DIRECTOR'S GUIDE 2011

DIRECTOR'S GUIDE 2011

DIRECTOR'S GUIDE 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

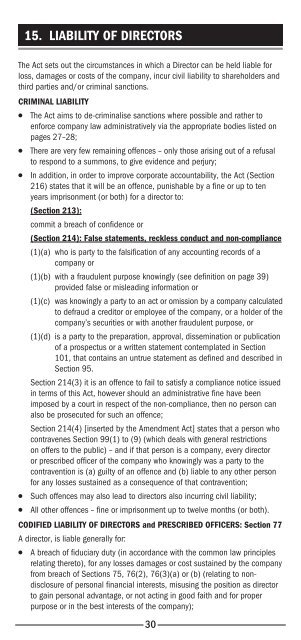

15. LIABILITY OF DIRECTORSThe Act sets out the circumstances in which a Director can be held liable forloss, damages or costs of the company, incur civil liability to shareholders andthird parties and/or criminal sanctions.CRIMINAL LIABILITY●●●●●●●●●●The Act aims to de-criminalise sanctions where possible and rather toenforce company law administratively via the appropriate bodies listed onpages 27–28;There are very few remaining offences – only those arising out of a refusalto respond to a summons, to give evidence and perjury;In addition, in order to improve corporate accountability, the Act (Section216) states that it will be an offence, punishable by a fine or up to tenyears imprisonment (or both) for a director to:(Section 213):commit a breach of confidence or(Section 214): False statements, reckless conduct and non‐compliance(1)(a) who is party to the falsification of any accounting records of acompany or(1)(b) with a fraudulent purpose knowingly (see definition on page 39)provided false or misleading information or(1)(c) was knowingly a party to an act or omission by a company calculatedto defraud a creditor or employee of the company, or a holder of thecompany’s securities or with another fraudulent purpose, or(1)(d) is a party to the preparation, approval, dissemination or publicationof a prospectus or a written statement contemplated in Section101, that contains an untrue statement as defined and described inSection 95.Section 214(3) it is an offence to fail to satisfy a compliance notice issuedin terms of this Act, however should an administrative fine have beenimposed by a court in respect of the non-compliance, then no person canalso be prosecuted for such an offence;Section 214(4) [inserted by the Amendment Act] states that a person whocontravenes Section 99(1) to (9) (which deals with general restrictionson offers to the public) – and if that person is a company, every directoror prescribed officer of the company who knowingly was a party to thecontravention is (a) guilty of an offence and (b) liable to any other personfor any losses sustained as a consequence of that contravention;Such offences may also lead to directors also incurring civil liability;All other offences – fine or imprisonment up to twelve months (or both).CODIFIED LIABILITY OF DIRECTORS and PRESCRIBED OFFICERS: Section 77A director, is liable generally for:●●A breach of fiduciary duty (in accordance with the common law principlesrelating thereto), for any losses damages or cost sustained by the companyfrom breach of Sections 75, 76(2), 76(3)(a) or (b) (relating to nondisclosureof personal financial interests, misusing the position as directorto gain personal advantage, or not acting in good faith and for properpurpose or in the best interests of the company);30