Governance

Form 990 (2009) - National Association for Interpretation

Form 990 (2009) - National Association for Interpretation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

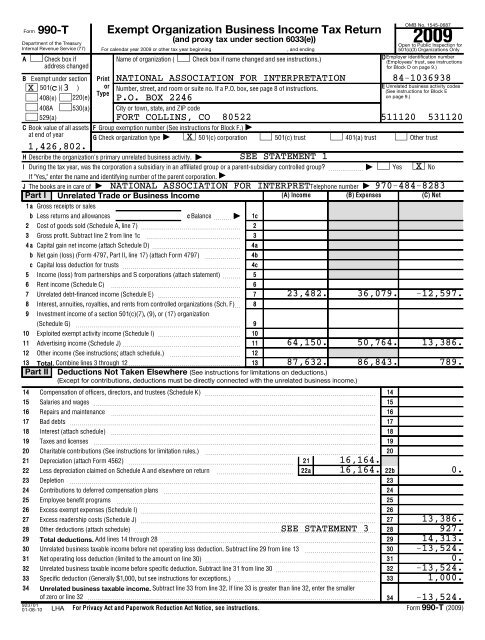

OMB No. 1545-0687<br />

Form<br />

Exempt Organization Business Income Tax Return<br />

Department of the Treasury<br />

(and proxy tax under section 6033(e))<br />

Open to Public Inspection for<br />

Internal Revenue Service (77) For calendar year 2009 or other tax year beginning<br />

, and ending<br />

501(c)(3) Organizations Only<br />

Employer identification number<br />

A Check box if<br />

Name of organization ( Check box if name changed and see instructions.)<br />

D<br />

(Employees’ trust, see instructions<br />

address changed<br />

for Block D on page 9.)<br />

B Exempt under section Print NATIONAL ASSOCIATION FOR INTERPRETATION 84-1036938<br />

X 501( c )( 3 ) or<br />

E Unrelated business activity codes<br />

Number, street, and room or suite no. If a P.O. box, see page 8 of instructions.<br />

(See instructions for Block E<br />

Type<br />

408(e) 220(e) P.O. BOX 2246<br />

on page 9.)<br />

C Book value of all assets F Group exemption number (See instructions for Block F.) |<br />

at end of year<br />

G Check organization type | X 501(c) corporation 501(c) trust 401(a) trust Other trust<br />

1,426,802.<br />

H Describe the organization’s primary unrelated business activity. | SEE STATEMENT 1<br />

I During the tax year, was the corporation a subsidiary in an affiliated group or a parent-subsidiary controlled group? ~~~~~~ |<br />

If "Yes," enter the name and identifying number of the parent corporation. |<br />

Yes X No<br />

J The books are in care of | NATIONAL ASSOCIATION FOR INTERPRETTelephone number | 970-484-8283<br />

Part I Unrelated Trade or Business Income<br />

(A) Income (B) Expenses (C) Net<br />

1a<br />

Gross receipts or sales<br />

2<br />

3<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

b<br />

b<br />

c<br />

Less returns and allowances c Balance ~~~ |<br />

12 Other income (See instructions; attach schedule.) ~~~~~~~~~~~~ 12<br />

13 Total. Combine lines 3 through 12 13 87,632. 86,843. 789.<br />

Part II Deductions Not Taken Elsewhere (See instructions for limitations on deductions.)<br />

(Except for contributions, deductions must be directly connected with the unrelated business income.)<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

990-T<br />

2009<br />

408A 530(a) City or town, state, and ZIP code<br />

529(a)<br />

FORT COLLINS, CO 80522 511120 531120<br />

Cost of goods sold (Schedule A, line 7) ~~~~~~~~~~~~~~~~~<br />

Gross profit. Subtract line 2 from line 1c<br />

~~~~~~~~~~~~~~~~<br />

4a<br />

Capital gain net income (attach Schedule D) ~~~~~~~~~~~~~~~<br />

Net gain (loss) (Form 4797, Part II, line 17) (attach Form 4797) ~~~~~~<br />

Capital loss deduction for trusts ~~~~~~~~~~~~~~~~~~~~<br />

Income (loss) from partnerships and S corporations (attach statement) ~~~<br />

Rent income (Schedule C)<br />

~~~~~~~~~~~~~~~~~~~~~~<br />

Unrelated debt-financed income (Schedule E) ~~~~~~~~~~~~~~<br />

Interest, annuities, royalties, and rents from controlled organizations (Sch. F)~<br />

Investment income of a section 501(c)(7), (9), or (17) organization<br />

(Schedule G)<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Exploited exempt activity income (Schedule I) ~~~~~~~~~~~~~~<br />

Advertising income (Schedule J) ~~~~~~~~~~~~~~~~~~~~<br />

Compensation of officers, directors, and trustees (Schedule K) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Salaries and wages ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Repairs and maintenance<br />

Bad debts ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Interest (attach schedule)<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Taxes and licenses ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Charitable contributions (See instructions for limitation rules.) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 20<br />

Depreciation (attach Form 4562) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 21 16,164.<br />

Less depreciation claimed on Schedule A and elsewhere on return ~~~~~~~~~~~~~ 22a 16,164. 22b<br />

0.<br />

Depletion<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Contributions to deferred compensation plans<br />

Total deductions. Add lines 14 through 28 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Unrelated business taxable income before net operating loss deduction. Subtract line 29 from line 13 ~~~~~~~~~~~~<br />

34 Unrelated business taxable income. Subtract line 33 from line 32. If line 33 is greater than line 32, enter the smaller<br />

of zero or line 32 <br />

923701<br />

01-08-10 LHA For Privacy Act and Paperwork Reduction Act Notice, see instructions.<br />

1c<br />

2<br />

3<br />

4a<br />

4b<br />

4c<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Employee benefit programs ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

23,482. 36,079. -12,597.<br />

64,150. 50,764. 13,386.<br />

Excess exempt expenses (Schedule I) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Excess readership costs (Schedule J) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Other deductions (attach schedule) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

SEE STATEMENT 3<br />

Net operating loss deduction (limited to the amount on line 30) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Unrelated business taxable income before specific deduction. Subtract line 31 from line 30 ~~~~~~~~~~~~~~~~~<br />

Specific deduction (Generally $1,000, but see instructions for exceptions.) ~~~~~~~~~~~~~~~~~~~~~~~~<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

13,386.<br />

927.<br />

14,313.<br />

-13,524.<br />

0.<br />

-13,524.<br />

1,000.<br />

-13,524.<br />

Form 990-T (2009)