Adams

Adams View adds 68 well-designed homes to Yakama Nation

Adams View adds 68 well-designed homes to Yakama Nation

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

News, Analysis and Commentary On Affordable Housing, Community Development and Renewable Energy Tax Credits<br />

October 2013, Volume IV, Issue X<br />

Title VI Loan, LIHTCs Build Single-Family<br />

Homes on Tribal Land<br />

Published by Novogradac & Company LLP<br />

By Teresa Garcia, Staff Writer, Novogradac & Company LLP<br />

<strong>Adams</strong> View near Wapato, Wash. is the newest<br />

affordable housing development on the Yakama Nation<br />

Reservation and is the largest low-income housing<br />

tax credit (LIHTC) property in Indian Country to date,<br />

said Bill Picotte, executive director for the Yakama Nation<br />

Housing Authority (YNHA). The new 45-acre <strong>Adams</strong> View<br />

development adds 68 single-family homes to an existing<br />

30-unit development. It also has one of the largest U.S.<br />

Department of Housing and Urban Development (HUD)<br />

Title VI guarantee loan sums in the nation: $11.4 million for<br />

housing and $4.4 million for infrastructure.<br />

Affordable Housing on Tribal Land<br />

“The supply and demand of affordable housing is a huge<br />

issue on the reservation, as it is on most reservations,” said<br />

Don Clem, YNHA project manager. “We have about 1,350<br />

applications representing over 8,000 individuals on lists for<br />

housing.”<br />

Affordable housing demand continues to rise among Yakama<br />

tribal members who live near Wapato in south-central<br />

Washington, where the unemployment is 18.7 percent and<br />

42 percent of residents have lived below the poverty level in<br />

the past 12 months. “The income in the county generally isn’t<br />

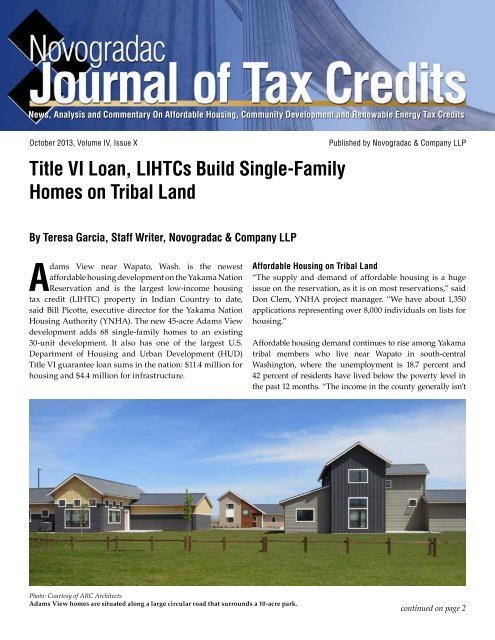

Photo: Courtesy of ARC Architects<br />

<strong>Adams</strong> View homes are situated along a large circular road that surrounds a 10-acre park.<br />

continued on page 2

novogradac journal of tax credits<br />

www.novoco.com October 2013<br />

continued from page 1<br />

Photo: Courtesy of ARC Architects<br />

This four-bedroom <strong>Adams</strong> View home features a gathering room with<br />

