Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

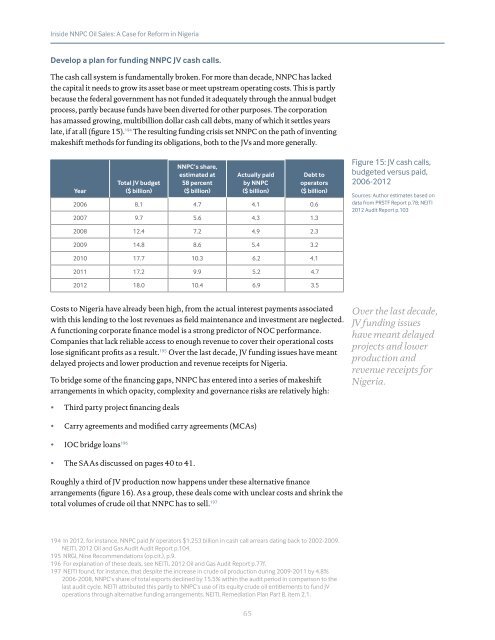

<strong>Inside</strong> <strong>NNPC</strong> <strong>Oil</strong> <strong>Sales</strong>: A <strong>Case</strong> <strong>for</strong> Re<strong>for</strong>m <strong>in</strong> <strong>Nigeria</strong>Develop a plan <strong>for</strong> fund<strong>in</strong>g <strong>NNPC</strong> JV cash calls.The cash call system is fundamentally broken. For more than decade, <strong>NNPC</strong> has lackedthe capital it needs to grow its asset base or meet upstream operat<strong>in</strong>g costs. This is partlybecause the federal government has not funded it adequately through the annual budgetprocess, partly because funds have been diverted <strong>for</strong> other purposes. The corporationhas amassed grow<strong>in</strong>g, multibillion dollar cash call debts, many of which it settles yearslate, if at all (figure 15). 194 The result<strong>in</strong>g fund<strong>in</strong>g crisis set <strong>NNPC</strong> on the path of <strong>in</strong>vent<strong>in</strong>gmakeshift methods <strong>for</strong> fund<strong>in</strong>g its obligations, both to the JVs and more generally.YearTotal JV budget($ billion)<strong>NNPC</strong>’s share,estimated at58 percent($ billion)Actually paidby <strong>NNPC</strong>($ billion)Debt tooperators($ billion)2006 8.1 4.7 4.1 0.62007 9.7 5.6 4.3 1.3Figure 15: JV cash calls,budgeted versus paid,2006-2012Sources: Author estimates based ondata from PRSTF Report p.78; NEITI2012 Audit Report p.1032008 12.4 7.2 4.9 2.32009 14.8 8.6 5.4 3.22010 17.7 10.3 6.2 4.12011 17.2 9.9 5.2 4.72012 18.0 10.4 6.9 3.5Costs to <strong>Nigeria</strong> have already been high, from the actual <strong>in</strong>terest payments associatedwith this lend<strong>in</strong>g to the lost revenues as field ma<strong>in</strong>tenance and <strong>in</strong>vestment are neglected.A function<strong>in</strong>g corporate f<strong>in</strong>ance model is a strong predictor of NOC per<strong>for</strong>mance.Companies that lack reliable access to enough revenue to cover their operational costslose significant profits as a result. 195 Over the last decade, JV fund<strong>in</strong>g issues have meantdelayed projects and lower production and revenue receipts <strong>for</strong> <strong>Nigeria</strong>.To bridge some of the f<strong>in</strong>anc<strong>in</strong>g gaps, <strong>NNPC</strong> has entered <strong>in</strong>to a series of makeshiftarrangements <strong>in</strong> which opacity, complexity and governance risks are relatively high:Over the last decade,JV fund<strong>in</strong>g issueshave meant delayedprojects and lowerproduction andrevenue receipts <strong>for</strong><strong>Nigeria</strong>.• Third party project f<strong>in</strong>anc<strong>in</strong>g deals• Carry agreements and modified carry agreements (MCAs)• IOC bridge loans 196• The SAAs discussed on pages 40 to 41.Roughly a third of JV production now happens under these alternative f<strong>in</strong>ancearrangements (figure 16). As a group, these deals come with unclear costs and shr<strong>in</strong>k thetotal volumes of crude oil that <strong>NNPC</strong> has to sell. 197194 In 2012, <strong>for</strong> <strong>in</strong>stance, <strong>NNPC</strong> paid JV operators $1.253 billion <strong>in</strong> cash call arrears dat<strong>in</strong>g back to 2002-2009.NEITI, 2012 <strong>Oil</strong> and Gas Audit Audit Report p.104.195 NRGI, N<strong>in</strong>e Recommendations (op.cit.), p.9.196 For explanation of these deals, see NEITI, 2012 <strong>Oil</strong> and Gas Audit Report p.77f.197 NEITI found, <strong>for</strong> <strong>in</strong>stance, that despite the <strong>in</strong>crease <strong>in</strong> crude oil production dur<strong>in</strong>g 2009-2011 by 4.8%2006-2008, <strong>NNPC</strong>’s share of total exports decl<strong>in</strong>ed by 15.5% with<strong>in</strong> the audit period <strong>in</strong> comparison to thelast audit cycle. NEITI attributed this partly to <strong>NNPC</strong>’s use of its equity crude oil entitlements to fund JVoperations through alternative fund<strong>in</strong>g arrangements. NEITI, Remediation Plan Part B, item 2.1.65