Acquisition of 50% equity interest in Shanghai Jinting Automobile ...

Acquisition of 50% equity interest in Shanghai Jinting Automobile ...

Acquisition of 50% equity interest in Shanghai Jinting Automobile ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

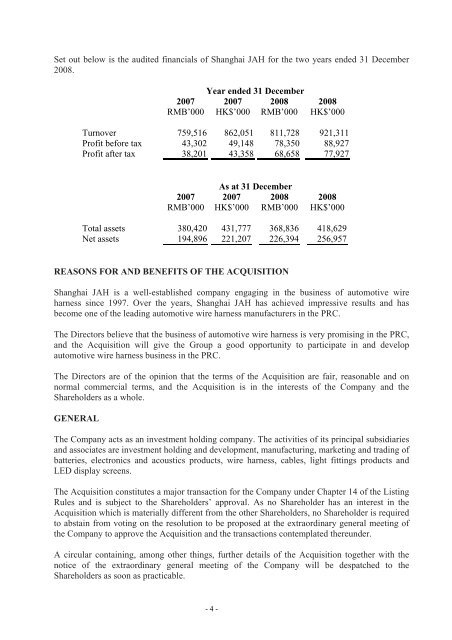

Set out below is the audited f<strong>in</strong>ancials <strong>of</strong> <strong>Shanghai</strong> JAH for the two years ended 31 December<br />

2008.<br />

Year ended 31 December<br />

2007 2007 2008 2008<br />

RMB’000 HK$’000 RMB’000 HK$’000<br />

Turnover 759,516 862,051 811,728 921,311<br />

Pr<strong>of</strong>it before tax 43,302 49,148 78,350 88,927<br />

Pr<strong>of</strong>it after tax 38,201 43,358 68,658 77,927<br />

As at 31 December<br />

2007 2007 2008 2008<br />

RMB’000 HK$’000 RMB’000 HK$’000<br />

Total assets 380,420 431,777 368,836 418,629<br />

Net assets 194,896 221,207 226,394 256,957<br />

REASONS FOR AND BENEFITS OF THE ACQUISITION<br />

<strong>Shanghai</strong> JAH is a well-established company engag<strong>in</strong>g <strong>in</strong> the bus<strong>in</strong>ess <strong>of</strong> automotive wire<br />

harness s<strong>in</strong>ce 1997. Over the years, <strong>Shanghai</strong> JAH has achieved impressive results and has<br />

become one <strong>of</strong> the lead<strong>in</strong>g automotive wire harness manufacturers <strong>in</strong> the PRC.<br />

The Directors believe that the bus<strong>in</strong>ess <strong>of</strong> automotive wire harness is very promis<strong>in</strong>g <strong>in</strong> the PRC,<br />

and the <strong>Acquisition</strong> will give the Group a good opportunity to participate <strong>in</strong> and develop<br />

automotive wire harness bus<strong>in</strong>ess <strong>in</strong> the PRC.<br />

The Directors are <strong>of</strong> the op<strong>in</strong>ion that the terms <strong>of</strong> the <strong>Acquisition</strong> are fair, reasonable and on<br />

normal commercial terms, and the <strong>Acquisition</strong> is <strong>in</strong> the <strong><strong>in</strong>terest</strong>s <strong>of</strong> the Company and the<br />

Shareholders as a whole.<br />

GENERAL<br />

The Company acts as an <strong>in</strong>vestment hold<strong>in</strong>g company. The activities <strong>of</strong> its pr<strong>in</strong>cipal subsidiaries<br />

and associates are <strong>in</strong>vestment hold<strong>in</strong>g and development, manufactur<strong>in</strong>g, market<strong>in</strong>g and trad<strong>in</strong>g <strong>of</strong><br />

batteries, electronics and acoustics products, wire harness, cables, light fitt<strong>in</strong>gs products and<br />

LED display screens.<br />

The <strong>Acquisition</strong> constitutes a major transaction for the Company under Chapter 14 <strong>of</strong> the List<strong>in</strong>g<br />

Rules and is subject to the Shareholders’ approval. As no Shareholder has an <strong><strong>in</strong>terest</strong> <strong>in</strong> the<br />

<strong>Acquisition</strong> which is materially different from the other Shareholders, no Shareholder is required<br />

to absta<strong>in</strong> from vot<strong>in</strong>g on the resolution to be proposed at the extraord<strong>in</strong>ary general meet<strong>in</strong>g <strong>of</strong><br />

the Company to approve the <strong>Acquisition</strong> and the transactions contemplated thereunder.<br />

A circular conta<strong>in</strong><strong>in</strong>g, among other th<strong>in</strong>gs, further details <strong>of</strong> the <strong>Acquisition</strong> together with the<br />

notice <strong>of</strong> the extraord<strong>in</strong>ary general meet<strong>in</strong>g <strong>of</strong> the Company will be despatched to the<br />

Shareholders as soon as practicable.<br />

- 4 -