You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

in their pipelines and processing plants. With<br />

oil prices falling - and with no end in sight -<br />

producers have been forced to sell pipes and<br />

plants for some quick cash in order to stay in<br />

the black (on top of layoffs and spending cuts).<br />

One such deal involved Canadian gas giant<br />

Encana Corp., who solds its Bakken pipeline<br />

network for $3 billion to Kinder Morgan last<br />

month. Back in December, Encana also sold<br />

gas pipelines and plants in Western Canada’s<br />

Montney shale region for a sum of $328 million.<br />

Other companies that have done the same<br />

include Royal Dutch Shell and Devon Energy.<br />

Meanwhile, fellow producer Pioneer Natural<br />

Resources is seeking a similar deal for its Eagle<br />

Ford shale interests for an expected sale price<br />

of over $3 billion.<br />

Conversely, some shale producers are<br />

continuing to pump the black gold out of the<br />

ground, with the US shale oil industry as a<br />

whole pushing output to 30-year highs and<br />

contributing to stockpiles that are at their<br />

largest since tracking first began in 2004. It<br />

appears at first to go against business sense to<br />

do so with oil prices where they are, but<br />

studies suggest that doing otherwise would<br />

leave the producers severely in debt.<br />

Many in the industry have borrowed to risky<br />

levels of leverage, at more than three times<br />

operating profits. From a paper by derivatives<br />

expert Satyajit Das, if firms don’t meet existing<br />

debt commitments, then the resulting<br />

decrease in available funding and higher costs<br />

as debt markets close for these firms will create<br />

a negative spiral. Inability to borrow sharply<br />

reduces production capacity, and this lower<br />

production combined with low prices reduces<br />

cash flows to the point of possible default.<br />

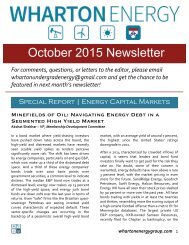

Another study out of the Bank of International<br />

Settlements similarly revealed that American<br />

oil companies have developed quite the<br />

appetite for debt, with capital expenditures far<br />

exceeding cash flow. Thus, “highly leveraged<br />

producers may attempt to maintain, or even<br />

increase, output levels even as the oil prices<br />

falls in order to remain liquid and to meet<br />

interest payments and tighter credit<br />

conditions.”<br />

But the US isn’t the only country where shale<br />

producers are continuing to pump at a loss.<br />

Russia’s Rosneft and Brazil’s Petrobras are also<br />

overleveraged due to annual increases in<br />

borrowing by 13 percent in Russia, 25 percent<br />

in Brazil, and 31 percent in China. However,<br />

these companies have a distinct advantage in<br />

that they are all government-backed, so their<br />

financing needs are met by treasury or<br />

sovereign funds.<br />

Most forecasts for oil prices have crude staying<br />

fairly low for the near future, with futures<br />

markets as of writing putting WTI prices sub-<br />

$60 through December 2016. Therefore, one<br />

can expect both trends to continue as long as<br />

the market stays constrained. However, with<br />

the furious activity in the industry that has<br />

taken place, there may be a breaking point<br />

approaching where companies reach some<br />

sort of new normal where $50 oil is the<br />

benchmark, at least until oil’s next big move.<br />

Sources:<br />

Bloomberg<br />

Economonitor