TRANSPORT

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS<br />

Exchange at centers other than the centers mentioned in the<br />

Application Form;<br />

• Category not ticked; and/or<br />

• Application Form accompanied with more than one cheque.<br />

• In case of cancellation of one or more orders (series) within<br />

an Application, leading to total order quantity falling under the<br />

minimum quantity required for a single Application.<br />

• SCSBs investing in the Issue through its own ASBA account.<br />

Kindly note that ASBA Applications submitted to the Lead<br />

Managers, the Co-Lead Managers, Lead Brokers, subbrokers<br />

or Trading Members of the Stock Exchange at<br />

the Specified Cities will not be accepted if the SCSB where the<br />

ASBA Account, as specified in the ASBA Form, is maintained<br />

has not named at least one branch at that Specified City<br />

for the Lead Managers, the Co-Lead Managers, Lead<br />

Brokers, sub-brokers or Trading Members of the<br />

Stock Exchange, as the case may be, to deposit ASBA<br />

Applications (A list of such branches is available at http://<br />

www.sebi.gov.in/sebiweb/home/list/5/33/0/0/Recognised-<br />

Intermediaries).<br />

For information on certain procedures to be carried out by the<br />

Registrar to the Offer for finalization of the basis of allotment,<br />

please refer to “Information for Applicants” on page 301 of the<br />

Prospectus.<br />

33. Information for Applicants: In case of ASBA Applications<br />

submitted to the SCSBs, in terms of the SEBI circular CIR/CFD/<br />

DIL/3/2010 dated April 22, 2010, the Registrar to the Issue will<br />

reconcile the compiled data received from the Stock Exchange<br />

and all SCSBs, and match the same with the Depository<br />

database for correctness of DP ID, Client ID and PAN. The<br />

Registrar to the Issue will undertake technical rejections based<br />

on the electronic details and the Depository database. In case of<br />

any discrepancy between the electronic data and the Depository<br />

records, the Company, in consultation with the Designated Stock<br />

Exchange, the Lead Managers, the Co-Lead Managers and the<br />

Registrar to the Issue, reserves the right to proceed as per the<br />

Depository records for such ASBA Applications or treat such<br />

ASBA Applications as rejected.<br />

In case of ASBA Applicants submitted to the Lead Managers,<br />

the Co-Lead Managers, Lead Brokers, sub-brokers and<br />

Trading Members of the Stock Exchange at the Specified<br />

Cities, the basis of allotment will be based on the Registrar‘s<br />

validation of the electronic details with the Depository records,<br />

and the complete reconciliation of the final certificates received<br />

from the SCSBs with the electronic details in terms of the<br />

SEBI circular CIR/CFD/DIL/1/2011 dated April 29, 2011. The<br />

Registrar to the Issue will undertake technical rejections based<br />

on the electronic details and the Depository database. In case of<br />

any discrepancy between the electronic data and the Depository<br />

records, the Company, in consultation with the Designated Stock<br />

Exchange, the Lead Managers, the Co-Lead Managers and the<br />

Registrar to the Issue, reserves the right to proceed as per the<br />

Depository records or treat such ASBA Application as rejected.<br />

In case of non-ASBA Applications and Direct Online<br />

Applications, the basis of allotment will be based on the<br />

Registrar‘s validation of the electronic details with the<br />

Depository records, and the complete reconciliation of the<br />

final certificates received from the Escrow Collection Banks<br />

with the electronic details in terms of the SEBI circular CIR/<br />