vaulted ceilings.<br />

enough to drive new market-rate housing,” said Alisa Luber, the<br />

senior project developer for Mercy Housing Northwest who worked<br />

on <strong>Adams</strong> View.<br />

Clem said that a bulk of the Yakama Nation Housing Authority<br />

housing stock was built under the U.S. Housing Act of 1937 and<br />

subsequent related legislation. While the Housing Act of 1937<br />

succeeded in expanding tribal housing stock and providing<br />

rental assistance programs, tribal leaders didn’t have much<br />

planning control over their own communities’ developments.<br />

This changed with the Native American Housing Assistance<br />

and Self Determination Act of 1996 (NAHASDA), which granted<br />

tribes greater self-governance in housing assistance matters.<br />

The legislation eliminated several separate housing assistance<br />

programs and replaced them with the Indian Housing Block<br />

Grant and the Title VI loan guarantee program. These initiatives,<br />

along with the LIHTC, are giving aging and limited reservation<br />

housing stock a welcomed infusion of resources for rehabilitation<br />

and new development.<br />

Financing <strong>Adams</strong> View<br />

Securing LIHTCs for developments on tribal land has always<br />

been a challenge because of unique ownership situations and<br />

limitations on securing debt against tribal land, said Bill Rumpf,<br />

president of Mercy Housing Northwest. In response to advocacy<br />

to make developments in Indian Country more competitive in<br />

the LIHTC application process, the Washington State Housing<br />

Finance Commission amended its policies in 2008 to award extra<br />

points to developments in eligible tribal areas.<br />

<strong>Adams</strong> View qualified for the extra points and received a<br />

continued on page 3<br />

Novogradac Journal of Tax Credits<br />

Editorial Board<br />

Publisher<br />

Michael J. Novogradac, CPA<br />

EditorIAL DIRECTOR<br />

Alex Ruiz<br />

Technical Editors<br />

Robert S. Thesman, CPA<br />

James R. Kroger, CPA<br />

Owen P. Gray, CPA<br />

Thomas Boccia, CPA<br />

Daniel J. Smith, CPA<br />

ASSOCIATE EDITOR<br />

Jennifer Dockery<br />

Staff Writers<br />

Teresa Garcia<br />

Mark O’Meara<br />

Editorial Assistant<br />

Elizabeth Orfin<br />

Contributing Writers<br />

Christina Apostolidis<br />

Brent Rudy Parker<br />

Brandi Day<br />

Dat Ksor<br />

Christian Ayson<br />

Owen P. Gray<br />

CARTOGRAPHER<br />

David R. Grubman<br />

Production<br />

Alexandra Louie<br />

Jesse Barredo<br />

James Matuszak<br />

Cyle Reissig<br />

Warren Sebra<br />

John M. Tess<br />

Dan J. Smith<br />

Forrest Milder<br />

Novogradac Journal of Tax Credits<br />

Information<br />

Correspondence and editorial submissions:<br />

Alex Ruiz / 415.356.8088<br />

Inquiries regarding advertising opportunities:<br />

Emil Bagalso / 415.356.8037<br />

Editorial material in this publication is for informational<br />

purposes only and should not be construed otherwise.<br />

Advice and interpretation regarding the low-income<br />

housing tax credit or any other material covered in this<br />

publication can only be obtained from your tax advisor.<br />

© Novogradac & Company LLP<br />

2013 All rights reserved.<br />

ISSN 2152-646X<br />

Reproduction of this publication in whole or in part in any<br />

form without written permission from the publisher is<br />

prohibited by law.<br />

2

Novogradac Journal of Tax Credits<br />

Advisory Board<br />

Low-Income Housing Tax Credits<br />

Bud Clarke Boston Financial Investment Management<br />

Jana Cohen Barbe<br />

SNR Denton<br />

Tom Dixon<br />

Boston Capital<br />

Rick Edson<br />

Housing Capital Advisors Inc.<br />

Richard Gerwitz<br />

Citi Community Capital<br />

Rochelle Lento<br />

Dykema Gossett PLLC<br />

John Lisella<br />

u.S. Bancorp Community Dev. Corp.<br />

Phillip Melton<br />

Centerline Capital Group<br />

Thomas Morton Pillsbury Winthrop Shaw Pittman LLP<br />

Mary Tingerthal<br />

Minnesota Housing Finance Agency<br />

Rob Wasserman<br />

U.S. Bancorp Community Dev. Corp.<br />

Property Compliance<br />

Michael Kotin<br />

kAy Kay Realty<br />

Michael Snowdon<br />

mCA Housing Partners\<br />

Kimberly Taylor<br />

Housing Development Center<br />

continued from page 2<br />

novogradac journal of tax credits<br />

Housing and Urban Development<br />

Flynann Janice<br />

Rainbow Housing<br />

Ray Landry<br />

Davis-Penn Mortgage Co.<br />

Denise Muha<br />

National Leased Housing Association<br />

Monica Sussman<br />

Nixon Peabody LLP<br />

New Markets Tax Credits<br />

Frank Altman<br />

Community Reinvestment Fund<br />

Merrill Hoopengardner<br />

Advantage Capital<br />

Scott Lindquist<br />

SNR Denton<br />

Matthew Philpott U.S. Bancorp Community Dev. Corp.<br />

Matthew Reilein<br />

JPMorgan Chase Bank NA<br />

Ruth Sparrow<br />

Futures Unlimited Law PC<br />

Elaine DiPietro Enterprise Community Investment Inc.<br />

Historic Tax Credits<br />

Jason Korb<br />

Capstone Communities<br />

John Leith-Tetrault National Trust Comm. Investment Corp.<br />

Bill MacRostie<br />

mACRostie Historic Advisors LLC<br />

John Tess<br />

Heritage Consulting Group<br />

Renewable Energy Tax Credits<br />

Bill Bush<br />

Borrego Solar<br />

Ben Cook<br />

SolarCity Corporation<br />

Jim Howard<br />

Dudley Ventures<br />

Forrest Milder<br />

Nixon Peabody LLP<br />

John Pimentel<br />

Foundation Windpower<br />

Photo: Courtesy of ARC Architects<br />

<strong>Adams</strong> View homes have specially designed gathering areas for family and<br />

