income tax act - Fiji Revenue & Customs Authority

income tax act - Fiji Revenue & Customs Authority

income tax act - Fiji Revenue & Customs Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

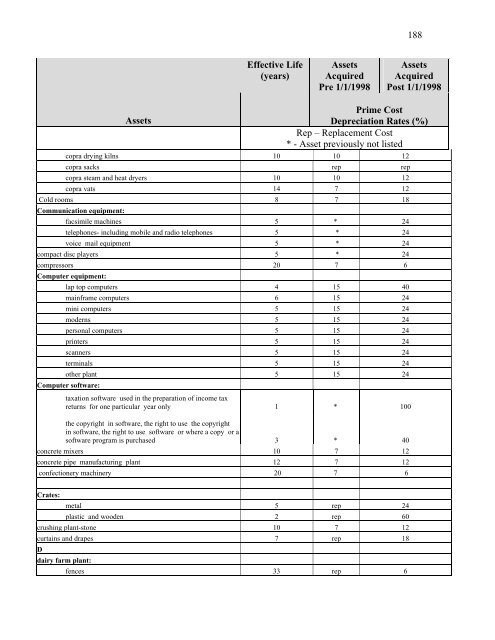

188<br />

Effective Life<br />

(years)<br />

Assets<br />

Acquired<br />

Pre 1/1/1998<br />

Assets<br />

Acquired<br />

Post 1/1/1998<br />

Assets<br />

Prime Cost<br />

Depreciation Rates (%)<br />

Rep – Replacement Cost<br />

* - Asset previously not listed<br />

copra drying kilns 10 10 12<br />

copra sacks rep rep<br />

copra steam and heat dryers 10 10 12<br />

copra vats 14 7 12<br />

Cold rooms 8 7 18<br />

Communication equipment:<br />

facsimile machines 5 * 24<br />

telephones- including mobile and radio telephones 5 * 24<br />

voice mail equipment 5 * 24<br />

comp<strong>act</strong> disc players 5 * 24<br />

compressors 20 7 6<br />

Computer equipment:<br />

lap top computers 4 15 40<br />

mainframe computers 6 15 24<br />

mini computers 5 15 24<br />

moderns 5 15 24<br />

personal computers 5 15 24<br />

printers 5 15 24<br />

scanners 5 15 24<br />

terminals 5 15 24<br />

other plant 5 15 24<br />

Computer software:<br />

<strong>tax</strong>ation software used in the preparation of <strong>income</strong> <strong>tax</strong><br />

returns for one particular year only 1 * 100<br />

the copyright in software, the right to use the copyright<br />

in software, the right to use software or where a copy or a<br />

software program is purchased 3 * 40<br />

concrete mixers 10 7 12<br />

concrete pipe manuf<strong>act</strong>uring plant 12 7 12<br />

confectionery machinery 20 7 6<br />

Crates:<br />

metal 5 rep 24<br />

plastic and wooden 2 rep 60<br />

crushing plant-stone 10 7 12<br />

curtains and drapes 7 rep 18<br />

D<br />

dairy farm plant:<br />

fences 33 rep 6