The Responsibility

TLwEs

TLwEs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINTECH INVESTMENT<br />

<strong>The</strong> Heat<br />

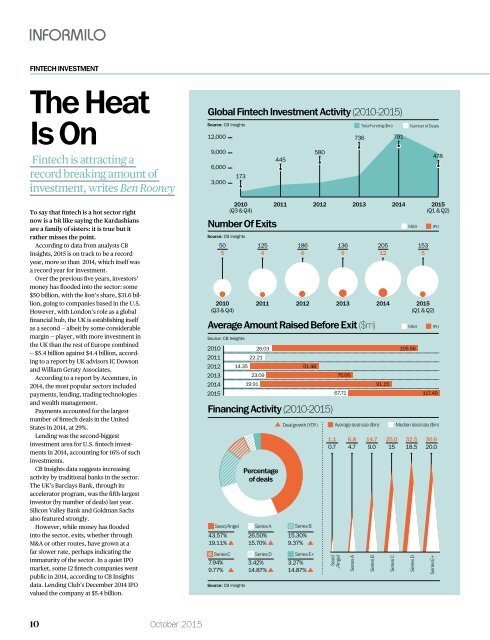

Global Fintech Investment Activity (2010-2015)<br />

Fintech Investment by Region 2010-2015 ($m)<br />

Is On<br />

Source: CB Insights<br />

12,000<br />

Total Funding ($m)<br />

736 791<br />

Number of Deals<br />

Source: IC Dowson and William Geraty Associates<br />

Fintech is attracting a<br />

record breaking amount of<br />

investment, writes Ben Rooney<br />

9,000<br />

6,000<br />

3,000<br />

173<br />

445<br />

580<br />

478<br />

To say that fintech is a hot sector right<br />

now is a bit like saying the Kardashians<br />

are a family of sisters: it is true but it<br />

rather misses the point.<br />

According to data from analysts CB<br />

Insights, 2015 is on track to be a record<br />

year, more so than 2014, which itself was<br />

a record year for investment.<br />

Over the previous five years, investors’<br />

money has flooded into the sector: some<br />

$50 billion, with the lion’s share, $31.6 billion,<br />

going to companies based in the U.S.<br />

However, with London’s role as a global<br />

financial hub, the UK is establishing itself<br />

as a second — albeit by some considerable<br />

margin — player, with more investment in<br />

the UK than the rest of Europe combined<br />

— $5.4 billion against $4.4 billion, according<br />

to a report by UK advisors IC Dowson<br />

and William Geraty Associates.<br />

According to a report by Accenture, in<br />

2014, the most popular sectors included<br />

payments, lending, trading technologies<br />

and wealth management.<br />

Payments accounted for the largest<br />

number of fintech deals in the United<br />

States in 2014, at 29%.<br />

Lending was the second-biggest<br />

investment area for U.S. fintech investments<br />

in 2014, accounting for 16% of such<br />

investments.<br />

CB Insights data suggests increasing<br />

activity by traditional banks in the sector.<br />

<strong>The</strong> UK’s Barclays Bank, through its<br />

accelerator program, was the fifth-largest<br />

investor (by number of deals) last year.<br />

Silicon Valley Bank and Goldman Sachs<br />

also featured strongly.<br />

However, while money has flooded<br />

into the sector, exits, whether through<br />

M&A or other routes, have grown at a<br />

far slower rate, perhaps indicating the<br />

immaturity of the sector. In a quiet IPO<br />

market, some 12 fintech companies went<br />

public in 2014, according to CB Insights<br />

data. Lending Club’s December 2014 IPO<br />

valued the company at $5.4 billion.<br />

Financing Activity (2010-2015)<br />

Seed/Angel<br />

43.57%<br />

19.11%<br />

Series C<br />

7.94%<br />

9.77%<br />

2010<br />

(Q3 & Q4)<br />

Number Of Exits<br />

Source: CB Insights<br />

50<br />

5<br />

2010<br />

(Q3 & Q4)<br />

125<br />

4<br />

Percentage<br />

of deals<br />

Series A<br />

26.50%<br />

15.70%<br />

Series D<br />

3.42%<br />

14.87%<br />

2011 2012 2013 2014 2015<br />

(Q1 & Q2)<br />

186<br />

6<br />

Deal growth (YOY) Average deal size ($m) Median deal size ($m)<br />

Series B<br />

15.30%<br />

9.37%<br />

Series E+<br />

3.27%<br />

14.87%<br />

1.1<br />

0.7<br />

Seed<br />

/Angel<br />

136<br />

9<br />

6.8<br />

4.7<br />

Series A<br />

14.7<br />

9.0<br />

Series B<br />

205<br />

12<br />

25.0<br />

15<br />

Series C<br />

M&A<br />

32.5<br />

18.5<br />

Series D<br />

153<br />

5<br />

2011 2012 2013 2014 2015<br />

(Q1 & Q2)<br />

Average Amount Raised Before Exit ($m)<br />

Source: CB Insights<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

Source: CB Insights<br />

26.03<br />

22.21<br />

14.35<br />

23.09<br />

19.91<br />

51.48<br />

70.06<br />

67.71<br />

91.15<br />

M&A<br />

105.56<br />

30.6<br />

20.0<br />

Series E+<br />

IPO<br />

IPO<br />

117.49<br />

CANADA<br />

$761<br />

Innotribe Global Fintech Hub Rankings<br />

<strong>The</strong> Innotribe Global Fintech Hub Rankings are an attempt<br />

to rank the hubs around the world using three different<br />

systems and combining them. <strong>The</strong> Global Financial<br />

Centers Index is a ranking of the competitiveness<br />

of financial centers based on over 29,000 financial<br />

New York<br />

1,544<br />

785<br />

64<br />

695<br />

Seoul<br />

1,390<br />

718<br />

58<br />

614<br />

USA<br />

$31,600<br />

SOUTH<br />

AMERICA<br />

$99<br />

UK<br />

$5,400<br />

EUROPE<br />

$4,400<br />

center assessments. <strong>The</strong> aim of the GFCI is to<br />

examine the major financial centers globally in terms of<br />

competitiveness. It is compiled and published twice a<br />

year by Z/Yen Group. <strong>The</strong> SparkLabs Global Ventures<br />

score is compiled by the venture fund of the same name.<br />

London<br />

784<br />

53<br />

683<br />

Singapore<br />

754<br />

40<br />

586<br />

ISRAEL<br />

$453<br />

AFRICA<br />

$329<br />

MIDDLE<br />

EAST<br />

$45<br />

INDIA<br />

$2,200<br />

CHINA<br />

$3,500<br />

Global Financial<br />

Centers Index<br />

San Francisco/Silicon Valley<br />

708<br />

75<br />

655<br />

Chicago<br />

707<br />

40<br />

601<br />

HONG<br />

KONG<br />

$154<br />

SINGAPORE<br />

$167<br />

SparkLabs Global<br />

Ventures Score<br />

1,520 1,438<br />

1,380 1,348<br />

AUSTRALIA/<br />

NZ<br />

$370<br />

SE ASIA<br />

$345<br />

CITIE City<br />

Report<br />

Finally, the CITIE City Report is the product of a<br />

partnership between the UK body Nesta, Accenture<br />

and the Future Cities Catapult. It examines cities<br />

across the world under nine different categories and<br />

scores them.<br />

Source: Z/Yen Group, venturebeat.com, CITIE Report 2015<br />

10 October January 2015 2015<br />

informilo.com 11