NON-CONVERTIBLE

MUTHOOT FINANCE LIMITED - HDFC Bank

MUTHOOT FINANCE LIMITED - HDFC Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

operations including for our capital expenditure and working capital requirements. For further details, see<br />

section titled “Objects of the Issue” beginning of the Prospectus. The fund requirement and deployment<br />

is based on internal management estimates and has not been appraised by any bank or financial institution.<br />

The management will have significant flexibility in applying the proceeds received by us from the Issue.<br />

Further, as per the provisions of the Debt Regulations, we are not required to appoint a monitoring agency<br />

and therefore no monitoring agency has been appointed for this Issue.<br />

GENERAL INFORMATION<br />

Our Company was originally incorporated as a private limited company on March 14, 1997 under the provisions<br />

of the Companies Act, 1956, with the name “The Muthoot Finance Private Limited”. Subsequently, by a fresh<br />

certificate of incorporation dated May 16, 2007, our name was changed to “Muthoot Finance Private Limited”.<br />

Our Company was converted into a public limited company on November 18, 2008 with the name “Muthoot<br />

Finance Limited” and received a fresh certificate of incorporation consequent to change in status on<br />

December 02, 2008 from the Registrar of Companies, Kerala and Lakshadweep. Registered Office : Muthoot<br />

Finance Limited, Muthoot Chambers, Opposite Saritha Theatre Complex, 2 nd Floor, Banerji Road, Kochi 682<br />

018 Kerala, India. • Tel: (91 484) 239 4712 • Fax: (91 484) 239 6506 • Website: www.muthootfinance.com •<br />

Email: cs@muthootgroup.com • For details of change in registered office, refer to the section titled “History and<br />

Main Objects” of the Prospectus. Registration : Registration Number: 011300. Corporate Identity Number:<br />

L65910KL1997PLC011300 issued by the Registrar of Companies, Kerala and Lakshadweep. Certificate of<br />

registration bearing number N. 16.00167 under Section 45IA of the RBI Act, 1934 from the RBI dated<br />

December 12, 2008 from the RBI to carry on the business of a non-banking financial institution without<br />

accepting public deposits.<br />

Impersonation : As a matter of abundant precaution, attention of the investors is specifically drawn to the<br />

provisions of sub-section (1) of section 68A of the Act, relating to punishment for fictitious applications.<br />

Minimum Subscription : Under the Debt Regulations, our Company is required to stipulate a minimum<br />

subscription amount which it seeks to raise. The consequence of minimum subscription amount not being<br />

raised is that the Issue shall not proceed and the entire application moneys received are refunded to the<br />

Applicants. If our Company does not receive the minimum subscription of 75% of the Base Issue i.e. ` 1,875<br />

million, prior to the Issue Closing Date, the entire subscription amount shall be refunded to the Applicants<br />

within 30 days from the date of closure of the Issue. If there is delay in the refund of subscription by more than<br />

eight days after our Company becomes liable to refund the subscription amount, our Company will pay interest<br />

for the delayed period, at rates prescribed under sub-sections (2) and (2A) of Section 73 of the Companies Act,<br />

1956.<br />

Utilisation of Issue proceeds<br />

Our Board of Directors certifies that: • all monies received out of the Issue shall be credited/transferred to a<br />

separate bank account other than the bank account referred to in sub-section (3) of Section 73 of the Act; • details<br />

of all monies utilised out of the Issue referred above shall be disclosed under an appropriate separate head<br />

in our balance sheet indicating the purpose for which such monies have been utilised; • details of all unutilised<br />

monies out of the Issue, if any, shall be disclosed under an appropriate head in our balance sheet indicating<br />

the form in which such unutilised monies have been invested; and • we shall utilize the Issue proceeds only<br />

upon creation of security as stated in the Prospectus in the section titled “Issue Structure” of the Prospectus.<br />

• the Issue proceeds shall not be utilized towards full or part consideration for the purchase or any other<br />

acquisition, inter alia by way of a lease, of any property.<br />

Issue Programme : The subscription list shall remain open at the commencement of banking hours and close<br />

at the close of banking hours for the period as indicated, with an option for early closure or extension by such<br />

period, as may be decided by the duly authorised committee of the Board constituted by resolution of the Board<br />

dated July 25, 2011. In the event of such early closure of subscription list of the Issue, our Company shall ensure<br />

that notice of such early closure is given on or before the day of such early date of closure through advertisement/<br />

s in a leading national daily newspaper.<br />

ISSUE OPENS ON MARCH 02, 2012<br />

ISSUE CLOSES ON MARCH 17, 2012<br />

CAPITAL STRUCTURE<br />

Details of share capital<br />

The share capital of our Company as at date of the Prospectus is set forth below:<br />