friends.<br />

reservation of nearly $1.4 million in LIHTCs in 2010. Bank of<br />

America provided an $11.4 million housing loan and a $4.4<br />

million infrastructure loan, both under the Title VI loan guarantee<br />

program. Key Bank contributed about $12.2 million in LIHTC<br />

equity through the syndicator, Raymond James Tax Credit Funds.<br />

“Leveraging resources was the key to accomplishing this<br />

development,” said Picotte. “It enables us to provide adequate,<br />

decent, safe, affordable housing to Yakama Nation tribal<br />

members.”<br />

<strong>Adams</strong> View<br />

A team from Seattle-based ARC Architects designed <strong>Adams</strong> View<br />

with six different floor plans for one- or two-story units. The units<br />

include three or four bedrooms, two baths, two car garages and large<br />

patios. <strong>Adams</strong> View was designed so that units could accommodate<br />

extended families with a large, high-ceilinged gathering room that<br />

can accommodate groups of family and friends.<br />

continued on page 4<br />

www.novoco.com October 2013<br />

3

novogradac journal of tax credits<br />

continued from page 3<br />

Photo: Courtesy of ARC Architects<br />

The <strong>Adams</strong> View affordable housing development was built on Yakama Nation<br />

tribal land near Wapato, Wash.<br />

The development meets Washington Evergreen<br />

Sustainable Development Standards with energyefficient<br />

green construction, ENERGY STAR appliances,<br />

high efficiency heating and cooling, cellulose insulation,<br />

fiberglass windows and doors, metal roofs and fire<br />

sprinkler systems. The units are situated and designed<br />

to minimize energy costs. They rely on the homes’<br />

orientation to the sun, natural cooling through window<br />

placement and air circulation. YNHA’s construction<br />

team completed half of the construction work on <strong>Adams</strong><br />

View to provide training, jobs and income to community<br />

members.<br />

<strong>Adams</strong> View sites homes around a large 11.3-<br />

acre center green. The green has two basketball<br />

courts, bleachers, picnic tables, a one-mile<br />

walking path that winds through the park<br />

and the surrounding neighborhood. There’s<br />

a conventional playground for toddlers and<br />

older children and a second ‘natural’ play<br />

area with logs from Yakama Forest Products, a<br />

tribal enterprise.<br />

One of the biggest challenges of developing on<br />

rural tribal land is lack of infrastructure, said<br />

Luber. The <strong>Adams</strong> View development added<br />

roads and sidewalks and expanded the water<br />

and wastewater treatment facilities to serve<br />

existing developments near <strong>Adams</strong> View, the<br />

68 new homes and future developments. A<br />

new 150,000-gallon elevated water storage tank<br />

and a new well link existing and new water<br />

mains for increased fire safety.<br />

<strong>Adams</strong> View is 100 percent occupied and leased to<br />

qualifying households that earn between 30 percent<br />

and 60 percent of the area median income (AMI). The<br />

68 homes are required to be rented for 15 years, and<br />

then there are options for the tribe to continue renting<br />

out the units or to sell the homes. If the tribe decides to<br />

sell the homes, leasees have the option to purchase their<br />

homes, if they meet certain requirements. Clem said<br />

this purchase option will allow households to make<br />

<strong>Adams</strong> View their family home for generations to come,<br />

he said, “It’s important to have a start in a place that lets<br />

you prosper and grow.”<br />

www.novoco.com October 2013<br />

This article first appeared in the October 2013 issue of the Novogradac Journal of Tax Credits.<br />

© Novogradac & Company LLP 2013 - All Rights Reserved<br />

Notice pursuant to IRS regulations: Any U.S. federal tax advice contained in this article is not intended to be used, and cannot<br />

be used, by any taxpayer for the purpose of avoiding penalties under the Internal Revenue Code; nor is any such advice intended<br />

to be used to support the promotion or marketing of a transaction. Any advice expressed in this article is limited to the federal<br />

tax issues addressed in it. Additional issues may exist outside the limited scope of any advice provided – any such advice does<br />

not consider or provide a conclusion with respect to any additional issues. Taxpayers contemplating undertaking a transaction<br />

should seek advice based on their particular circumstances.<br />

This editorial material is for informational purposes only and should not be construed otherwise. Advice and interpretation regarding<br />

property compliance or any other material covered in this article can only be obtained from your tax advisor. For further information<br />

visit www.novoco.com.<br />

4