Our article about FX-Quant (PDF) - 2hedge

Our article about FX-Quant (PDF) - 2hedge

Our article about FX-Quant (PDF) - 2hedge

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

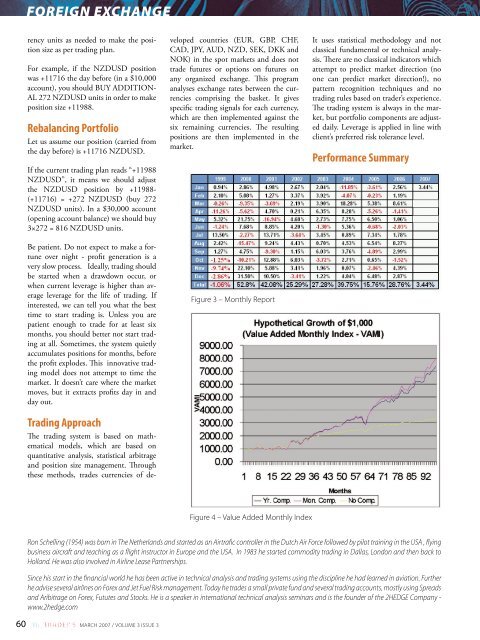

FOREIGN EXCHANGErency units as needed to make the positionsize as per trading plan.For example, if the NZDUSD positionwas +11716 the day before (in a $10,000account), you should BUY ADDITION-AL 272 NZDUSD units in order to makeposition size +11988.Rebalancing PortfolioLet us assume our position (carried fromthe day before) is +11716 NZDUSD.If the current trading plan reads “+11988NZDUSD”, it means we should adjustthe NZDUSD position by +11988-(+11716) = +272 NZDUSD (buy 272NZDUSD units). In a $30,000 account(opening account balance) we should buy3×272 = 816 NZDUSD units.Trading ApproachThe trading system is based on mathematicalmodels, which are based onquantitative analysis, statistical arbitrageand position size management. Throughthese methods, trades currencies of developedcountries (EUR, GBP, CHF,CAD, JPY, AUD, NZD, SEK, DKK andNOK) in the spot markets and does nottrade futures or options on futures onany organized exchange. This programanalyses exchange rates between the currenciescomprising the basket. It givesspecific trading signals for each currency,which are then implemented against thesix remaining currencies. The resultingpositions are then implemented in themarket.It uses statistical methodology and notclassical fundamental or technical analysis.There are no classical indicators whichattempt to predict market direction (noone can predict market direction!), nopattern recognition techniques and notrading rules based on trader’s experience.The trading system is always in the market,but portfolio components are adjusteddaily. Leverage is applied in line withclient’s preferred risk tolerance level.Performance SummaryBe patient. Do not expect to make a fortuneover night - profit generation is avery slow process. Ideally, trading shouldbe started when a drawdown occur, orwhen current leverage is higher than averageleverage for the life of trading. Ifinterested, we can tell you what the besttime to start trading is. Unless you arepatient enough to trade for at least sixmonths, you should better not start tradingat all. Sometimes, the system quietlyaccumulates positions for months, beforethe profit explodes. This innovative tradingmodel does not attempt to time themarket. It doesn’t care where the marketmoves, but it extracts profits day in andday out.Figure 3 – Monthly ReportFigure 4 – Value Added Monthly IndexRon Schelling (1954) was born in The Netherlands and started as an Airtrafic controller in the Dutch Air Force followed by pilot training in the USA , flyingbusiness aircraft and teaching as a flight instructor in Europe and the USA. In 1983 he started commodity trading in Dallas, London and then back toHolland. He was also involved in Airline Lease Partnerships.Since his start in the financial world he has been active in technical analysis and trading systems using the discipline he had learned in aviation. Furtherhe advise several airlines on Forex and Jet Fuel Risk management. Today he trades a small private fund and several trading accounts, mostly using Spreadsand Aribitrage on Forex, Fututes and Stocks. He is a speaker in international technical analysis seminars and is the founder of the 2HEDGE Company -www.<strong>2hedge</strong>.com60 MARCH 2007 / VOLUME 3 ISSUE 3