IT'S FREE!

HKMagazine_1123

HKMagazine_1123

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MIND THE<br />

Hong Kong’s wage disparity is worse than ever. Justin Heifetz finds out why.<br />

Lau Chung-ki is worried about the future of Tin Shui Wai. Property developer<br />

The Link REIT is ready to open the first phase of an upscale market at the Tin<br />

Shing Court public housing estate around Christmas. There will be a “SoHo”<br />

area for upmarket food and beverages, and a seafood street with chemical-free<br />

freshwater fish. Sounds great, but there’s just one problem. Tin Shui Wai has<br />

always been one of Hong Kong’s poorest areas and many of its inhabitants just<br />

can’t afford it.<br />

Lau, who works for the Tin Shui Wai Community Alliance, says that the Link<br />

is monopolizing options for the public housing estates that accommodate the<br />

city’s working poor—the Link owns five of Tin Shui Wai’s six wet markets and this<br />

upscale market isn’t a new construction but instead a major expansion of<br />

an existing wet market. Unless the government steps in, this gentrification is<br />

likely to push up prices for everyone in the area. “The Link’s development is highly<br />

focused around a shopping mall,” says Lau. “We’re fighting for more options—<br />

like wet markets governed by the Housing Authority.” It might be the only way to<br />

keep prices low.<br />

But the problem isn’t only in Tin Shui Wai anymore—Hong Kong is becoming<br />

increasingly and more drastically polarized between rich and poor. The wealth<br />

gap has long been a problem plaguing the city—and it’s growing larger than<br />

ever. As the minimum wage—$32.50 an hour—lags behind inflation, the number<br />

of working poor in the city continues to shoot upwards.<br />

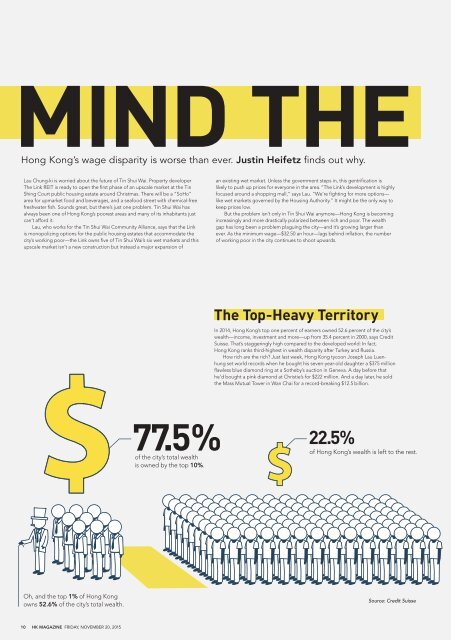

The Top-Heavy Territory<br />

In 2014, Hong Kong’s top one percent of earners owned 52.6 percent of the city’s<br />

wealth—income, investment and more—up from 35.4 percent in 2000, says Credit<br />

Suisse. That’s staggeringly high compared to the developed world: In fact,<br />

Hong Kong ranks third-highest in wealth disparity after Turkey and Russia.<br />

How rich are the rich? Just last week, Hong Kong tycoon Joseph Lau Luenhung<br />

set world records when he bought his seven-year-old daughter a $375 million<br />

flawless blue diamond ring at a Sotheby’s auction in Geneva. A day before that<br />

he’d bought a pink diamond at Christie’s for $222 million. And a day later, he sold<br />

the Mass Mutual Tower in Wan Chai for a record-breaking $12.5 billion.<br />

77.5%<br />

of the city’s total wealth<br />

is owned by the top 10%.<br />

22.5%<br />

of Hong Kong’s wealth is left to the rest.<br />

Oh, and the top 1% of Hong Kong<br />

owns 52.6% of the city’s total wealth.<br />

Source: Credit Suisse<br />

10 HK MAGAZINE FRIDAY, NOVEMBER 20, 2015