www.maref.org.my VOLUME 1 ISSUE NO 2 2010-2011 KDNPP ...

www.maref.org.my VOLUME 1 ISSUE NO 2 2010-2011 KDNPP ...

www.maref.org.my VOLUME 1 ISSUE NO 2 2010-2011 KDNPP ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

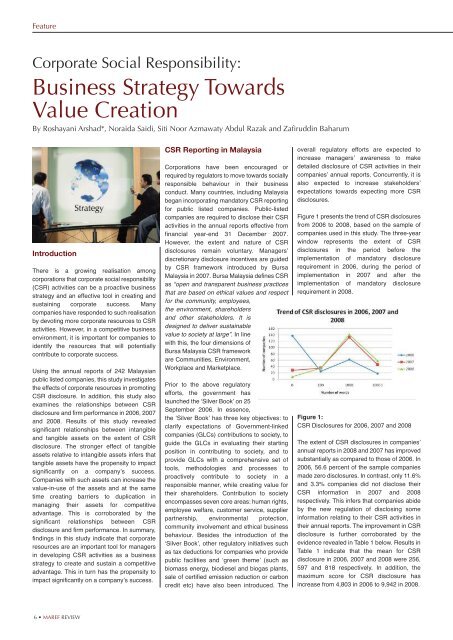

FeatureCorporate Social Responsibility:Business Strategy TowardsValue CreationBy Roshayani Arshad*, Noraida Saidi, Siti Noor Azmawaty Abdul Razak and Zafiruddin BaharumIntroductionThere is a growing realisation amongcorporations that corporate social responsibility(CSR) activities can be a proactive businessstrategy and an effective tool in creating andsustaining corporate success. Manycompanies have responded to such realisationby devoting more corporate resources to CSRactivities. However, in a competitive businessenvironment, it is important for companies toidentify the resources that will potentiallycontribute to corporate success.Using the annual reports of 242 Malaysianpublic listed companies, this study investigatesthe effects of corporate resources in promotingCSR disclosure. In addition, this study alsoexamines the relationships between CSRdisclosure and firm performance in 2006, 2007and 2008. Results of this study revealedsignificant relationships between intangibleand tangible assets on the extent of CSRdisclosure. The stronger effect of tangibleassets relative to intangible assets infers thattangible assets have the propensity to impactsignificantly on a companyʼs success.Companies with such assets can increase thevalue-in-use of the assets and at the sametime creating barriers to duplication inmanaging their assets for competitiveadvantage. This is corroborated by thesignificant relationships between CSRdisclosure and firm performance. In summary,findings in this study indicate that corporateresources are an important tool for managersin developing CSR activities as a businessstrategy to create and sustain a competitiveadvantage. This in turn has the propensity toimpact significantly on a companyʼs success.CSR Reporting in MalaysiaCorporations have been encouraged orrequired by regulators to move towards sociallyresponsible behaviour in their businessconduct. Many countries, including Malaysiabegan incorporating mandatory CSR reportingfor public listed companies. Public-listedcompanies are required to disclose their CSRactivities in the annual reports effective fromfinancial year-end 31 December 2007.However, the extent and nature of CSRdisclosures remain voluntary. Managersʼdiscretionary disclosure incentives are guidedby CSR framework introduced by BursaMalaysia in 2007. Bursa Malaysia defines CSRas “open and transparent business practicesthat are based on ethical values and respectfor the community, employees,the environment, shareholdersand other stakeholders. It isdesigned to deliver sustainablevalue to society at large”. In linewith this, the four dimensions ofBursa Malaysia CSR frameworkare Communities, Environment,Workplace and Marketplace.Prior to the above regulatoryefforts, the government haslaunched the ʻSilver Bookʼ on 25September 2006. In essence,the ʻSilver Bookʼ has three key objectives: toclarify expectations of Government-linkedcompanies (GLCs) contributions to society, toguide the GLCs in evaluating their startingposition in contributing to society, and toprovide GLCs with a comprehensive set oftools, methodologies and processes toproactively contribute to society in aresponsible manner, while creating value fortheir shareholders. Contribution to societyencompasses seven core areas: human rights,employee welfare, customer service, supplierpartnership, environmental protection,community involvement and ethical businessbehaviour. Besides the introduction of theʻSilver Bookʼ, other regulatory initiatives suchas tax deductions for companies who providepublic facilities and ʻgreen themeʼ (such asbiomass energy, biodiesel and biogas plants,sale of certified emission reduction or carboncredit etc) have also been introduced. Theoverall regulatory efforts are expected toincrease managersʼ awareness to makedetailed disclosure of CSR activities in theircompaniesʼ annual reports. Concurrently, it isalso expected to increase stakeholdersʼexpectations towards expecting more CSRdisclosures.Figure 1 presents the trend of CSR disclosuresfrom 2006 to 2008, based on the sample ofcompanies used in this study. The three-yearwindow represents the extent of CSRdisclosures in the period before theimplementation of mandatory disclosurerequirement in 2006, during the period ofimplementation in 2007 and after theimplementation of mandatory disclosurerequirement in 2008.Figure 1:CSR Disclosures for 2006, 2007 and 2008The extent of CSR disclosures in companiesʼannual reports in 2008 and 2007 has improvedsubstantially as compared to those of 2006. In2006, 56.6 percent of the sample companiesmade zero disclosures. In contrast, only 11.6%and 3.3% companies did not disclose theirCSR information in 2007 and 2008respectively. This infers that companies abideby the new regulation of disclosing someinformation relating to their CSR activities intheir annual reports. The improvement in CSRdisclosure is further corroborated by theevidence revealed in Table 1 below. Results inTable 1 indicate that the mean for CSRdisclosure in 2006, 2007 and 2008 were 256,597 and 818 respectively. In addition, themaximum score for CSR disclosure hasincrease from 4,803 in 2006 to 9,942 in 2008.6 • MAREF REVIEW