SEB Commodities

vvqrs

vvqrs

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Commodities</strong> Monthly<br />

<strong>SEB</strong> <strong>Commodities</strong> price outlook<br />

Sources: Bloomberg, <strong>SEB</strong> Commodity Research<br />

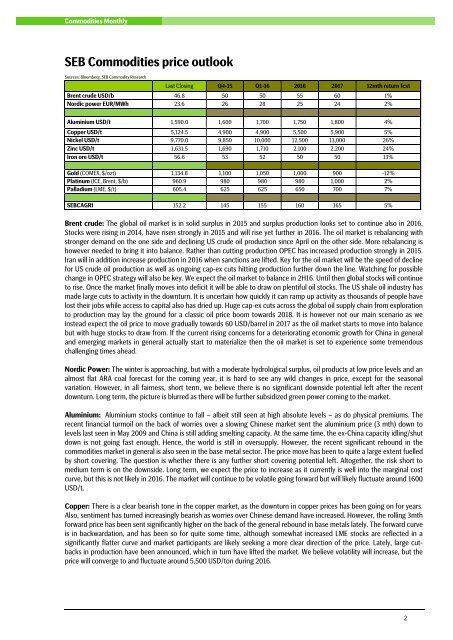

Last Closing Q4-15 Q1-16 2016 2017 12mth return fcst<br />

Brent crude USD/b 46.8 50 50 55 60 1%<br />

Nordic power EUR/MWh 23.6 26 28 25 24 2%<br />

Aluminium USD/t 1,590.0 1,600 1,700 1,750 1,800 4%<br />

Copper USD/t 5,124.5 4,900 4,900 5,500 5,900 5%<br />

Nickel USD/t 9,770.0 9,850 10,000 12,500 13,000 26%<br />

Zinc USD/t 1,631.5 1,690 1,710 2,100 2,200 24%<br />

Iron ore USD/t 56.6 53 52 50 50 13%<br />

Gold (COMEX, $/ozt) 1,134.8 1,100 1,050 1,000 900 -12%<br />

Platinum (ICE, Brent, $/b) 960.9 980 980 980 1,000 2%<br />

Palladium (LME, $/t) 605.4 625 625 650 700 7%<br />

<strong>SEB</strong>CAGRI 152.2 145 155 160 165 5%<br />

Brent crude: The global oil market is in solid surplus in 2015 and surplus production looks set to continue also in 2016.<br />

Stocks were rising in 2014, have risen strongly in 2015 and will rise yet further in 2016. The oil market is rebalancing with<br />

stronger demand on the one side and declining US crude oil production since April on the other side. More rebalancing is<br />

however needed to bring it into balance. Rather than cutting production OPEC has increased production strongly in 2015.<br />

Iran will in addition increase production in 2016 when sanctions are lifted. Key for the oil market will be the speed of decline<br />

for US crude oil production as well as ongoing cap-ex cuts hitting production further down the line. Watching for possible<br />

change in OPEC strategy will also be key. We expect the oil market to balance in 2H16. Until then global stocks will continue<br />

to rise. Once the market finally moves into deficit it will be able to draw on plentiful oil stocks. The US shale oil industry has<br />

made large cuts to activity in the downturn. It is uncertain how quickly it can ramp up activity as thousands of people have<br />

lost their jobs while access to capital also has dried up. Huge cap-ex cuts across the global oil supply chain from exploration<br />

to production may lay the ground for a classic oil price boom towards 2018. It is however not our main scenario as we<br />

instead expect the oil price to move gradually towards 60 USD/barrel in 2017 as the oil market starts to move into balance<br />

but with huge stocks to draw from. If the current rising concerns for a deteriorating economic growth for China in general<br />

and emerging markets in general actually start to materialize then the oil market is set to experience some tremendous<br />

challenging times ahead.<br />

Nordic Power: The winter is approaching, but with a moderate hydrological surplus, oil products at low price levels and an<br />

almost flat ARA coal forecast for the coming year, it is hard to see any wild changes in price, except for the seasonal<br />

variation. However, in all fairness, short term, we believe there is no significant downside potential left after the recent<br />

downturn. Long term, the picture is blurred as there will be further subsidized green power coming to the market.<br />

Aluminium: Aluminium stocks continue to fall – albeit still seen at high absolute levels – as do physical premiums. The<br />

recent financial turmoil on the back of worries over a slowing Chinese market sent the aluminium price (3 mth) down to<br />

levels last seen in May 2009 and China is still adding smelting capacity. At the same time, the ex-China capacity idling/shut<br />

down is not going fast enough. Hence, the world is still in oversupply. However, the recent significant rebound in the<br />

commodities market in general is also seen in the base metal sector. The price move has been to quite a large extent fuelled<br />

by short covering. The question is whether there is any further short covering potential left. Altogether, the risk short to<br />

medium term is on the downside. Long term, we expect the price to increase as it currently is well into the marginal cost<br />

curve, but this is not likely in 2016. The market will continue to be volatile going forward but will likely fluctuate around 1600<br />

USD/t.<br />

Copper: There is a clear bearish tone in the copper market, as the downturn in copper prices has been going on for years.<br />

Also, sentiment has turned increasingly bearish as worries over Chinese demand have increased. However, the rolling 3mth<br />

forward price has been sent significantly higher on the back of the general rebound in base metals lately. The forward curve<br />

is in backwardation, and has been so for quite some time, although somewhat increased LME stocks are reflected in a<br />

significantly flatter curve and market participants are likely seeking a more clear direction of the price. Lately, large cutbacks<br />

in production have been announced, which in turn have lifted the market. We believe volatility will increase, but the<br />

price will converge to and fluctuate around 5,500 USD/ton during 2016.<br />

2