ACC 291 Final Exam Question Answers

TransWebeTutors Provide ACC 291 UOP New Final Exam Answers Online Homework Help for University of Phoenix Students! A++ Tutorials.

TransWebeTutors Provide ACC 291 UOP New Final Exam Answers Online Homework Help for University of Phoenix Students! A++ Tutorials.

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

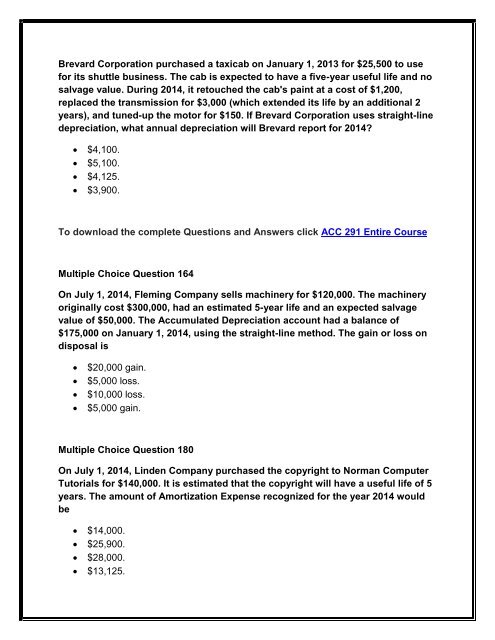

Brevard Corporation purchased a taxicab on January 1, 2013 for $25,500 to use<br />

for its shuttle business. The cab is expected to have a five-year useful life and no<br />

salvage value. During 2014, it retouched the cab's paint at a cost of $1,200,<br />

replaced the transmission for $3,000 (which extended its life by an additional 2<br />

years), and tuned-up the motor for $150. If Brevard Corporation uses straight-line<br />

depreciation, what annual depreciation will Brevard report for 2014?<br />

$4,100.<br />

$5,100.<br />

$4,125.<br />

$3,900.<br />

To download the complete <strong>Question</strong>s and <strong>Answers</strong> click <strong>ACC</strong> <strong>291</strong> Entire Course<br />

Multiple Choice <strong>Question</strong> 164<br />

On July 1, 2014, Fleming Company sells machinery for $120,000. The machinery<br />

originally cost $300,000, had an estimated 5-year life and an expected salvage<br />

value of $50,000. The Accumulated Depreciation account had a balance of<br />

$175,000 on January 1, 2014, using the straight-line method. The gain or loss on<br />

disposal is<br />

<br />

<br />

<br />

<br />

$20,000 gain.<br />

$5,000 loss.<br />

$10,000 loss.<br />

$5,000 gain.<br />

Multiple Choice <strong>Question</strong> 180<br />

On July 1, 2014, Linden Company purchased the copyright to Norman Computer<br />

Tutorials for $140,000. It is estimated that the copyright will have a useful life of 5<br />

years. The amount of Amortization Expense recognized for the year 2014 would<br />

be<br />

$14,000.<br />

$25,900.<br />

$28,000.<br />

$13,125.