Amount in `<br />

A Authorised share capital<br />

450,000,000 Equity Shares 4,500,000,000<br />

5,000,000 Redeemable Preference Shares of ` 1,000.00 each 5,000,000,000<br />

TOTAL 9,500,000,000<br />

B Issued, subscribed and paid-up share capital<br />

371,712,768 Equity Shares 3,717,127,680<br />

Changes in the authorised capital of our Company as on the date of the Prospectus:<br />

Details of increase in authorised share capital since incorporation For further details please refer to the Prospectus.<br />

Notes to capital structure For further details please refer to the Prospectus.<br />

Share holding pattern of our Company as on December 31, 2011 For further details please refer to the Prospectus.<br />

OBJECTS OF THE ISSUE<br />

Issue proceeds : Our Company has filed the Prospectus for a public issue of NCDs aggregating upto ` 2,500<br />

million with an option to retain over-subscription upto ` 2,500 million for issuance of additional NCDs aggregating<br />

to a total of upto ` 5,000 million. The funds raised through this Issue will be utilised for our various financing<br />

activities including lending and investments, to repay our existing liabilities or loans and towards our business<br />

operations including for our capital expenditure and working capital requirements and general corporate<br />

purposes, after meeting the expenditures of and related to the Issue and subject to applicable statutory/<br />

regulatory requirements. The main objects clause of the Memorandum of Association of our Company permits<br />

our Company to undertake its existing activities as well as the activities for which the funds are being raised<br />

through this Issue.<br />

Monitoring of utilisation of funds : There is no requirement for appointment of a monitoring agency in terms<br />

of the SEBI Debt Regulations. The Board of Directors of our Company shall monitor the utilisation of the<br />

proceeds of the Issue. Our Company will disclose in the Company’s financial statements for the relevant<br />

financial year commencing from FY 2012, the utilisation of the proceeds of the Issue under a separate head<br />

along with details, if any, in relation to all such proceeds of the Issue that have not been utilised thereby also<br />

indicating investments, if any, of such unutilised proceeds of the Issue.<br />

Interim use of proceeds : The management of the Company, in accordance with the policies formulated by it<br />

from time to time, will have flexibility in deploying the proceeds received from the Issue. Pending utilisation<br />

of the proceeds out of the Issue for the purposes described above, the Company intends to temporarily invest<br />

funds in high quality interest bearing liquid instruments including money market mutual funds, deposits with<br />

banks or temporarily deploy the funds in investment grade interest bearing securities as may be approved by<br />

the Board / Committee of Directors of the Company, as the case may be. Such investment would be in<br />

accordance with the investment policy of our Company approved by the Board or any committee thereof from<br />

time to time.<br />

Utilisation of proceeds from the NCDs allotted to NRIs, if any : We propose to offer Option II, Option III and Option<br />

IV NCDs for subscription, pursuant to the Issue, to NRIs only on a non-repatriable basis. Under the provisions<br />

of the Foreign Exchange Management (Borrowing and Lending in Rupees) Regulations, 2000, any monies<br />

borrowed from a person resident outside India cannot be used: (a) for any purpose except in ones own business<br />

other than (i) the business of chit fund, (ii) as Nidhi Company, (iii) agricultural or plantation activities or real<br />

estate business; or construction of farm houses; or (iv) trading in Transferable Development Rights (TDRs); or<br />

(b) for any investment, whether by way of capital or otherwise, in any company or partnership firm or proprietorship<br />

concern or any entity, whether incorporated or not, or for the purpose of re-lending. To ensure compliance with<br />

the above, our Company shall open and maintain a separate account with the Escrow Collection Bank(s) in<br />

connection with all application monies received from NRIs, (“Special Account”). All application monies received<br />

from NRI applicants shall be deposited in the Special Account maintained with any of the Bankers to the Issue.<br />

Upon creation of security as disclosed in the Prospectus, the Escrow Collection Bank(s) shall transfer the monies<br />

from the Special Account to a separate bank account, (“NRI Account”), which shall be different from the Public<br />

