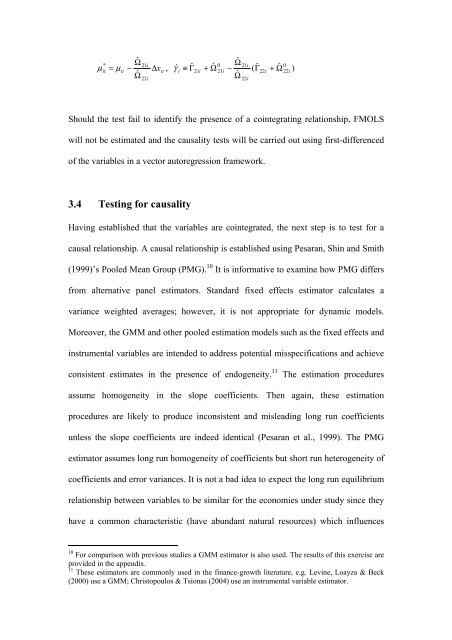

Ωˆˆ*21i0 21i0μ it = μit− Δxit, ˆ γ i ≡ Γ21i+ Ω 21i− Γ22i+ Ω 22i)Ωˆˆ22iΩ 22iˆΩˆ( ˆˆShould the test fail to identify the presence of a cointegrating relationship, FMOLSwill not be estimated and the causality tests will be carried out using first-differencedof the variables in a vector autoregression framework.3.4 Testing <strong>for</strong> causalityHaving established that the variables are cointegrated, the next step is to test <strong>for</strong> acausal relationship. A causal relationship is established using Pesaran, Shin and Smith(1999)’s Pooled Mean Group (PMG). 10 It is in<strong>for</strong>mative to examine how PMG differsfrom alternative panel estimators. Standard fixed effects estimator calculates avariance weighted averages; however, it is not appropriate <strong>for</strong> dynamic models.Moreover, the GMM and other pooled estimation models such as the fixed effects andinstrumental variables are intended to address potential misspecifications and achieveconsistent estimates in the presence of endogeneity. 11The estimation proceduresassume homogeneity in the slope coefficients. Then again, these estimationprocedures are likely to produce inconsistent and misleading long run coefficientsunless the slope coefficients are indeed identical (Pesaran et al., 1999). The PMGestimator assumes long run homogeneity of coefficients but short run heterogeneity ofcoefficients and error variances. It is not a bad idea to expect the long run equilibriumrelationship between variables to be similar <strong>for</strong> the economies under study since theyhave a common characteristic (have abundant natural resources) which influences10 For comparison with previous studies a GMM estimator is also used. The results of this exercise areprovided in the appendix.11 These estimators are commonly used in the finance-growth literature, e.g. Levine, Loayza & Beck(2000) use a GMM; Christopoulos & Tsionas (2004) use an instrumental variable estimator.

them in a similar fashion. They generally undergo similar structural changes, due tosimilar experiences, such as the Dutch disease (Davis, 1995), over optimism ofgovernments (Gelb & Associates, 1988). Furthermore, the estimator permits theestimation of the common long run coefficient without making the less credibleassumption of identical dynamics in each economy (Pesaran et al., 1999).The error correction VAR used here is specified as:ΔYi,tt−1t−1m−1∑k = 1iki,t−km−1= α + α t + φ y + φ x + θ ΔY+ β ′ ΔX+ ε0112∑k = 1i,ki,t−kitWhere t= 1,…, T; i=1,…, N , k is the optimal lag length i , Δ represents firstdifferencing. The φ ’s represent the long run multipliers, while θ and β are therespective short-run dynamic coefficients. An explanatory variable will, in the shortrun, Granger cause growth if its coefficient is statistically significant (as determinedby the Wald F-test) .The long run causality is established by determining thesignificance of the φ ’sFinally, the PMG estimator is more desirable because it assumes fixed effects. A fixedeffects based model is particularly useful in this paper since the focus is on a specificset of economies and the inference made is restricted to the behavior of that set(random effects used <strong>for</strong> making inference about a population). The fixed effectsassumption used in the paper is a common choice <strong>for</strong> macroeconomists (e.g. Judson &Owen, 1999). A typical macroeconomic panel will typically contain countries that areof interest and not randomly sampled from a ‘much larger universe of countries,’(Judson & Owen, 1999, p. 11). Second, the individual effect may represent an omittedvariable, in such cases there is a likely correlation between the country-specific

- Page 2 and 3: 1. IntroductionThis study is relate

- Page 4 and 5: properties of the data. 5 Consequen

- Page 7 and 8: where saving had gone up subsequent

- Page 9 and 10: Empirical examination of the causal

- Page 11 and 12: solving problems of omitted variabl

- Page 13 and 14: As mentioned earlier, the Hadri tes

- Page 15: Where ê it is the estimated residu

- Page 19 and 20: of credit to the private sector (F

- Page 21 and 22: Financial development index : Follo

- Page 23 and 24: The statistics also illustrate a ne

- Page 25 and 26: Tables 3 and 4 present panel cointe

- Page 27 and 28: is the dependent variable. Thus, it

- Page 29 and 30: The results from table 9 show that

- Page 31 and 32: Previous FMOLS estimates show a pos

- Page 33 and 34: Tsionas, 2004; Darrat, 1999) that t

- Page 35 and 36: Table A.2 Definition of variablesVa

- Page 37 and 38: Alternative causality testsTable A.

- Page 39 and 40: Chang, T., & Caudill, S. B. (2005).

- Page 41 and 42: Levine, R., & Zervos, S. (1998). St

![Recycling [ PDF, 62KB ] - University of Queensland](https://img.yumpu.com/51805185/1/184x260/recycling-pdf-62kb-university-of-queensland.jpg?quality=85)