20 15 ANNUAL REPORT

GUF_ANNUAL-REPORT-2015_web

GUF_ANNUAL-REPORT-2015_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

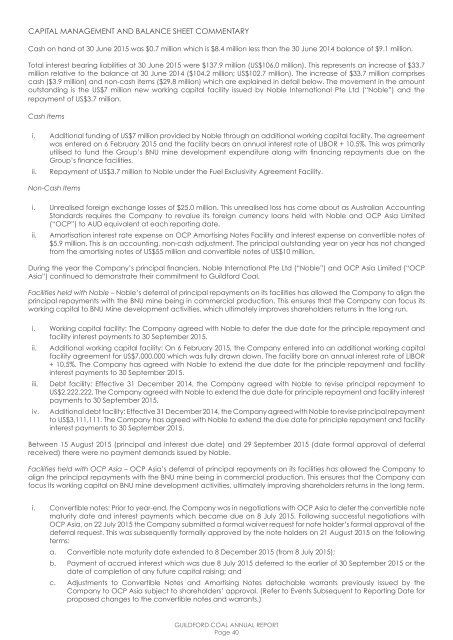

CAPITAL MANAGEMENT AND BALANCE SHEET COMMENTARY<br />

Cash on hand at 30 June <strong>20</strong><strong>15</strong> was $0.7 million which is $8.4 million less than the 30 June <strong>20</strong>14 balance of $9.1 million.<br />

Total interest bearing liabilities at 30 June <strong>20</strong><strong>15</strong> were $137.9 million (US$106.0 million). This represents an increase of $33.7<br />

million relative to the balance at 30 June <strong>20</strong>14 ($104.2 million; US$102.7 million). The increase of $33.7 million comprises<br />

cash ($3.9 million) and non-cash items ($29.8 million) which are explained in detail below. The movement in the amount<br />

outstanding is the US$7 million new working capital facility issued by Noble International Pte Ltd (“Noble”) and the<br />

repayment of US$3.7 million.<br />

Cash Items<br />

i. Additional funding of US$7 million provided by Noble through an additional working capital facility. The agreement<br />

was entered on 6 February <strong>20</strong><strong>15</strong> and the facility bears an annual interest rate of LIBOR + 10.5%. This was primarily<br />

utilised to fund the Group’s BNU mine development expenditure along with financing repayments due on the<br />

Group’s finance facilities.<br />

ii. Repayment of US$3.7 million to Noble under the Fuel Exclusivity Agreement Facility.<br />

Non-Cash Items<br />

i. Unrealised foreign exchange losses of $25.0 million. This unrealised loss has come about as Australian Accounting<br />

Standards requires the Company to revalue its foreign currency loans held with Noble and OCP Asia Limited<br />

(“OCP”) to AUD equivalent at each reporting date.<br />

ii. Amortisation interest rate expense on OCP Amortising Notes Facility and interest expense on convertible notes of<br />

$5.9 million. This is an accounting, non-cash adjustment. The principal outstanding year on year has not changed<br />

from the amortising notes of US$55 million and convertible notes of US$10 million.<br />

During the year the Company’s principal financiers, Noble International Pte Ltd (“Noble”) and OCP Asia Limited (“OCP<br />

Asia”) continued to demonstrate their commitment to Guildford Coal.<br />

Facilities held with Noble – Noble’s deferral of principal repayments on its facilities has allowed the Company to align the<br />

principal repayments with the BNU mine being in commercial production. This ensures that the Company can focus its<br />

working capital to BNU Mine development activities, which ultimately improves shareholders returns in the long run.<br />

i. Working capital facility: The Company agreed with Noble to defer the due date for the principle repayment and<br />

facility interest payments to 30 September <strong>20</strong><strong>15</strong>.<br />

ii. Additional working capital facility: On 6 February <strong>20</strong><strong>15</strong>, the Company entered into an additional working capital<br />

facility agreement for US$7,000,000 which was fully drawn down. The facility bore an annual interest rate of LIBOR<br />

+ 10.5%. The Company has agreed with Noble to extend the due date for the principle repayment and facility<br />

interest payments to 30 September <strong>20</strong><strong>15</strong>.<br />

iii. Debt facility: Effective 31 December <strong>20</strong>14, the Company agreed with Noble to revise principal repayment to<br />

US$2,222,222. The Company agreed with Noble to extend the due date for principle repayment and facility interest<br />

payments to 30 September <strong>20</strong><strong>15</strong>.<br />

iv. Additional debt facility: Effective 31 December <strong>20</strong>14, the Company agreed with Noble to revise principal repayment<br />

to US$3,111,111. The Company has agreed with Noble to extend the due date for principle repayment and facility<br />

interest payments to 30 September <strong>20</strong><strong>15</strong>.<br />

Between <strong>15</strong> August <strong>20</strong><strong>15</strong> (principal and interest due date) and 29 September <strong>20</strong><strong>15</strong> (date formal approval of deferral<br />

received) there were no payment demands issued by Noble.<br />

Facilities held with OCP Asia – OCP Asia’s deferral of principal repayments on its facilities has allowed the Company to<br />

align the principal repayments with the BNU mine being in commercial production. This ensures that the Company can<br />

focus its working capital on BNU mine development activities, ultimately improving shareholders returns in the long term.<br />

i. Convertible notes: Prior to year-end, the Company was in negotiations with OCP Asia to defer the convertible note<br />

maturity date and interest payments which became due on 8 July <strong>20</strong><strong>15</strong>. Following successful negotiations with<br />

OCP Asia, on 22 July <strong>20</strong><strong>15</strong> the Company submitted a formal waiver request for note holder’s formal approval of the<br />

deferral request. This was subsequently formally approved by the note holders on 21 August <strong>20</strong><strong>15</strong> on the following<br />

terms:<br />

a. Convertible note maturity date extended to 8 December <strong>20</strong><strong>15</strong> (from 8 July <strong>20</strong><strong>15</strong>);<br />

b. Payment of accrued interest which was due 8 July <strong>20</strong><strong>15</strong> deferred to the earlier of 30 September <strong>20</strong><strong>15</strong> or the<br />

date of completion of any future capital raising; and<br />

c. Adjustments to Convertible Notes and Amortising Notes detachable warrants previously issued by the<br />

Company to OCP Asia subject to shareholders’ approval. (Refer to Events Subsequent to Reporting Date for<br />

proposed changes to the convertible notes and warrants.)<br />

GUILDFORD COAL <strong>ANNUAL</strong> <strong>REPORT</strong><br />

Page 40