Issue Account. Our Company shall at all times ensure that any monies kept in the Special Account and/or the<br />

NRI Account shall be utilised only in accordance with and subject to the restrictions contained in the Foreign<br />

Exchange Management (Borrowing and Lending in Rupee) Regulations, 2000, and other applicable statutory<br />

and/or regulatory requirements.<br />

Other confirmations : In accordance with the SEBI Debt Regulations, our Company will not utilise the proceeds<br />

of the Issue for providing loans to or acquisition of shares of any person who is a part of the same group as our<br />

Company or who is under the same management as our Company or any subsidiary of our Company. The Issue<br />

proceeds shall not be utilised towards full or part consideration for the purchase or any other acquisition, inter<br />

alia by way of a lease, of any property. No part of the proceeds from this Issue will be paid by us as consideration<br />

to our Promoter, our Directors, Key Managerial Personnel, or companies promoted by our Promoter except in<br />

the usual course of business. Further the Company undertakes that Issue proceeds from NCDs allotted to banks<br />

shall not be used for any purpose, which may be in contravention of the RBI guidelines on bank financing to<br />

NBFCs including those relating to classification as capital market exposure or any other sectors that are<br />

prohibited under the RBI regulations.<br />

STATEMENT OF TAX BENEFITS : For details please refer to the Prospectus.<br />

INDUSTRY : For details please refer to the Prospectus.<br />

OUR BUSINESS<br />

Overview : We are the largest gold financing company in India in terms of loan portfolio, according to the 2010<br />

update to the IMaCS Research & Analytics Industry Reports, Gold Loans Market in India, 2009 (“IMaCS Industry<br />

Report, (2010 Update)”). For further details please refer to the Prospectus.<br />

HISTORY AND MAIN OBJECTS<br />

Brief background of our Company : For details please refer to the Prospectus.<br />

Main objects of our Company : For details please refer to the Prospectus.<br />

OUR MANAGEMENT : Board of Directors - The general superintendence, direction and management<br />

of our affairs and business are vested in our Board of Directors. We have not appointed any ‘manager’ within<br />

the meaning thereof under the provisions of the Act. Under the Articles of Association, we are required to have<br />

not less than three Directors and not more than 12 Directors. We currently have 8 Directors on the Board out<br />

of which 4 Directors, i. e. 50% of the total strength of Directors are independent directors. For further details<br />

please refer to the Prospectus.<br />

OUR PROMOTER<br />

Profile of our Promoters : The following individuals are the Promoters of the Company: 1. M.G. George Muthoot;<br />

2. George Thomas Muthoot; 3. George Jacob Muthoot; and 4. George Alexander Muthoot; For additional<br />

details on the age, background, personal address, educational qualifications, experience, experience in the<br />

business of the Company, positions/posts held in the past, terms of appointment as Directors and other<br />

directorships of our Promoters, For further details please refer to the Prospectus.<br />

8<br />

MUTHOOT FINANCE LIMITED<br />

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS<br />

66. Prominent Notes : • This is a public issue of NCDs aggregating upto ` 2,500 million with an option<br />

to retain over-subscription upto ` 2,500 million for issuance of additional NCDs aggregating to a total<br />

of upto ` 5,000 million. • For details on the interest of our Company’s Directors, please refer to the sections<br />

titled “Our Management” and “Capital Structure” of the Prospectus. • Our Company has entered into certain<br />

related party transactions, within the meaning of AS 18 as notified by the Companies (Accounting<br />

Standards) Rules, 2006, as disclosed in the section titled “Financial Information” of the Prospectus. • Any<br />

clarification or information relating to the Issue shall be made available by the Lead Managers and our<br />

SUMMARY FINANCIAL INFORMATION<br />

The following tables present an extract of Reformatted Summary Financial Statements. The Reformatted<br />

Summary Financial Statements should be read in conjunction with the examination report thereon issued by<br />

our Statutory Auditors and statement of significant accounting policies and notes to accounts on the Reformatted<br />

Summary Financial Statements contained, For further details please refer to the Prospectus.<br />

