ACC 349 Final Exam Guide-acc349dotcom

For more course tutorials visit www.acc349.com 1) What does cost accounting measure, record, and report? 2) What is the best way to handle manufacturing overhead costs in order to get the most timely job cost information? 3) At the end of the year, manufacturing overhead has been overapplied. What occurred to create this situation? 4) Which of the following would be accounted for using a job order cost system? 5) In a job order cost accounting system, the Work in Process account is 6) Which one of the following is an important feature of a job order cost system? 7) Which one of the following is indirect labor considered? 8) Which of the following is an element of manufacturing overhead? 9) Which one of the following costs would be included in manufacturing overhead of a lawn mower manufacturer? 10) A well-designed activity-based costing system starts with 11) An activity that has a direct cause-effect relationship with the resources consumed is a(n) 12) In traditional costing systems, overhead is generally applied based on 13) All of the following statements are correct EXCEPT that

For more course tutorials visit

www.acc349.com

1) What does cost accounting measure, record, and report?

2) What is the best way to handle manufacturing overhead costs in order to get the most timely job cost information?

3) At the end of the year, manufacturing overhead has been overapplied. What occurred to create this situation?

4) Which of the following would be accounted for using a job order cost system?

5) In a job order cost accounting system, the Work in Process account is

6) Which one of the following is an important feature of a job order cost system?

7) Which one of the following is indirect labor considered?

8) Which of the following is an element of manufacturing overhead?

9) Which one of the following costs would be included in manufacturing overhead of a lawn mower manufacturer?

10) A well-designed activity-based costing system starts with

11) An activity that has a direct cause-effect relationship with the resources consumed is a(n)

12) In traditional costing systems, overhead is generally applied based on

13) All of the following statements are correct EXCEPT that

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

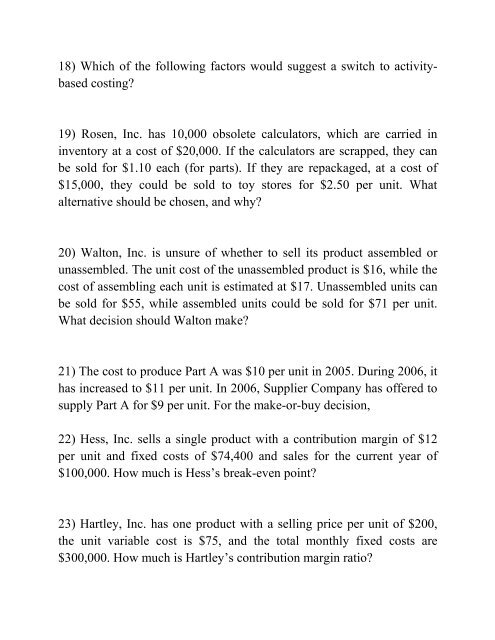

18) Which of the following factors would suggest a switch to activitybased<br />

costing?<br />

19) Rosen, Inc. has 10,000 obsolete calculators, which are carried in<br />

inventory at a cost of $20,000. If the calculators are scrapped, they can<br />

be sold for $1.10 each (for parts). If they are repackaged, at a cost of<br />

$15,000, they could be sold to toy stores for $2.50 per unit. What<br />

alternative should be chosen, and why?<br />

20) Walton, Inc. is unsure of whether to sell its product assembled or<br />

unassembled. The unit cost of the unassembled product is $16, while the<br />

cost of assembling each unit is estimated at $17. Unassembled units can<br />

be sold for $55, while assembled units could be sold for $71 per unit.<br />

What decision should Walton make?<br />

21) The cost to produce Part A was $10 per unit in 2005. During 2006, it<br />

has increased to $11 per unit. In 2006, Supplier Company has offered to<br />

supply Part A for $9 per unit. For the make-or-buy decision,<br />

22) Hess, Inc. sells a single product with a contribution margin of $12<br />

per unit and fixed costs of $74,400 and sales for the current year of<br />

$100,000. How much is Hess’s break-even point?<br />

23) Hartley, Inc. has one product with a selling price per unit of $200,<br />

the unit variable cost is $75, and the total monthly fixed costs are<br />

$300,000. How much is Hartley’s contribution margin ratio?