Form 4506-T (Rev. January 2011) - The Dalton School

Form 4506-T (Rev. January 2011) - The Dalton School

Form 4506-T (Rev. January 2011) - The Dalton School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

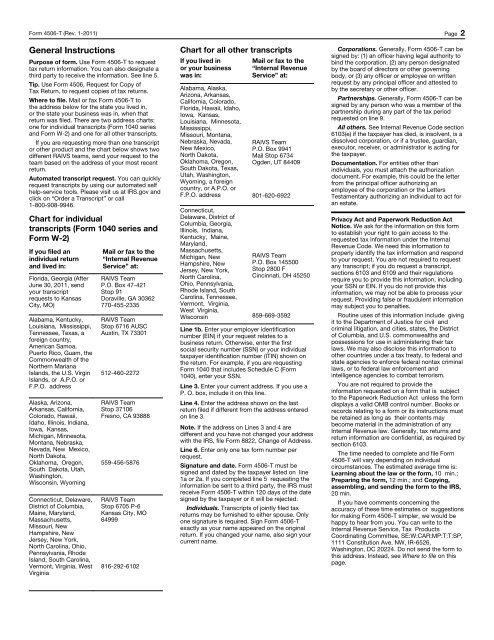

<strong>Form</strong> <strong>4506</strong>-T (<strong>Rev</strong>. 1-<strong>2011</strong>) Page 2General InstructionsPurpose of form. Use <strong>Form</strong> <strong>4506</strong>-T to requesttax return information. You can also designate athird party to receive the information. See line 5.Tip. Use <strong>Form</strong> <strong>4506</strong>, Request for Copy ofTax Return, to request copies of tax returns.Where to file. Mail or fax <strong>Form</strong> <strong>4506</strong>-T tothe address below for the state you lived in,or the state your business was in, when thatreturn was filed. <strong>The</strong>re are two address charts:one for individual transcripts (<strong>Form</strong> 1040 seriesand <strong>Form</strong> W-2) and one for all other transcripts.If you are requesting more than one transcriptor other product and the chart below shows twodifferent RAIVS teams, send your request to theteam based on the address of your most recentreturn.Automated transcript request. You can quicklyrequest transcripts by using our automated selfhelp-service tools. Please visit us at IRS.gov andclick on “Order a Transcript” or call1-800-908-9946.Chart for individualtranscripts (<strong>Form</strong> 1040 series and<strong>Form</strong> W-2)If you filed anindividual returnand lived in:Florida, Georgia (AfterJune 30, <strong>2011</strong>, sendyour transcriptrequests to KansasCity, MO)Alabama, Kentucky,Louisiana, Mississippi,Tennessee, Texas, aforeign country,American Samoa,Puerto Rico, Guam, theCommonwealth of theNorthern MarianaIslands, the U.S. VirginIslands, or A.P.O. orF.P.O. addressAlaska, Arizona,Arkansas, California,Colorado, Hawaii,Idaho, Illinois, Indiana,Iowa, Kansas,Michigan, Minnesota,Montana, Nebraska,Nevada, New Mexico,North Dakota,Oklahoma, Oregon,South Dakota, Utah,Washington,Wisconsin, WyomingConnecticut, Delaware,District of Columbia,Maine, Maryland,Massachusetts,Missouri, NewHampshire, NewJersey, New York,North Carolina, Ohio,Pennsylvania, RhodeIsland, South Carolina,Vermont, Virginia, WestVirginiaMail or fax to the“Internal <strong>Rev</strong>enueService” at:RAIVS TeamP.O. Box 47-421Stop 91Doraville, GA 30362770-455-2335RAIVS TeamStop 6716 AUSCAustin, TX 73301512-460-2272RAIVS TeamStop 37106Fresno, CA 93888559-456-5876RAIVS TeamStop 6705 P-6Kansas City, MO64999816-292-6102Chart for all other transcriptsIf you lived inor your businesswas in:Alabama, Alaska,Arizona, Arkansas,California, Colorado,Florida, Hawaii, Idaho,Iowa, Kansas,Louisiana, Minnesota,Mississippi,Missouri, Montana,Nebraska, Nevada,New Mexico,North Dakota,Oklahoma, Oregon,South Dakota, Texas,Utah, Washington,Wyoming, a foreigncountry, or A.P.O. orF.P.O. addressConnecticut,Delaware, District ofColumbia, Georgia,Illinois, Indiana,Kentucky, Maine,Maryland,Massachusetts,Michigan, NewHampshire, NewJersey, New York,North Carolina,Ohio, Pennsylvania,Rhode Island, SouthCarolina, Tennessee,Vermont, Virginia,West Virginia,WisconsinMail or fax to the“Internal <strong>Rev</strong>enueService” at:RAIVS TeamP.O. Box 9941Mail Stop 6734Ogden, UT 84409801-620-6922RAIVS TeamP.O. Box 145500Stop 2800 FCincinnati, OH 45250859-669-3592Line 1b. Enter your employer identificationnumber (EIN) if your request relates to abusiness return. Otherwise, enter the firstsocial security number (SSN) or your individualtaxpayer identification number (ITIN) shown onthe return. For example, if you are requesting<strong>Form</strong> 1040 that includes Schedule C (<strong>Form</strong>1040), enter your SSN.Line 3. Enter your current address. If you use aP. O. box, include it on this line.Line 4. Enter the address shown on the lastreturn filed if different from the address enteredon line 3.Note. If the address on Lines 3 and 4 aredifferent and you have not changed your addresswith the IRS, file <strong>Form</strong> 8822, Change of Address.Line 6. Enter only one tax form number perrequest.Signature and date. <strong>Form</strong> <strong>4506</strong>-T must besigned and dated by the taxpayer listed on line1a or 2a. If you completed line 5 requesting theinformation be sent to a third party, the IRS mustreceive <strong>Form</strong> <strong>4506</strong>-T within 120 days of the datesigned by the taxpayer or it will be rejected.Individuals. Transcripts of jointly filed taxreturns may be furnished to either spouse. Onlyone signature is required. Sign <strong>Form</strong> <strong>4506</strong>-Texactly as your name appeared on the originalreturn. If you changed your name, also sign yourcurrent name.Corporations. Generally, <strong>Form</strong> <strong>4506</strong>-T can besigned by: (1) an officer having legal authority tobind the corporation, (2) any person designatedby the board of directors or other governingbody, or (3) any officer or employee on writtenrequest by any principal officer and attested toby the secretary or other officer.Partnerships. Generally, <strong>Form</strong> <strong>4506</strong>-T can besigned by any person who was a member of thepartnership during any part of the tax periodrequested on line 9.All others. See Internal <strong>Rev</strong>enue Code section6103(e) if the taxpayer has died, is insolvent, is adissolved corporation, or if a trustee, guardian,executor, receiver, or administrator is acting forthe taxpayer.Documentation. For entities other thanindividuals, you must attach the authorizationdocument. For example, this could be the letterfrom the principal officer authorizing anemployee of the corporation or the LettersTestamentary authorizing an individual to act foran estate.Privacy Act and Paperwork Reduction ActNotice. We ask for the information on this formto establish your right to gain access to therequested tax information under the Internal<strong>Rev</strong>enue Code. We need this information toproperly identify the tax information and respondto your request. You are not required to requestany transcript; if you do request a transcript,sections 6103 and 6109 and their regulationsrequire you to provide this information, includingyour SSN or EIN. If you do not provide thisinformation, we may not be able to process yourrequest. Providing false or fraudulent informationmay subject you to penalties.Routine uses of this information include givingit to the Department of Justice for civil andcriminal litigation, and cities, states, the Districtof Columbia, and U.S. commonwealths andpossessions for use in administering their taxlaws. We may also disclose this information toother countries under a tax treaty, to federal andstate agencies to enforce federal nontax criminallaws, or to federal law enforcement andintelligence agencies to combat terrorism.You are not required to provide theinformation requested on a form that is subjectto the Paperwork Reduction Act unless the formdisplays a valid OMB control number. Books orrecords relating to a form or its instructions mustbe retained as long as their contents maybecome material in the administration of anyInternal <strong>Rev</strong>enue law. Generally, tax returns andreturn information are confidential, as required bysection 6103.<strong>The</strong> time needed to complete and file <strong>Form</strong><strong>4506</strong>-T will vary depending on individualcircumstances. <strong>The</strong> estimated average time is:Learning about the law or the form, 10 min.;Preparing the form, 12 min.; and Copying,assembling, and sending the form to the IRS,20 min.If you have comments concerning theaccuracy of these time estimates or suggestionsfor making <strong>Form</strong> <strong>4506</strong>-T simpler, we would behappy to hear from you. You can write to theInternal <strong>Rev</strong>enue Service, Tax ProductsCoordinating Committee, SE:W:CAR:MP:T:T:SP,1111 Constitution Ave. NW, IR-6526,Washington, DC 20224. Do not send the form tothis address. Instead, see Where to file on thispage.