:15

- Page 25 and 26: CFO Highlights• Key regional hubs

- Page 27 and 28: Lower headline and sustaining capex

- Page 29 and 30: New debt guarantee structure implem

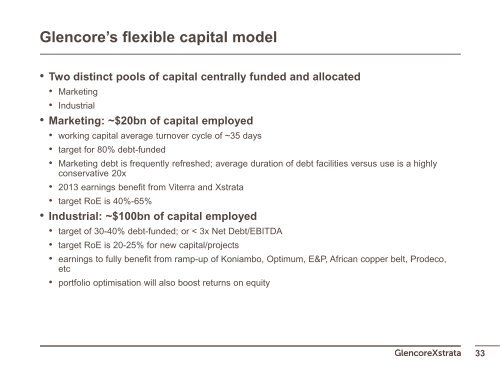

- Page 31: Balance sheet remains robust and fl

- Page 35 and 36: Q&A

- Page 37 and 38: How does Glencore find the best inv

- Page 39 and 40: Our values• Entrepreneurialism•

- Page 41 and 42: Growth - MarketingMarketing has mad

- Page 43 and 44: Duration of Marketing financing is

- Page 45: Solid credit profile across the cyc

- Page 48 and 49: This presentation has been prepared

- Page 50 and 51: Coal highlightsLeading thermal coal

- Page 52 and 53: Industrial synergies and cost savin

- Page 54 and 55: Jun12Exp ProjSavingsDec12Exp ProjSa

- Page 56 and 57: Thermal projects in execution will

- Page 58 and 59: Coal production mix offers geograph

- Page 60 and 61: Coal project commissioning datesUla

- Page 62 and 63: Major project update - Ravensworth

- Page 64 and 65: Major project update - TweefonteinA

- Page 66 and 67: Projects: Portfolio Rationalisation

- Page 68 and 69: Marketing - how we create valueArbi

- Page 70 and 71: Conclusion• The merger creates th

- Page 72 and 73: Investor Day10 September 201308:15

- Page 74 and 75: Chris MahoneyAgricultural Products

- Page 76 and 77: Historical pricesGlobal supply and

- Page 78 and 79: Trading and logistics are integrate

- Page 80 and 81: Viterra: significant reduction of o

- Page 82 and 83:

Agricultural Products location map8

- Page 84 and 85:

Glencore’s logistics infrastructu

- Page 86 and 87:

Asset baseCommodity Production capa

- Page 88 and 89:

Market update - short-term outlook

- Page 90 and 91:

Q&A

- Page 92 and 93:

This presentation has been prepared

- Page 94 and 95:

A high value, liquids-based strateg

- Page 96 and 97:

Glencore E&P progression• A strat

- Page 98 and 99:

Equatorial Guinea - Alen, now on st

- Page 100 and 101:

Cameroon - encouraging drilling res

- Page 102 and 103:

Chad - facilities completed and fir

- Page 104 and 105:

Glencore E&P - reservesGlencore gro

- Page 106 and 107:

Russneft• Corporate restructuring

- Page 108 and 109:

Oil departmentCEOIvan GlasenbergCFO

- Page 110 and 111:

Freight - ST Shipping and Transport

- Page 112 and 113:

ST Shipping fleet reductionShipping

- Page 114 and 115:

Investor Day10 September 201308:15

- Page 116 and 117:

Daniel MatéChris EskdaleZinc

- Page 118 and 119:

Zinc key asset overviewIndustrial a

- Page 120 and 121:

Zinc prioritiesWorld class portfoli

- Page 122 and 123:

Zinc divisional reporting structure

- Page 124 and 125:

Forecast zinc mine production growt

- Page 126 and 127:

Major project update - Bracemac-McL

- Page 128 and 129:

Major project update - George Fishe

- Page 130 and 131:

Further growth options• Multiple

- Page 132 and 133:

Marketing - how we create value•

- Page 134 and 135:

Xstrata merger opportunities - leve

- Page 136 and 137:

Market update - medium/long-term zi

- Page 138 and 139:

Q&A

- Page 140 and 141:

This presentation has been prepared

- Page 142 and 143:

Copper overviewThird largest global

- Page 144 and 145:

Integration outcome - Corporate and

- Page 146 and 147:

Resource baseContained copper in re

- Page 148 and 149:

Enlarged copper production profilek

- Page 150 and 151:

Modular investment can provide supe

- Page 152 and 153:

Major project update - KatangaDescr

- Page 154 and 155:

Major project update - Mutanda and

- Page 156 and 157:

Major project update - Mopani Syncl

- Page 158 and 159:

Major project update - Las BambasDe

- Page 160 and 161:

Further growth optionality - Mutand

- Page 162 and 163:

Further growth optionality - Corocc

- Page 164 and 165:

Chinese Fixed Assets Investment % y

- Page 166 and 167:

Crude steel consumption (Mt)Copper

- Page 168 and 169:

Crude steel consumption (Mt)Copper

- Page 170 and 171:

Global copper demand (Mt)Copper dem

- Page 172 and 173:

Q&A

- Page 174 and 175:

This presentation has been prepared

- Page 176 and 177:

Nickel highlightsTop three integrat

- Page 178 and 179:

Nickel divisional reporting structu

- Page 180 and 181:

Capital focusHighlights• XNA - Re

- Page 182 and 183:

Koniambo - construction and product

- Page 184 and 185:

Nickel resource baseContained nicke

- Page 186 and 187:

Mined nickel production profileOwn

- Page 188 and 189:

Nickel marketing

- Page 190 and 191:

Marketing chainOreConcentratesInter

- Page 192 and 193:

Healthy nickel demand growth to dat

- Page 194 and 195:

Excess nickel supply yielded hefty

- Page 196 and 197:

Development of NPI• NPI productio

- Page 198 and 199:

No NPI without IndonesiaKey feature

- Page 200 and 201:

Nickel market conclusionsThe bad ne

- Page 202 and 203:

Investor Day10 September 201308:15

- Page 204 and 205:

Stuart CutlerGary NagleFerroalloys

- Page 206 and 207:

Strong historical growth with a hig

- Page 208 and 209:

Ferroalloys assets overview• Dive

- Page 210 and 211:

Industrial synergies and cost savin

- Page 212 and 213:

Large long-life resource base (chro

- Page 214 and 215:

First quartile ferrochrome cost str

- Page 216 and 217:

Major project update - Lion II smel

- Page 218 and 219:

Major project update - Eland• Own

- Page 220 and 221:

Marketing - how we create value•

- Page 222 and 223:

Global FeCr production growth align

- Page 224 and 225:

Vanadium, FeSi, SiMn and Co demand

- Page 226 and 227:

Q&A

- Page 228 and 229:

FeMn production growth tempered but

- Page 230 and 231:

Ivan Glasenberg

- Page 233 and 234:

Andrew CaplanAluminium

- Page 235 and 236:

Aluminium overviewGlencore assets a

- Page 237 and 238:

Sherwin Alumina (100%)Location• C

- Page 239 and 240:

UC Rusal (8.8%)Overview• Largest

- Page 241 and 242:

Alumina/Aluminium marketing value c

- Page 243:

Market update - medium/long-term ou

- Page 246 and 247:

This presentation has been prepared

- Page 248 and 249:

Iron ore asset overviewMauritaniaRe

- Page 250 and 251:

Marketing - how Glencore creates va

- Page 252 and 253:

Iron ore structureCEOIvan Glasenber

- Page 254 and 255:

Mauritania - proven mining district

- Page 256:

Conclusion• Delivering value• S