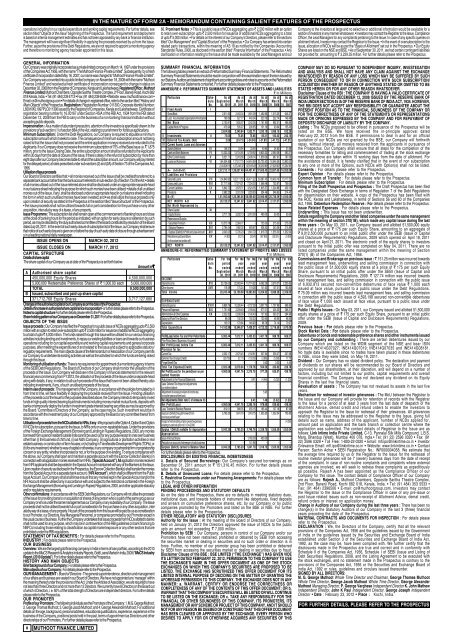

ANNEXURE-I: REFORMATTED SUMMARY STATEMENT OF ASSETS AND LIABILITIES<br />

` In Millions<br />

Particulars Sche- As at As at As at As at As at As at<br />

dule September March March March March March<br />

No. 30, 2011 31, 2011 31, 2010 31, 2009 31, 2008 31, 2007<br />

I Fixed Assets I<br />

Gross Block 2,911.60 2,463.34 1,691.09 1,482.66 1,215.25 646.37<br />

Less: Accumulated Depreciation/Amortization 760.69 627.77 449.04 320.76 222.74 149.48<br />

Net Block 2,150.91 1,835.57 1,242.05 1,161.90 992.51 496.89<br />

Capital Work in Progress 473.94 505.27 290.65 131.19 93.64 135.40<br />

2,624.85 2,340.84 1,532.71 1,293.10 1,086.15 632.29<br />

II Investments II 75.05 75.05 75.05 85.31 183.43 242.15<br />

III Deferred Tax Assets, (Net) 5.06 (24.73) (-24.84) (-37.87) (-41.73) (-47.31)<br />

IV<br />

V<br />

Current Assets, Loans and Advances<br />

Sundry Debtors III 159.37 53.94 33.45 40.95 34.92 21.66<br />

Cash and Bank Balances IV 13,322.22 13,754.95 5,759.92 8,825.32 2,580.38 563.21<br />

Other Current Assets V 6,521.71 5,919.68 2,408.14 1,658.09 967.91 787.06<br />

Loans and Advances VI 1,84,504.85 1,17,517.75 54,616.99 25,735.53 18,046.59 13,893.02<br />

2,04,508.15 1,37,246.32 62,818.49 36,259.89 21,629.80 15,264.95<br />

A= (I+II+III+IV) 2,07,213.11 1,39,637.48 64,401.41 37,600.43 22,857.65 16,092.08<br />

Liabilities and Provisions<br />

Secured Loans VII 1,34,849.95 1,02,111.55 45,471.22 30,087.45 18,400.19 13,117.52<br />

Unsecured Loans VIII 37,717.95 17,274.31 7,334.03 1,568.48 752.87 709.00<br />

Current Liabilities IX 5,842.72 3,878.71 4,524.35 1,805.57 1,224.88 459.10<br />

Provisions X 2,682.22 3,031.00 1,229.90 524.46 348.65 214.43<br />

B=(V) 1,81,092.84 1,26,295.56 58,559.50 33,985.96 20,726.59 14,500.06<br />

NET WORTH A-B 26,120.27 13,341.92 5,841.92 3,614.47 2,131.07 1,592.03<br />

Net Worth Represented by<br />

Share Capital<br />

XI<br />

- Equity Shares 3,717.13 3,202.13 3,010.00 490.00 50.00 50.00<br />

Reserves and Surplus<br />

- Securities Premium XII 10,570.78 2,364.77 - 755.00 275.00 275.00<br />

- Statutory Reserve XIII 2,794.04 1,982.02 993.67 538.52 343.08 215.89<br />

- Surplus/ (Deficit) in Profit and Loss Account XIV 9,043.25 5,795.20 1,841.79 1,918.75 1,555.50 1,052.04<br />

Miscellaneous Expenditure XV (4.93) (2.21) (3.54) (87.80) (92.51) (0.90)<br />

(to the extent not written off)<br />

NET WORTH 26,120.27 13,341.92 5,841.92 3,614.47 2,131.07 1,592.03<br />

ANNEXURE-II: REFORMATTED SUMMARY STATEMENT OF PROFITS AND LOSSES<br />

` In Millions<br />

Particulars Sche- For the For the For the For the For the For the<br />

dule period year year year year year<br />

No. ended ended ended ended ended ended<br />

September March March March March March<br />

30, 2011 31, 2011 31, 2010 31, 2009 31, 2008 31, 2007<br />

INCOME<br />

Interest Income XVI 20,126.05 22,983.44 10,774.52 6,062.39 3,579.37 2,235.85<br />

