CLOSE BROTHERS

Close Brothers Protected VCT PLC - Albion Ventures

Close Brothers Protected VCT PLC - Albion Ventures

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

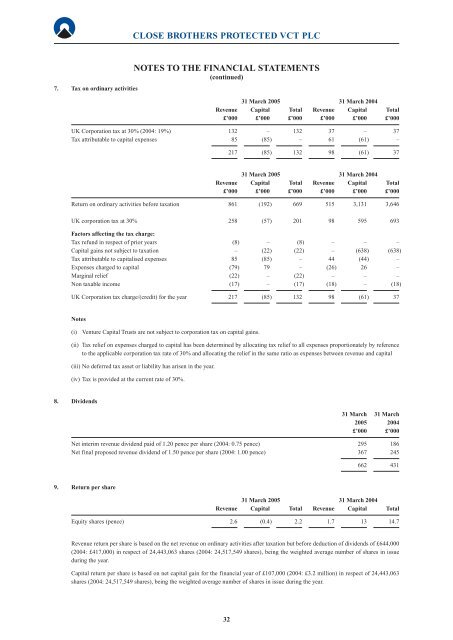

<strong>CLOSE</strong> <strong>BROTHERS</strong> PROTECTED VCT PLC7. Tax on ordinary activitiesNOTES TO THE FINANCIAL STATEMENTS(continued)31 March 2005 31 March 2004Revenue Capital Total Revenue Capital Total£’000 £’000 £’000 £’000 £’000 £’000UK Corporation tax at 30% (2004: 19%) 132 – 132 37 – 37Tax attributable to capital expenses 85 (85) – 61 (61) –217 (85) 132 98 (61) 3731 March 2005 31 March 2004Revenue Capital Total Revenue Capital Total£’000 £’000 £’000 £’000 £’000 £’000Return on ordinary activities before taxation 861 (192) 669 515 3,131 3,646UK corporation tax at 30% 258 (57) 201 98 595 693Factors affecting the tax charge:Tax refund in respect of prior years (8) – (8) – – –Capital gains not subject to taxation – (22) (22) – (638) (638)Tax attributable to capitalised expenses 85 (85) – 44 (44) –Expenses charged to capital (79) 79 – (26) 26 –Marginal relief (22) – (22) – – –Non taxable income (17) – (17) (18) – (18)UK Corporation tax charge/(credit) for the year 217 (85) 132 98 (61) 37Notes(i)Venture Capital Trusts are not subject to corporation tax on capital gains.(ii) Tax relief on expenses charged to capital has been determined by allocating tax relief to all expenses proportionately by referenceto the applicable corporation tax rate of 30% and allocating the relief in the same ratio as expenses between revenue and capital(iii) No deferred tax asset or liability has arisen in the year.(iv) Tax is provided at the current rate of 30%.8. Dividends31 March 31 March2005 2004£’000 £’000Net interim revenue dividend paid of 1.20 pence per share (2004: 0.75 pence) 295 186Net final proposed revenue dividend of 1.50 pence per share (2004: 1.00 pence) 367 245662 4319. Return per share31 March 2005 31 March 2004Revenue Capital Total Revenue Capital TotalEquity shares (pence) 2.6 (0.4) 2.2 1.7 13 14.7Revenue return per share is based on the net revenue on ordinary activities after taxation but before deduction of dividends of £644,000(2004: £417,000) in respect of 24,443,063 shares (2004: 24,517,549 shares), being the weighted average number of shares in issueduring the year.Capital return per share is based on net capital gain for the financial year of £107,000 (2004: £3.2 million) in respect of 24,443,063shares (2004: 24,517,549 shares), being the weighted average number of shares in issue during the year.32