PANTAGRAPH

Download the complete issue - Pantagraph.com

Download the complete issue - Pantagraph.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18<br />

Pantagraph HOME MARKET, Friday, January 4, 2013<br />

NATION'S HOUSING MARKET TO CONTINUE STRENGHTENING IN 2013<br />

Home sales and prices are<br />

expected to keep rising in most<br />

areas in the year ahead, but<br />

mortgage rates are likely to climb<br />

too.<br />

DEAR MR. MYERS: We have<br />

wanted to buy a home for the past<br />

two years, but have been waiting<br />

for prices to bottom out. Home<br />

values in the areas that we have<br />

been shopping in have climbed a<br />

little bit in the past few months,<br />

but we're worried that it's just a<br />

temporary "blip" that will end<br />

soon and that prices will start<br />

going down again. How do you<br />

think the housing market will do<br />

in 2013?<br />

ANSWER: Sales and prices<br />

fluctuate from one area to the<br />

next based on a variety of factors,<br />

ranging from national mortgagerate<br />

trends to the state of both<br />

the U.S. and local economy. But<br />

housing markets in some parts of<br />

the country began showing new<br />

signs of life last spring, and all<br />

indications are that many more<br />

markets will begin a full-fledged<br />

recovery in 2013 from the housing<br />

bust that began about six years<br />

ago.<br />

I'm devoting this entire column<br />

to answering some common<br />

questions that readers have<br />

recently asked about the housing<br />

market in the upcoming year.<br />

Q: How can you be so positive<br />

about the market, considering that<br />

there are so many homes for sale<br />

and so many others in foreclosure?<br />

A: Actually, there really aren't<br />

that many homes for sale. There<br />

were a relatively modest 2.03<br />

million homes on the market at the<br />

end of November, according to the<br />

National Association of Realtors,<br />

which equates to a 4.8-month<br />

supply based on current sales<br />

rates. That's the lowest supply<br />

level since the boom days of 2005.<br />

Foreclosures indeed are still<br />

holding back some markets<br />

because their offering prices are<br />

so low. But the foreclosure rate<br />

has been slowing, and should<br />

continue to fall in 2013 as more<br />

people find new jobs or finally<br />

are able to refinance at today's<br />

lower mortgage rates to save their<br />

homes. Fewer foreclosures will<br />

help keep the supply-and-demand<br />

balance in check, which in turn<br />

will add more fuel to expected<br />

price gains.<br />

Overall, about 4.6 million<br />

homes were sold in 2012. The<br />

National Association of Realtors<br />

forecasts that purchases in the<br />

year ahead will climb about 9<br />

percent, to 5.1 million.<br />

Q: How much will prices rise?<br />

A: Again, it depends primarily<br />

on the state of the economy where<br />

you live and, to a lesser extent, the<br />

number of local homes for sale.<br />

Price forecasts vary among<br />

trade groups and private-sector<br />

research companies. Economists<br />

at Standard & Poor's and the<br />

Realtors trade group are each<br />

calling for an average gain across<br />

the U.S. of about 5 percent in<br />

2013. Researchers at lending giant<br />

J.P. Morgan Chase & Co. foresee<br />

a minimum 3.4 percent price<br />

increase, but say the average home<br />

value could surge as much as 9.7<br />

percent if the economy meets<br />

the bank's most bullish growth<br />

projections.<br />

Q: Which parts of the country<br />

will do best in the coming year?<br />

A: Real estate information and<br />

services giant Trulia.com says the<br />

best price gains likely will be in<br />

areas with high job growth, low<br />

apartment vacancy rates (which<br />

encourage more renters to become<br />

homeowners) and a low number<br />

of foreclosures. Its top-10 list of<br />

best markets for 2013 includes four<br />

cities in Texas -- Houston, San<br />

Antonio, Austin and Fort Worth.<br />

Rounding out Trulia's list are<br />

San Francisco; Seattle; Omaha,<br />

Neb.; Greater Bethesda, Md., and<br />