Other Income XVII 119.39 175.24 119.28 141.63 107.01 103.80<br />

Total Income 20,245.44 23,158.68 10,893.80 6,204.02 3,686.38 2,339.65<br />

EXPENDITURE<br />

Interest Expense XVIII 9,858.76 10,326.44 4,737.28 3,097.70 1,797.99 998.95<br />

Personnel Expenses XIX 1,751.90 2,209.49 1,169.44 677.01 405.35 266.31<br />

Administrative & Other Expenses XX 2,322.82 2,638.99 1,190.43 727.93 390.21 284.96<br />

Salary to Whole Time Directors 96.00 192.00 192.23 120.90 48.90 48.90<br />

Depreciation 133.51 179.64 148.90 98.78 74.14 70.97<br />

Total Expenditure 14,162.99 15,546.57 7,438.27 4,722.32 2,716.59 1,670.09<br />

Profit/(Loss) before Tax and Prior Period Items 6,082.44 7,612.11 3,455.53 1,481.70 969.78 669.57<br />

Prior Period Items [ Expenses / (Income)] - - - - - -<br />

Net Profit/(Loss) before Tax 6,082.44 7,612.11 3,455.53 1,481.70 969.78 669.57<br />

Provision for tax<br />

Current Tax 2,052.17 2,670.45 1,192.81 507.94 336.07 207.68<br />

Deferred Tax Charge/(Credit) (29.79) (0.11) (13.03) (3.86) (5.58) 17.70<br />

Fringe Benefit Tax - - 0.42 3.32 4.40<br />

Total Tax Expense/(Credit) 2,022.38 2,670.34 1,179.78 504.50 333.82 229.78<br />

Net Profit/(Loss) for the period/year as per 4,060.06 4,941.76 2,275.75 977.20 635.97 439.79<br />

audited financials<br />

Adjustments to the Financial Statements - 9.41 (4.46) (5.32) (1.23)<br />

Less: Deferred Tax Impact on Adjustments - - - - -<br />

considered above<br />

Adjustment of excess provision of income tax, - - 5.95 - -<br />

for earlier years written back<br />

Net Adjustments (Refer note C of Annexure IV) - - 9.41 1.49 (5.32) (1.23)<br />

Net Profit/(Loss) 4,060.06 4,941.76 2,285.16 978.69 630.65 438.56<br />

Less: Transfer to Statutory Reserve 812.01 988.35 455.15 195.44 127.19 87.96<br />

Surplus/ (Deficit) brought forward from 5,795.20 1,841.79 1,918.75 1,555.50 1,052.04 705.80<br />

previous period/year<br />

Impact of reformatting of prior period expenses (4.36)<br />

relating to periods prior to 01.04.2006<br />

Surplus / (Deficit) available for Appropriation 9,043.25 5,795.20 3,748.76 2,338.75 1,555.50 1,052.04<br />

Appropriation:<br />

Issue of Bonus Shares - 1,765.00 420.00 - -<br />

Reduction on account of demerger of radio business - 141.98 - - -<br />

Surplus/ (Deficit) carried to Balance Sheet 9,043.25 5,795.20 1,841.79 1,918.75 1,555.50 1,052.04<br />

For further details please refer to the Prospectus.<br />

DISCLOSURES ON EXISTING FINANCIAL INDEBTEDNESS<br />

A. Details of Secured Borrowings: Our Company’s secured borrowings as on<br />

December 31, 2011 amount to ` 151,310.45 million. For further details please<br />

refer to the Prospectus.<br />

B. Details of Unsecured Loans: For details please refer to the Prospectus.<br />

C. Restrictive Covenants under our Financing Arrangements: For details please refer<br />

to the Prospectus.<br />

LEGAL AND OTHER INFORMATION<br />

PENDING PROCEEDINGS AND STATUTORY DEFAULTS<br />

As on the date of the Prospectus, there are no defaults in meeting statutory dues,<br />

institutional dues, and towards holders of instrument like debentures, fixed deposits<br />

and arrears on cumulative preference shares, etc, by our Company or by public<br />

companies promoted by the Promoters and listed on the BSE or NSE. For further<br />

details please refer to the Prospectus.<br />

OTHER REGULATORY AND STATUTORY DISCLOSURES<br />

Authority for the Issue : At the meeting of the Board of Directors of our Company,<br />

held on January 31, 2012 the Directors approved the issue of NCDs to the public<br />

upto an amount not exceeding ` 7,000 million.<br />

Prohibition by SEBI : Our Company, persons in control of our Company and/or our<br />

