Executive Summary - Institute for Money, Technology and Financial ...

Executive Summary - Institute for Money, Technology and Financial ...

Executive Summary - Institute for Money, Technology and Financial ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

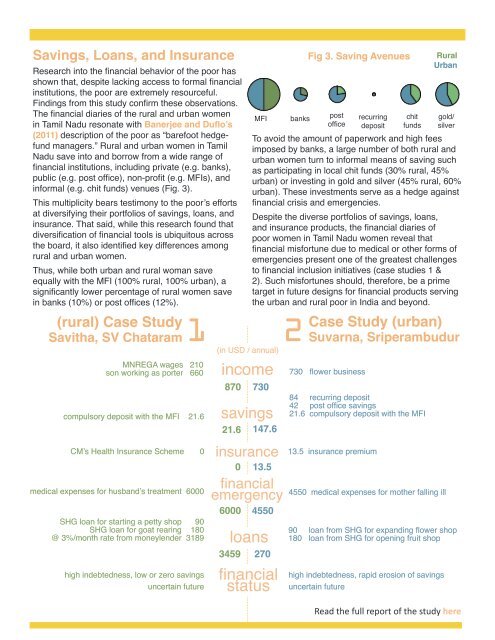

Savings, Loans, <strong>and</strong> InsuranceResearch into the financial behavior of the poor hasshown that, despite lacking access to <strong>for</strong>mal financialinstitutions, the poor are extremely resourceful.Findings from this study confirm these observations.The financial diaries of the rural <strong>and</strong> urban womenin Tamil Nadu resonate with Banerjee <strong>and</strong> Duflo’s(2011) description of the poor as “barefoot hedgefundmanagers.” Rural <strong>and</strong> urban women in TamilNadu save into <strong>and</strong> borrow from a wide range offinancial institutions, including private (e.g. banks),public (e.g. post office), non-profit (e.g. MFIs), <strong>and</strong>in<strong>for</strong>mal (e.g. chit funds) venues (Fig. 3).This multiplicity bears testimony to the poor’s ef<strong>for</strong>tsat diversifying their portfolios of savings, loans, <strong>and</strong>insurance. That said, while this research found thatdiversification of financial tools is ubiquitous acrossthe board, it also identified key differences amongrural <strong>and</strong> urban women.Thus, while both urban <strong>and</strong> rural woman saveequally with the MFI (100% rural, 100% urban), asignificantly lower percentage of rural women savein banks (10%) or post offices (12%).(rural) Case StudySavitha, SV ChataramMNREGA wages 210son working as porter 660compulsory deposit with the MFI 21.6CM’s Health Insurance Scheme 0medical expenses <strong>for</strong> husb<strong>and</strong>’s treatment 6000SHG loan <strong>for</strong> starting a petty shop 90SHG loan <strong>for</strong> goat rearing 180@ 3%/month rate from moneylender 3189high indebtedness, low or zero savingsuncertain futureMFIsavingsinsurancebanks1 2(in USD / annual)income87021.60financialemergency6000loans3459financialstatusFig 3. Saving AvenuespostofficerecurringdepositchitfundsRuralUrbangold/silverTo avoid the amount of paperwork <strong>and</strong> high feesimposed by banks, a large number of both rural <strong>and</strong>urban women turn to in<strong>for</strong>mal means of saving suchas participating in local chit funds (30% rural, 45%urban) or investing in gold <strong>and</strong> silver (45% rural, 60%urban). These investments serve as a hedge againstfinancial crisis <strong>and</strong> emergencies.Despite the diverse portfolios of savings, loans,<strong>and</strong> insurance products, the financial diaries ofpoor women in Tamil Nadu women reveal thatfinancial mis<strong>for</strong>tune due to medical or other <strong>for</strong>ms ofemergencies present one of the greatest challengesto financial inclusion initiatives (case studies 1 &2). Such mis<strong>for</strong>tunes should, there<strong>for</strong>e, be a primetarget in future designs <strong>for</strong> financial products servingthe urban <strong>and</strong> rural poor in India <strong>and</strong> beyond.730147.613.54550270Case Study (urban)Suvarna, Sriperambudur730 flower business84 recurring deposit42 post office savings21.6 compulsory deposit with the MFI13.5 insurance premium4550 medical expenses <strong>for</strong> mother falling ill90 loan from SHG <strong>for</strong> exp<strong>and</strong>ing flower shop180 loan from SHG <strong>for</strong> opening fruit shophigh indebtedness, rapid erosion of savingsuncertain futureRead the full report of the study here