Peabody, Mass.<br />

Q: Where are mortgage rates<br />

headed?<br />

A: Most experts agree that<br />

they'll go up, but not by much.<br />

www.PantagraphHomeMarket.com<br />

Rates on 30-year fixed-rate<br />

loans currently stand at about 3.5<br />

percent for so-called "conforming"<br />

loans of $417,500 or less,<br />

according to the Mortgage Bankers<br />

Association. Economists at the<br />

trade group predict they'll rise to<br />

3.9 percent in the first quarter of<br />

2013, and hit 4.4 percent by the<br />

end of the year as the economy<br />

slowly picks up steam.<br />

A roughly one-percentagepoint<br />

increase over the coming<br />

year would add about $77 to<br />

the monthly cost of a $150,000<br />

mortgage. But ironically, a rate<br />

hike actually could fuel the<br />

expected upswing in sales and<br />

prices by creating a "sense of<br />

urgency" among consumers who<br />

have been sitting on the homebuying<br />

fence.<br />

The expected rate hike<br />

also serves as a reminder that<br />

homeowners who haven't yet<br />

refinanced at today's record-low<br />

rates should start filling out their<br />

loan applications sooner rather<br />

than later.<br />

20496146<br />

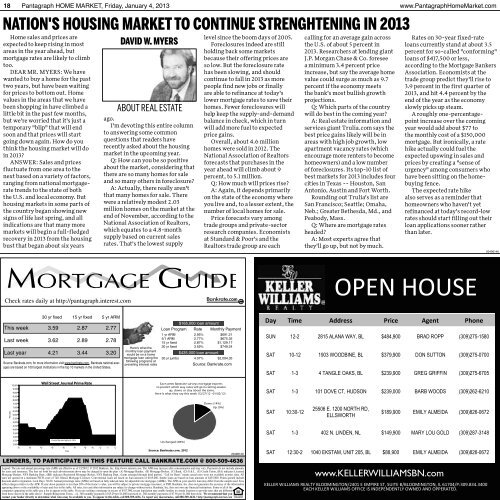

Check rates daily at http://pantagraph.interest.com<br />

OPEN HOUSE<br />

Day Time Address Price Agent Phone<br />

SUN 12-2 2815 ALANA WAY, BL $484,900 BRAD ROPP (309)275-1580<br />

SAT 10-12 1903 WOODBINE, BL $379,900 DON SUTTON (309)275-0700<br />

SAT 1-3 4 TANGLE OAKS, BL $239,900 GREG GRIFFIN (309)275-6705<br />

SAT 1-3 101 DOVE CT, HUDSON $239,000 BARB WOODS (309)262-6210<br />

SAT 10:30-12<br />

25506 E. 1200 NORTH RD,<br />

ELLSWORTH<br />

$189,900 EMILY ALMEIDA (309)826-0672<br />

SAT 1-3 402 N. LINDEN, NL $149,900 MARY LOU GOLD (309)287-3148<br />

LENDERS, TO PARTICIPATE IN THIS FEATURE CALL BANKRATE.COM @ 800-509-4636<br />

20496129<br />

Legend: The rate and annual percentage rate (APR) are effective as of 12/28/12. © 2012 Bankrate, Inc. http://www.interest.com. The APR may increase after consummation and may vary. Payments do not include amounts<br />

for taxes and insurance. The fees set forth for each advertisement above may be charged to open the plan (A) Mortgage Banker, (B) Mortgage Broker, (C) Bank, (D) S & L, (E) Credit Union, (BA) indicates Licensed<br />

Mortgage Banker, NYS Banking Dept., (BR) indicates Registered Mortgage Broker, NYS Banking Dept., (loans arranged through third parties). “Call for Rates” means actual rates were not available at press time. All<br />

rates are quoted on a minimum FICO score of 740. Illinois Mortgage Licensee. Conventional loans are based on loan amounts of $165,000. Jumbo loans are based on loan amounts of $435,000. Points quoted include<br />

discount and/or origination. Lock Days: 30-60. Annual percentage rates (APRs) are based on fully indexed rates for adjustable rate mortgages (ARMs). The APR on your specific loan may differ from the sample used. Fees<br />

reflect charges relative to the APR. If your down payment is less than 20% of the home’s value, you will be subject to private mortgage insurance, or PMI. Bankrate, Inc. does not guarantee the accuracy of the information<br />

appearing above or the availability of rates and fees in this table. All rates, fees and other information are subject to change without notice. Bankrate, Inc. does not own any financial institutions. Some or all of the<br />

companies appearing in this table pay a fee to appear in this table. If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different<br />

from those shown in the table above. Sample Repayment Terms – ex. 360 monthly payments of $5.29 per $1,000 borrowed ex. 180 monthly payments of $7.56 per $1,000 borrowed. We recommend that you<br />

contact your lender directly to determine what rates may be available to you. To appear in this table, call 800-509-4636. To report any inaccuracies, call 888-509-4636. <br />

SAT 12:30-2 1040 EKSTAM, UNIT 205, BL $88,900 EMILY ALMEIDA (309)826-0672<br />

www.KELLERWILLIAMSBN.com<br />

KELLER WILLIAMS REALTY BLOOMINGTON/2401 E EMPIRE ST, SUITE B/BLOOMINGTON, IL 61704/P:309.834.3400<br />

EACH KELLER WILLIAMS OFFICE IS INDEPENDENTLY OWNED AND OPPERATED.