Promoters have not been restrained, prohibited or debarred by SEBI from accessing<br />

the securities market or dealing in securities and no such order or direction is in<br />

force. Further, no member of our promoter group has been prohibited or debarred<br />

by SEBI from accessing the securities market or dealing in securities due to fraud.<br />

Disclaimer Clause of the BSE : BSE LIMITED (“THE EXCHANGE”) HAS GIVEN VIDE<br />

ITS LETTER DATED FEBRUARY 22, 2012, PERMISSION TO THIS COMPANY TO USE<br />

THE EXCHANGE’S NAME IN THIS OFFER DOCUMENT AS ONE OF THE STOCK<br />

EXCHANGES ON WHICH THIS COMPANY’S SECURITIES ARE PROPOSED TO BE<br />

LISTED. THE EXCHANGE HAS SCRUTINIZED THIS OFFER DOCUMENT FOR ITS<br />

LIMITED INTERNAL PURPOSE OF DECIDING ON THE MATTER OF GRANTING THE<br />

AFORESAID PERMISSION TO THIS COMPANY. THE EXCHANGE DOES NOT IN ANY<br />

MANNER: a. WARRANT, CERTIFY OR ENDORSE THE CORRECTNESS OR<br />

COMPLETENESS OF ANY OF THE CONTENTS OF THIS OFFER DOCUMENT; OR b.<br />

WARRANT THAT THIS COMPANY’S SECURITIES WILL BE LISTED OR WILL CONTINUE<br />

TO BE LISTED ON THE EXCHANGE; OR c. TAKE ANY RESPONSIBILITY FOR THE<br />

FINANCIAL OR OTHER SOUNDNESS OF THIS COMPANY, ITS PROMOTERS, ITS<br />

MANAGEMENT OR ANY SCHEME OR PROJECT OF THIS COMPANY. AND IT SHOULD<br />

NOT FOR ANY REASON BE DEEMED OR CONSTRUED THAT THIS OFFER DOCUMENT<br />

HAS BEEN CLEARED OR APPROVED BY THE EXCHANGE. EVERY PERSON WHO<br />

DESIRES TO APPLY FOR OR OTHERWISE ACQUIRES ANY SECURITIES OF THIS<br />

Company to the investors at large and no selective or additional information would be available for a<br />

section of investors in any manner whatsoever. • Investors may contact the Registrar to the Issue, Compliance<br />

Officer, the Lead Managers for any complaints pertaining to the Issue. In case of any specific queries on<br />

allotment/refund, Investor may contact the Registrar to the Issue. • In the event of oversubscription to the<br />

Issue, allocation of NCDs will be as per the “Basis of Allotment” set out in the Prospectus. • Our Equity<br />

Shares are listed on the NSE and BSE. • As of September 30, 2011, we had certain contingent liabilities<br />

not provided for, amounting to ` 3,229.35 million. For further details please refer to the Prospectus.<br />

COMPANY MAY DO SO PURSUANT TO INDEPENDENT INQUIRY, INVESTEGATION<br />

AND ANALYSIS AND SHALL NOT HAVE ANY CLAIM AGAINST THE EXCHANGE<br />

WHATSOEVER BY REASON OF ANY LOSS WHICH MAY BE SUFFERED BY SUCH<br />

PERSON CONSEQUENT TO OR IN CONNECTION WITH SUCH SUBSCRIPTION/<br />

ACQUISITION WHETHER BY REASON OF ANYTHING STATED OR OMITTED TO BE<br />

STATED HEREIN OR FOR ANY OTHER REASON WHATSOEVER.<br />

Disclaimer Clause of the RBI : THE COMPANY IS HAVING A VALID CERTIFICATE OF<br />

