Savings + GPA + Group Term Account Opening ... - DCB Bank

Savings + GPA + Group Term Account Opening ... - DCB Bank

Savings + GPA + Group Term Account Opening ... - DCB Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

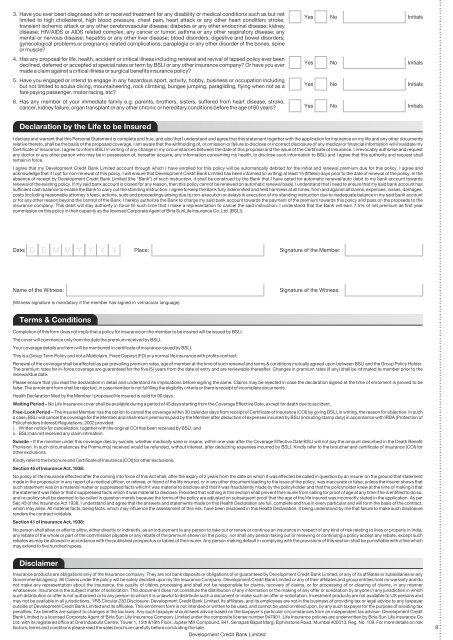

3. Have you ever been diagnosed with or received treatment for any disability or medical conditions such as but notlimited to high cholesterol, high blood pressure, chest pain, heart attack or any other heart condition; stroke,transient ischemic attack or any other cerebrovascular disease; diabetes or any other endocrinal disease; kidneydisease; HIV/AIDS or AIDS related complex; any cancer or tumor; asthma or any other respiratory disease; anymental or nervous disease; hepatitis or any other liver disease; blood disorders; digestive and bowel disorders;gynecological problems or pregnancy related complications; paraplegia or any other disorder of the bones, spineor muscle?4. Has any proposal for life, health, accident or critical illness including renewal and revival of lapsed policy ever beendeclined, deferred or accepted at special rates or term by BSLI or any other insurance company? Or have you evermade a claim against a critical illness or surgical benefits insurance policy?5. Have you engaged or intend to engage in any hazardous sport, activity, hobby, business or occupation includingbut not limited to scuba diving, mountaineering, rock climbing, bungee jumping, paragliding, flying when not as afare paying passenger, motor racing, etc?6. Has any member of your immediate family e.g. parents, brothers, sisters, suffered from heart disease, stroke,cancer, kidney failure, organ transplant or any other chronic or hereditary conditions before the age of 60 years?Yes No InitialsYes No InitialsYes No InitialsYes No InitialsDeclaration by the Life to be InsuredI declare and warrant that this Personal Statement is complete and true, and also that I understand and agree that this statement together with the application for insurance on my life and any other documentsrelative thereto, shall be the basis of the proposed coverage. I am aware that the withholding of, or omission or failure to disclose or incorrect disclosure of any medical or financial information will invalidate myCertificate of Insurance. I agree to inform BSLI in writing of any change in my circumstances between the date of this proposal and the issue of the Certificate of Insurance. I irrevocably authorise and requestany doctor or any other person who may be in possession of, hereafter acquire, any information concerning my health, to disclose such information to BSLI and I agree that this authority and request shallremain in force.I agree that my Development Credit <strong>Bank</strong> Limited account through which I have enrolled for this policy will be automatically debited for the initial and renewal premium due for this policy. I agree andacknowledge that if I opt for non-renewal of this policy, I will ensure that Development Credit <strong>Bank</strong> Limited has been informed (in writing) at least 15 (fifteen) days prior to the date of renewal of the policy. In theabsence of receipt by Development Credit <strong>Bank</strong> Limited (the “<strong>Bank</strong>”) of such instruction, it shall be construed by the <strong>Bank</strong> that I have opted for automatic renewal/auto debit to my bank account towardsrenewal of the existing policy. If my said bank account is closed for any reason, then this policy cannot be renewed on automatic renewal basis. I understand that I need to ensure that my said bank account hassufficient cash balance to enable the <strong>Bank</strong> to carry out the standing instruction. I agree to keep the <strong>Bank</strong> fully indemnified and held harmless at all times, from and against all claims, expenses, losses, damages,costs (including reasonable attorney's fees), actions, suits and proceedings arising due to non-execution or delays in execution of my standing instruction due to inadequate balance in my said bank accountor for any other reason beyond the control of the <strong>Bank</strong>. I hereby authorize the <strong>Bank</strong> to charge my said bank account towards the payment of the premium towards this policy and pass on the proceeds to theinsurance company. This debit will stay authority in force till such time that I make a representation to cancel the said instruction. I understand that the <strong>Bank</strong> will earn 7.5% of net premium as first yearcommission on this policy in their capacity as the licensed Corporate Agent of Birla SunLife Insurance Co. Ltd. (BSLI).Date:D D M M Y Y Y Y Place: Signature of the Member:Name of the Witness:Signature of the Witness:(Witness signature is mandatory if the member has signed in vernacular language)<strong>Term</strong>s & ConditionsCompletion of this form does not imply that a policy for insurance on the member to be insured will be issued by BSLI.The cover will commence only from the date the premium received by BSLI.Your coverage details and term will be mentioned in certificate of insurance issued by BSLI.This is a <strong>Group</strong> <strong>Term</strong> Policy and not a Mediclaim, Fixed Deposit (FD) or a normal life insurance with profits contract.Renewal of the coverage shall be affected as per prevailing premium rates, age of member at the time of such renewal and terms & conditions mutually agreed upon between BSLI and the <strong>Group</strong> Policy Holder.The premium rates for in-force coverage are guaranteed for the five (5) years from the date of entry and are reviewable thereafter. Changes in premium rates (if any) shall be intimated to member