issue no. 172 - july–september 2009 / rajab–ramadan 1430

issue no. 172 - july–september 2009 / rajab–ramadan 1430

issue no. 172 - july–september 2009 / rajab–ramadan 1430

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWHORIZON Rajab–Ramadan <strong>1430</strong><br />

RATINGS & INDICES<br />

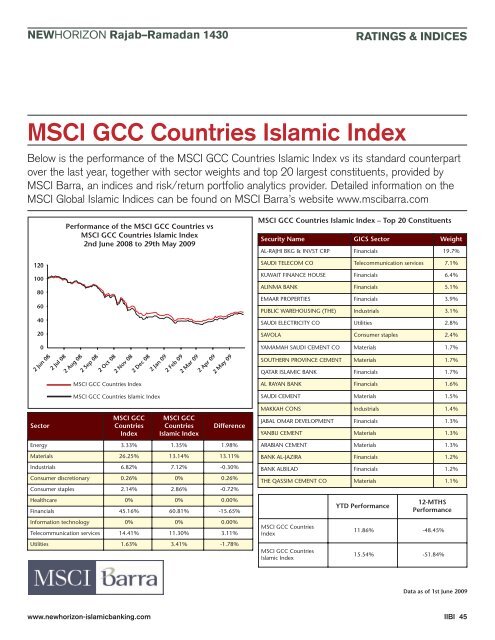

MSCI GCC Countries Islamic Index<br />

Below is the performance of the MSCI GCC Countries Islamic Index vs its standard counterpart<br />

over the last year, together with sector weights and top 20 largest constituents, provided by<br />

MSCI Barra, an indices and risk/return portfolio analytics provider. Detailed information on the<br />

MSCI Global Islamic Indices can be found on MSCI Barra’s website www.mscibarra.com<br />

Performance of the MSCI GCC Countries vs<br />

MSCI GCC Countries Islamic Index<br />

2nd June 2008 to 29th May <strong>2009</strong><br />

MSCI GCC Countries Islamic Index – Top 20 Constituents<br />

Security Name GICS Sector Weight<br />

AL-RAJHI BKG & INVST CRP Financials 19.7%<br />

SAUDI TELECOM CO Telecommunication services 7.1%<br />

KUWAIT FINANCE HOUSE Financials 6.4%<br />

ALINMA BANK Financials 5.1%<br />

EMAAR PROPERTIES Financials 3.9%<br />

PUBLIC WAREHOUSING (THE) Industrials 3.1%<br />

SAUDI ELECTRICITY CO Utilities 2.8%<br />

SAVOLA Consumer staples 2.4%<br />

YAMAMAH SAUDI CEMENT CO Materials 1.7%<br />

SOUTHERN PROVINCE CEMENT Materials 1.7%<br />

QATAR ISLAMIC BANK Financials 1.7%<br />

Sector<br />

MSCI GCC Countries Index<br />

MSCI GCC Countries Islamic Index<br />

MSCI GCC<br />

Countries<br />

Index<br />

MSCI GCC<br />

Countries<br />

Islamic Index<br />

Difference<br />

Energy 3.33% 1.35% 1.98%<br />

Materials 26.25% 13.14% 13.11%<br />

Industrials 6.82% 7.12% -0.30%<br />

Consumer discretionary 0.26% 0% 0.26%<br />

Consumer staples 2.14% 2.86% -0.72%<br />

Healthcare 0% 0% 0.00%<br />

Financials 45.16% 60.81% -15.65%<br />

Information tech<strong>no</strong>logy 0% 0% 0.00%<br />

Telecommunication services 14.41% 11.30% 3.11%<br />

Utilities 1.63% 3.41% -1.78%<br />

AL RAYAN BANK Financials 1.6%<br />

SAUDI CEMENT Materials 1.5%<br />

MAKKAH CONS Industrials 1.4%<br />

JABAL OMAR DEVELOPMENT Financials 1.3%<br />

YANBU CEMENT Materials 1.3%<br />

ARABIAN CEMENT Materials 1.3%<br />

BANK AL-JAZIRA Financials 1.2%<br />

BANK ALBILAD Financials 1.2%<br />

THE QASSIM CEMENT CO Materials 1.1%<br />

MSCI GCC Countries<br />

Index<br />

MSCI GCC Countries<br />

Islamic Index<br />

YTD Performance<br />

12-MTHS<br />

Performance<br />

11.86% -48.45%<br />

15.54% -51.84%<br />

Data as of 1st June <strong>2009</strong><br />

www.newhorizon-islamicbanking.com<br />

IIBI 45