REGISTRATION DATED DECEMBER 12, 2008 ISSUED BY THE RESERVE BANK OF<br />

INDIA UNDER SECTION 45 IA OF THE RESERVE BANK OF INDIA ACT, 1934. HOWEVER,<br />

THE RBI DOES NOT ACCEPT ANY RESPONSIBILITY OR GUARANTEE ABOUT THE<br />

PRESENT POSITION AS TO THE FINANCIAL SOUNDNESS OF THE COMPANY OR<br />

FOR THE CORRECTNESS OF ANY OF THE STATEMENTS OR REPRESENTATIONS<br />

MADE OR OPINIONS EXPRESSED BY THE COMPANY AND FOR REPAYMENT OF<br />

DEPOSITS/ DISCHARGE OF LIABILITY BY THE COMPANY.<br />

Listing : The NCDs proposed to be offered in pursuance of the Prospectus will be<br />

listed on the BSE. We have received the in-principle approval dated<br />

February 22, 2012 from the BSE. If permissions to deal in and for an official<br />

quotation of our NCDs are not granted by the BSE, our Company will forthwith<br />

repay, without interest, all moneys received from the applicants in pursuance of<br />

the Prospectus. Our Company shall ensure that all steps for the completion of the<br />

necessary formalities for listing and commencement of trading at the stock exchange<br />

mentioned above are taken within 15 working days from the date of allotment. For<br />

the avoidance of doubt, it is hereby clarified that in the event of non subscription<br />

to any one or more of the Options, such NCDs with Option(s) shall not be listed.<br />

Consents : For details please refer to the Prospectus.<br />

Expert Opinion : For details please refer to the Prospectus.<br />

Common form of Transfer : For details please refer to the Prospectus.<br />

Minimum Subscription : For details please refer to the Prospectus.<br />

Filing of the Draft Prospectus and Prospectus : The Draft Prospectus has been filed<br />

with the Designated Stock Exchange in terms of Regulation 7 of the Debt Regulations<br />

for dissemination on their website. A copy of the Prospectus has been filed with<br />

the ROC, Kerala and Lakshadweep, in terms of Sections 56 and 60 of the Companies<br />

Act, 1956. Debenture Redemption Reserve : For details please refer to the Prospectus.<br />

Issue Related Expenses : For details please refer to the Prospectus.<br />

Underwriting : This Issue has not been underwritten.<br />

Details regarding the Company and other listed companies under the same management<br />

within the meaning of section 370(1B), which made any capital issue during the last<br />

three years : On May 03, 2011, our Company issued and allotted 51,500,000 equity<br />

shares at a price of ` 175 per such Equity Share, amounting to an aggregate of<br />

` 9,012,500,000 pursuant to an initial public offer under the SEBI (Issue of Capital<br />

and Disclosure Requirements) Regulations, 2009 which opened on April 18, 2011<br />

and closed on April 21, 2011. The electronic credit of the equity shares to investors<br />

pursuant to the initial public offer was completed on May 04, 2011. There are no<br />

listed companies under the same management within the meaning of Section<br />

370(1) (B) of the Companies Act, 1956.<br />

Commissions and Brokerage on previous issue : ` 151.25 million was incurred towards<br />

lead management fees, underwriting and selling commission in connection with<br />

the public issue of 51,500,000 equity shares at a price of ` 175 per such Equity<br />

Share, pursuant to an initial public offer under the SEBI (Issue of Capital and<br />

Disclosure Requirements) Regulations, 2009. ` 127.74 million was incurred towards<br />

lead management fees, and selling commission in connection with the public issue<br />

of 6,932,813 secured non-convertible debentures of face value ` 1,000 each<br />

issued at face value, pursuant to a public issue under the Debt Regulations.<br />

` 75.09 million was incurred towards lead management fees, and selling commission<br />

in connection with the public issue of 4,593,198 secured non-convertible debentures<br />

of face value ` 1,000 each issued at face value, pursuant to a public issue under<br />

the Debt Regulations.<br />

Public / Rights Issues : On May 03, 2011, our Company issued and allotted 51,500,000<br />

equity shares at a price of ` 175 per such Equity Share, pursuant to an initial public<br />

offer under the SEBI (Issue of Capital and Disclosure Requirements) Regulations,<br />

2009.<br />

Previous Issue : For details please refer to the Prospectus.<br />

Stock Market Data : For details please refer to the Prospectus.<br />

Debentures or bonds and redeemable preference shares and other instruments issued<br />

by our Company and outstanding : There are certain debentures issued by our<br />

