Chile-Korea

Chile-Korea

Chile-Korea

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

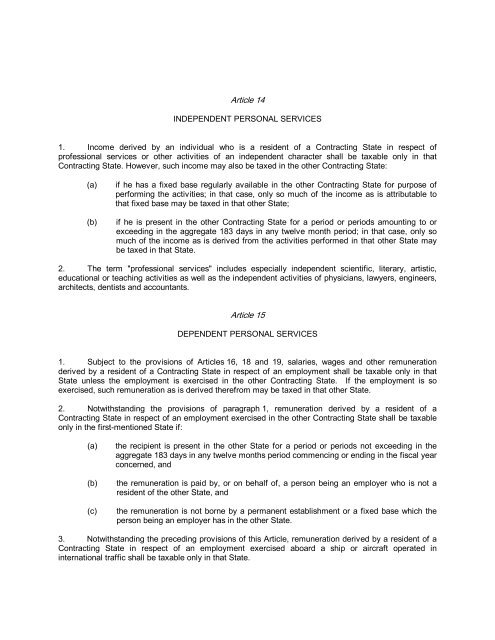

Article 14INDEPENDENT PERSONAL SERVICES1. Income derived by an individual who is a resident of a Contracting State in respect ofprofessional services or other activities of an independent character shall be taxable only in thatContracting State. However, such income may also be taxed in the other Contracting State:(a)(b)if he has a fixed base regularly available in the other Contracting State for purpose ofperforming the activities; in that case, only so much of the income as is attributable tothat fixed base may be taxed in that other State;if he is present in the other Contracting State for a period or periods amounting to orexceeding in the aggregate 183 days in any twelve month period; in that case, only somuch of the income as is derived from the activities performed in that other State maybe taxed in that State.2. The term "professional services" includes especially independent scientific, literary, artistic,educational or teaching activities as well as the independent activities of physicians, lawyers, engineers,architects, dentists and accountants.Article 15DEPENDENT PERSONAL SERVICES1. Subject to the provisions of Articles 16, 18 and 19, salaries, wages and other remunerationderived by a resident of a Contracting State in respect of an employment shall be taxable only in thatState unless the employment is exercised in the other Contracting State. If the employment is soexercised, such remuneration as is derived therefrom may be taxed in that other State.2. Notwithstanding the provisions of paragraph 1, remuneration derived by a resident of aContracting State in respect of an employment exercised in the other Contracting State shall be taxableonly in the firstmentioned State if:(a)(b)(c)the recipient is present in the other State for a period or periods not exceeding in theaggregate 183 days in any twelve months period commencing or ending in the fiscal yearconcerned, andthe remuneration is paid by, or on behalf of, a person being an employer who is not aresident of the other State, andthe remuneration is not borne by a permanent establishment or a fixed base which theperson being an employer has in the other State.3. Notwithstanding the preceding provisions of this Article, remuneration derived by a resident of aContracting State in respect of an employment exercised aboard a ship or aircraft operated ininternational traffic shall be taxable only in that State.