CFD/DIL/3/2010 dated April 22, 2010 and the SEBI circular<br />

CIR/CFD/DIL/1/2011 dated April 29, 2011. The Registrar will<br />

undertake technical rejections based on the electronic details and<br />

the Depository database. In case of any discrepancy between<br />

the electronic data and the Depository records, the Company,<br />

in consultation with the Designated Stock Exchange, the Lead<br />

Managers, the Co-Lead Managers, the Registrar to the Issue,<br />

reserves the right to proceed as per the Depository records or<br />

treat such Applications as rejected.<br />

Based on the information provided by the Depositories, the<br />

Company shall have the right to accept Applications belonging<br />

to an account for the benefit of a minor (under guardianship).<br />

In case of Applications for a higher number of NCDs than<br />

specified for that category of Applicant, only the maximum<br />

amount permissible for such category of Applicant will be<br />

considered for Allotment.<br />

34. BASIS OF ALLOTMENT:<br />

The Registrar will aggregate the Applications, based on the<br />

Applications received through an electronic book, from the<br />

Stock Exchanges and determine the valid Applications for the<br />

purpose of drawing the basis of allocation.<br />

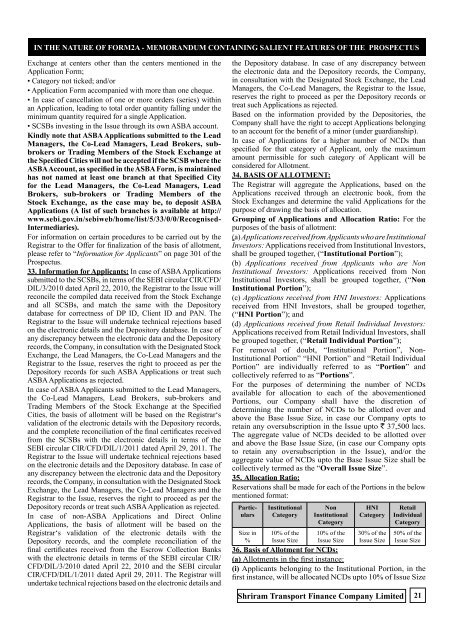

Grouping of Applications and Allocation Ratio: For the<br />

purposes of the basis of allotment:<br />

(a) Applications received from Applicants who are Institutional<br />

Investors: Applications received from Institutional Investors,<br />

shall be grouped together, (“Institutional Portion”);<br />

(b) Applications received from Applicants who are Non<br />

Institutional Investors: Applications received from Non<br />

Institutional Investors, shall be grouped together, (“Non<br />

Institutional Portion”);<br />

(c) Applications received from HNI Investors: Applications<br />

received from HNI Investors, shall be grouped together,<br />

(“HNI Portion”); and<br />

(d) Applications received from Retail Individual Investors:<br />

Applications received from Retail Individual Investors, shall<br />

be grouped together, (“Retail Individual Portion”);<br />

For removal of doubt, “Institutional Portion”, Non-<br />

Institutional Portion” “HNI Portion” and “Retail Individual<br />

Portion” are individually referred to as “Portion” and<br />

collectively referred to as “Portions”.<br />

For the purposes of determining the number of NCDs<br />

available for allocation to each of the abovementioned<br />

Portions, our Company shall have the discretion of<br />

determining the number of NCDs to be allotted over and<br />

above the Base Issue Size, in case our Company opts to<br />

retain any oversubscription in the Issue upto ` 37,500 lacs.<br />

The aggregate value of NCDs decided to be allotted over<br />

and above the Base Issue Size, (in case our Company opts<br />

to retain any oversubscription in the Issue), and/or the<br />

aggregate value of NCDs upto the Base Issue Size shall be<br />

collectively termed as the “Overall Issue Size”.<br />

35. Allocation Ratio:<br />

Reservations shall be made for each of the Portions in the below<br />

mentioned format:<br />

Particulars<br />

Size in<br />

%<br />

Institutional<br />

Category<br />

10% of the<br />

Issue Size<br />

Non<br />

Institutional<br />

Category<br />

10% of the<br />

Issue Size<br />

HNI<br />

Category<br />

30% of the<br />

Issue Size<br />

Shriram Transport Finance Company Limited<br />

Retail<br />

Individual<br />

Category<br />

50% of the<br />

Issue Size<br />

36. Basis of Allotment for NCDs:<br />

(a) Allotments in the first instance:<br />

(i) Applicants belonging to the Institutional Portion, in the<br />

first instance, will be allocated NCDs upto 10% of Issue Size<br />

21