Company which are listed on the WDM segment of the NSE and bear ISIN<br />

numbers INE414G07027; INE414G07019; INE414G07035 and INE414G08181.<br />

No trade data is available since no trades have taken placed in these debentures<br />

in NSE, since they were listed, on May 19, 2011.<br />

Dividend : Our Company has no stated dividend policy. The declaration and payment<br />

of dividends on our shares will be recommended by our Board of Directors and<br />

approved by our shareholders, at their discretion, and will depend on a number of<br />

factors, including but not limited to our profits, capital requirements and overall<br />

financial condition. The Company has not declared any dividend on its Equity<br />

Shares in the last five financial years.<br />

Revaluation of assets : The Company has not revalued its assets in the last five<br />

years.<br />

Mechanism for redressal of investor grievances : The MoU between the Registrar to<br />

the Issue and our Company will provide for retention of records with the Registrar<br />

to the Issue for a period of at least 3 years from the last date of despatch of the<br />

Allotment Advice, demat credit and refund orders to enable the investors to<br />

approach the Registrar to the Issue for redressal of their grievances. All grievances<br />

relating to the Issue may be addressed to the Registrar to the Issue, giving full<br />

details such as name, address of the applicant, number of NCDs applied for,<br />

amount paid on application and the bank branch or collection centre where the<br />

application was submitted. The contact details of Registrar to the Issue are as<br />

follows: Link Intime India Private Limited, C-13, Pannalal Silk Mills Compound, L.B.S.<br />

Marg, Bhandup (West), Mumbai 400 078, India.• Tel: (91 22) 2596 0320 • Fax: (91<br />

22) 2596 0329 • Toll Free: 1-800-22-0320 • Email: mfl.ipo@linkintime.co.in • Investor<br />

Grievance Email: mfl.ipo@linkintime.co.in • Website: www.linkintime.co.in • Contact<br />

Person: Sachin Achar • SEBI Registration No.: INR000004058. We estimate that<br />

the average time required by us or the Registrar to the Issue for the redressal of<br />

routine investor grievances will be 7 (seven) business days from the date of receipt<br />

of the complaint. In case of non-routine complaints and complaints where external<br />

agencies are involved, we will seek to redress these complaints as expeditiously<br />

as possible. Rajesh A has been appointed as the Compliance Officer of our<br />

Company for this issue. The contact details of Compliance Officer of our Company<br />

are as follows: Rajesh A., Muthoot Chambers, Opposite Saritha Theatre Complex,<br />

2nd Floor, Banerji Road, Kochi 682 018, Kerala, India. • Tel: (91 484) 353 5533 •<br />

Fax: (91 484) 2396506 • E-mail: cs@muthootgroup.com. Investors may contact<br />

the Registrar to the Issue or the Compliance Officer in case of any pre-issue or<br />

post Issue related issues such as non-receipt of Allotment Advice, demat credit,<br />

refund orders or interest on application money.<br />

Change in Auditors of our Company during the last three years : There has been no<br />

change(s) in the Statutory Auditors of our Company in the last 3 (three) financial<br />

years preceding the date of the Prospectus.<br />

MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION : For details please<br />

refer to the Prospectus.<br />

DECLARATION : We, the Directors of the Company, certify that all the relevant<br />

provisions of the Companies Act, 1956 and the guidelines issued by the Government<br />

of India or the guidelines issued by the Securities and Exchange Board of India<br />

established under Section 3 of the Securities and Exchange Board of India Act,<br />

1992, as the case may be, have been complied with. We further certify that the<br />

disclosures made in the Prospectus are true and correct and in conformity with<br />

Schedule II of the Companies Act, 1956, Schedule I of SEBI (Issue and Listing of<br />

Debt Securities) Regulations, 2008, and the Listing Agreement to be executed with<br />

the stock exchanges, and no statement made in the Prospectus is contrary to the<br />

provisions of the Companies Act, 1956 or the Securities and Exchange Board of<br />

India Act, 1992 or rules, guidelines and circulars issued thereunder.<br />

SIGNED BY ALL DIRECTORS:<br />

M. G. George Muthoot Whole Time Director and Chairman, George Thomas Muthoot<br />

Whole Time Director, George Jacob Muthoot Whole Time Director, George Alexander<br />

Muthoot Managing Director, P. George Varghese Independent Director K. John Mathew<br />

Independent Director, John K Paul Independent Director, George Joseph Independent<br />

Director • Date : February 23, 2012 • Place : Kochi, India.<br />

FOR FURTHER DETAILS, PLEASE REFER TO THE PROSPECTUS