Annual Report-FY 2012-13 - Timex Group India

Annual Report-FY 2012-13 - Timex Group India

Annual Report-FY 2012-13 - Timex Group India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

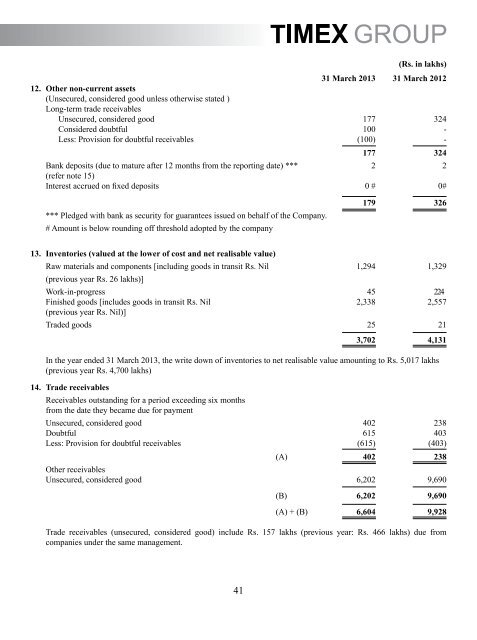

(Rs. in lakhs)31 March 20<strong>13</strong> 31 March <strong>2012</strong>12. Other non-current assets(Unsecured, considered good unless otherwise stated )Long-term trade receivablesUnsecured, considered good 177 324Considered doubtful 100 -Less: Provision for doubtful receivables (100) -177 324Bank deposits (due to mature after 12 months from the reporting date) *** 2 2(refer note 15)Interest accrued on fixed deposits 0 # 0#*** Pledged with bank as security for guarantees issued on behalf of the Company.# Amount is below rounding off threshold adopted by the company179 326<strong>13</strong>. Inventories (valued at the lower of cost and net realisable value)Raw materials and components [including goods in transit Rs. Nil 1,294 1,329(previous year Rs. 26 lakhs)]Work-in-progress 45 224Finished goods [includes goods in transit Rs. Nil 2,338 2,557(previous year Rs. Nil)]Traded goods 25 2<strong>13</strong>,702 4,<strong>13</strong>1In the year ended 31 March 20<strong>13</strong>, the write down of inventories to net realisable value amounting to Rs. 5,017 lakhs(previous year Rs. 4,700 lakhs)14. Trade receivablesReceivables outstanding for a period exceeding six monthsfrom the date they became due for paymentUnsecured, considered good 402 238Doubtful 615 403Less: Provision for doubtful receivables (615) (403)(A) 402 238Other receivablesUnsecured, considered good 6,202 9,690(B) 6,202 9,690(A) + (B) 6,604 9,928Trade receivables (unsecured, considered good) include Rs. 157 lakhs (previous year: Rs. 466 lakhs) due fromcompanies under the same management.41