prior to therenewal due date.Please ensure that you read the declaration in detail and understand its implications before signing the same. Claims may be rejected in case the declaration signed at the time of enrolment is proved to befalse. The enrolment form shall be rejected, in case member is not fulfilling the eligibility criteria or there is receipt of incomplete documents.Health Declaration filled by the Member / proposed life insured is valid for 90 days.Waiting Period – No Life Insurance cover shall be available during a period of 45 days starting from the Coverage Effective Date, except for death due to accident.Free-Look Period – The insured Member has the option to cancel the coverage within 30 calendar days from receipt of Certificate of Insurance (COI) by giving BSLI, in writing, the reason for objection. In sucha case, BSLI will cancel the coverage for the Member and shall return premiums paid by the Member after deduction of expenses incurred by BSLI (including stamp duty) in accordance with IRDA (Protection ofPolicyholders Interest) Regulations, 2002 provided:i. Written notice for cancellation, together with the original COI has been received by BSLI; andii. BSLI has not received any claim intimation.Suicide – If the member under this coverage dies by suicide, whether medically sane or insane, within one year after the Coverage Effective Date BSLI will not pay the amount described in the Death BenefitProvision. In such circumstances the Premium(s) received would be refunded, without interest, after deducting expenses incurred by BSLI. Kindly refer to the broucher and certificate of insurance (COI) forother exclusions.Kindly refer to the brochure and Certificate of Insurance (COI) for other exclusions.Section 45 of Insurance Act, 1938:No policy of life insurance effected after the coming into force of this Act shall, after the expiry of 2 years from the date on which it was effected be called in question by an insurer on the ground that statementmade in the proposal or in any report of a medical officer, or referee, or friend of the life insured, or in any other document leading to the issue of the policy, was inaccurate or false, unless the insurer shows thatsuch statement was on a material matter or suppressed facts which it was material to disclose and that it was fraudulently made by the policyholder and that the policyholder knew at the time of making it thatthe statement was false or that it suppressed facts which it was material to disclose. Provided that nothing in this section shall prevent the insurer from calling for proof of age at any time if he is entitled to do so,and no policy shall be deemed to be called in question merely because the terms of the policy are adjusted on subsequent proof that the age of the life insured was incorrectly stated in the application. As perSec 45 of the Insurance Act 1938, I understand and agree that the answers and statements made on this Health Declaration are full, complete and true in every particular and will form the basis of the contract,which may arise. All material facts, being facts, which may influence the assessment of this risk, have been disclosed in this Health Declaration, it being understood by me that failure to make such disclosurerenders the contract voidable.Section 41 of Insurance Act, 1938:No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India,any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except suchrebates as may be allowed in accordance with the published prospectus or tables of the insurer. Any person making default in complying with the provisions of this section shall be punishable with a fine whichmay extend to five hundred rupees.DisclaimerInsurance products are obligations only of the Insurance company. They are not bank deposits or obligations of or guaranteed by Development Credit <strong>Bank</strong> Limited, or any of its affiliates or subsidiaries or anyGovernmental agency. All Claims under the policy will be solely decided upon by the Insurance Company. Development Credit <strong>Bank</strong> Limited or any of their affiliates and group entities hold no warranty and donot make any representation about the insurance, the quality of claims processing and shall not be responsible for claims, recovery of claims, or for processing of or clearing of claims, in any mannerwhatsoever. Insurance is the subject matter of solicitation. This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in whichsuch distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation. Investment products are not available to US persons andmay not be available in all jurisdictions. *IRS Circular 230 Disclosure: Development Credit <strong>Bank</strong> Limited, its affiliates, and its employees are not in the business of providing tax or legal advice to any taxpayeroutside of Development Credit <strong>Bank</strong> Limited and its affiliates. This enrolment form is not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding taxpenalties. Tax benefits are subject to changes in the tax laws. Any such taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor. Development Credit<strong>Bank</strong> Limited is a licensed Corporate Agent of Birla Sun Life Insurance Company Limited under the composite license number 947901. Life Insurance policies are underwritten by Birla Sun Life Insurance CoLtd. with its registered office at One Indiabulls Centre, Tower 1, 15th &16th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai 400013, Reg. No. 109. For more details on riskfactors, terms and conditions please read the sales brochure carefully before concluding the sale.Development Credit <strong>Bank</strong> Limited8