RELIGION AND EARNINGS MANAGEMENT - Some ... - Unitec

RELIGION AND EARNINGS MANAGEMENT - Some ... - Unitec

RELIGION AND EARNINGS MANAGEMENT - Some ... - Unitec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

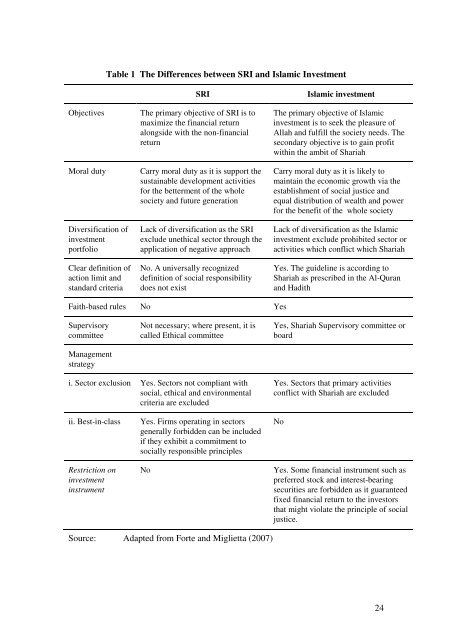

Table 1 The Differences between SRI and Islamic Investment<br />

Objectives The primary objective of SRI is to<br />

maximize the financial return<br />

alongside with the non-financial<br />

return<br />

Moral duty Carry moral duty as it is support the<br />

sustainable development activities<br />

for the betterment of the whole<br />

society and future generation<br />

Diversification of<br />

investment<br />

portfolio<br />

Clear definition of<br />

action limit and<br />

standard criteria<br />

SRI Islamic investment<br />

Lack of diversification as the SRI<br />

exclude unethical sector through the<br />

application of negative approach<br />

No. A universally recognized<br />

definition of social responsibility<br />

does not exist<br />

Faith-based rules No Yes<br />

Supervisory<br />

committee<br />

Management<br />

strategy<br />

Not necessary; where present, it is<br />

called Ethical committee<br />

i. Sector exclusion Yes. Sectors not compliant with<br />

social, ethical and environmental<br />

criteria are excluded<br />

ii. Best-in-class Yes. Firms operating in sectors<br />

generally forbidden can be included<br />

if they exhibit a commitment to<br />

socially responsible principles<br />

Restriction on<br />

investment<br />

instrument<br />

The primary objective of Islamic<br />

investment is to seek the pleasure of<br />

Allah and fulfill the society needs. The<br />

secondary objective is to gain profit<br />

within the ambit of Shariah<br />

Carry moral duty as it is likely to<br />

maintain the economic growth via the<br />

establishment of social justice and<br />

equal distribution of wealth and power<br />

for the benefit of the whole society<br />

Lack of diversification as the Islamic<br />

investment exclude prohibited sector or<br />

activities which conflict which Shariah<br />

Yes. The guideline is according to<br />

Shariah as prescribed in the Al-Quran<br />

and Hadith<br />

Yes, Shariah Supervisory committee or<br />

board<br />

Yes. Sectors that primary activities<br />

conflict with Shariah are excluded<br />

No<br />

No Yes. <strong>Some</strong> financial instrument such as<br />

preferred stock and interest-bearing<br />

securities are forbidden as it guaranteed<br />

fixed financial return to the investors<br />

that might violate the principle of social<br />

justice.<br />

Source: Adapted from Forte and Miglietta (2007)<br />

24