Danubius Hotel and Spa Rt - Danubius Hotels Group

Danubius Hotel and Spa Rt - Danubius Hotels Group

Danubius Hotel and Spa Rt - Danubius Hotels Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Danubius</strong> <strong>Hotel</strong> <strong>and</strong> <strong>Spa</strong> <strong>Rt</strong>. <strong>and</strong> Subsidiaries<br />

Notes to the Consolidated Financial Statements<br />

(All amounts in million HUF)<br />

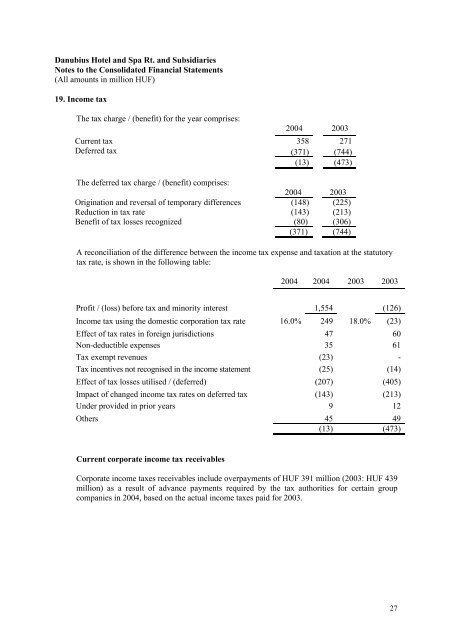

19. Income tax<br />

The tax charge / (benefit) for the year comprises:<br />

2004 2003<br />

Current tax 358 271<br />

Deferred tax (371) (744)<br />

(13) (473)<br />

The deferred tax charge / (benefit) comprises:<br />

2004 2003<br />

Origination <strong>and</strong> reversal of temporary differences (148) (225)<br />

Reduction in tax rate (143) (213)<br />

Benefit of tax losses recognized (80) (306)<br />

(371) (744)<br />

A reconciliation of the difference between the income tax expense <strong>and</strong> taxation at the statutory<br />

tax rate, is shown in the following table:<br />

2004 2004 2003 2003<br />

Profit / (loss) before tax <strong>and</strong> minority interest 1,554 (126)<br />

Income tax using the domestic corporation tax rate 16.0% 249 18.0% (23)<br />

Effect of tax rates in foreign jurisdictions 47 60<br />

Non-deductible expenses 35 61<br />

Tax exempt revenues (23) -<br />

Tax incentives not recognised in the income statement (25) (14)<br />

Effect of tax losses utilised / (deferred) (207) (405)<br />

Impact of changed income tax rates on deferred tax (143) (213)<br />

Under provided in prior years 9 12<br />

Others 45 49<br />

(13) (473)<br />

Current corporate income tax receivables<br />

Corporate income taxes receivables include overpayments of HUF 391 million (2003: HUF 439<br />

million) as a result of advance payments required by the tax authorities for certain group<br />

companies in 2004, based on the actual income taxes paid for 2003.<br />

27