Audit Report(Revenue Receipt) - Accountant General, Odisha

Audit Report(Revenue Receipt) - Accountant General, Odisha

Audit Report(Revenue Receipt) - Accountant General, Odisha

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter-I <strong>General</strong><br />

Head of revenue Year Amount<br />

collected at<br />

pre<br />

assessment<br />

stage<br />

1. Sales tax 2003-04<br />

2004-05<br />

2005-06*<br />

2. Profession tax 2003-04<br />

2004-05<br />

2005-06*<br />

3. Entry tax 2003-04<br />

2004-05<br />

2005-06*<br />

4. Luxury tax 2003-04<br />

2004-05<br />

2005-06*<br />

Amount collected<br />

after regular<br />

assessment<br />

(additional<br />

demand)<br />

Amount<br />

of arrear<br />

demand<br />

collected<br />

( R u p e e s i n c r o r e )<br />

Net<br />

collection<br />

Amount<br />

refunded<br />

Per -<br />

centage<br />

of column<br />

3 to 7<br />

(1) (2) (3) (4) (5) (6) (7) (8)<br />

1,820.65<br />

37.80 36.61 17.01 1,877.75<br />

2,420.87<br />

35.34 34.68 23.54 2,467.35<br />

2,909.94<br />

72.90 46.48 22.14 3,007.18<br />

5. Entertainment<br />

tax<br />

2003-04<br />

2004-05<br />

2005-06*<br />

50.62<br />

56.16<br />

64.18<br />

350.67<br />

361.65<br />

432.71<br />

11.26<br />

10.15<br />

0.08<br />

3.33<br />

3.06<br />

2.98<br />

--<br />

--<br />

--<br />

17.44<br />

19.87<br />

29.01<br />

--<br />

0.01<br />

--<br />

0.01<br />

0.06<br />

--<br />

--<br />

--<br />

--<br />

3.45<br />

4.81<br />

8.33<br />

--<br />

--<br />

--<br />

0.06<br />

0.21<br />

0.09<br />

--<br />

--<br />

--<br />

0.04<br />

0.74<br />

0.82<br />

--<br />

--<br />

--<br />

--<br />

--<br />

--<br />

50.62<br />

56.16<br />

64.18<br />

371.52<br />

385.59<br />

469.23<br />

11.26<br />

10.16<br />

0.08<br />

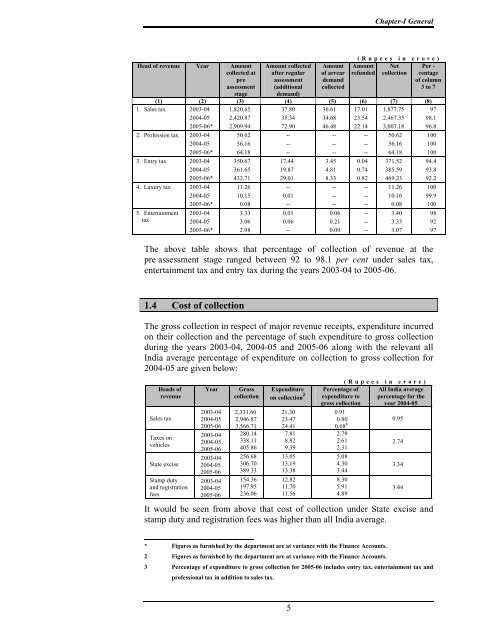

The above table shows that percentage of collection of revenue at the<br />

pre assessment stage ranged between 92 to 98.1 per cent under sales tax,<br />

entertainment tax and entry tax during the years 2003-04 to 2005-06.<br />

3.40<br />

3.33<br />

3.07<br />

97<br />

98.1<br />

96.8<br />

100<br />

100<br />

100<br />

94.4<br />

93.8<br />

92.2<br />

100<br />

99.9<br />

100<br />

98<br />

92<br />

97<br />

1.4 Cost of collection<br />

The gross collection in respect of major revenue receipts, expenditure incurred<br />

on their collection and the percentage of such expenditure to gross collection<br />

during the years 2003-04, 2004-05 and 2005-06 along with the relevant all<br />

India average percentage of expenditure on collection to gross collection for<br />

2004-05 are given below:<br />

Heads of<br />

revenue<br />

Sales tax<br />

Taxes on<br />

vehicles<br />

State excise<br />

Stamp duty<br />

and registration<br />

fees<br />

Year<br />

2003-04<br />

2004-05<br />

2005-06<br />

2003-04<br />

2004-05<br />

2005-06<br />

2003-04<br />

2004-05<br />

2005-06<br />

2003-04<br />

2004-05<br />

2005-06<br />

Gross<br />

collection<br />

2,331.60<br />

2,946.87<br />

3,566.71<br />

280.14<br />

338.11<br />

405.86<br />

256.68<br />

306.70<br />

389.33<br />

154.36<br />

197.95<br />

236.06<br />

Expenditure<br />

on collection 2<br />

21.30<br />

23.47<br />

24.41<br />

7.81<br />

8.82<br />

9.39<br />

13.05<br />

13.19<br />

13.38<br />

12.82<br />

11.70<br />

11.56<br />

( R u p e e s i n c r o r e )<br />

Percentage of All India average<br />

expenditure to percentage for the<br />

gross collection year 2004-05<br />

0.91<br />

0.80<br />

0.95<br />

0.68 3<br />

2.79<br />

2.61<br />

2.74<br />

2.31<br />

5.08<br />

4.30<br />

3.34<br />

3.44<br />

It would be seen from above that cost of collection under State excise and<br />

stamp duty and registration fees was higher than all India average.<br />

8.30<br />

5.91<br />

4.89<br />

3.44<br />

* Figures as furnished by the department are at variance with the Finance Accounts.<br />

2 Figures as furnished by the department are at variance with the Finance Accounts.<br />

3 Percentage of expenditure to gross collection for 2005-06 includes entry tax, entertainment tax and<br />

professional tax in addition to sales tax.<br />

5