SAVE

PRUsave limited pay e-Brochure English - Prudential Singapore

PRUsave limited pay e-Brochure English - Prudential Singapore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

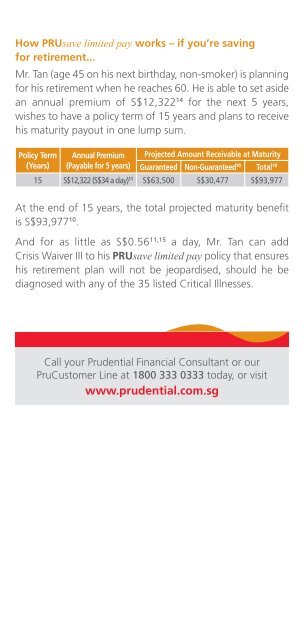

How PRUsave limited pay works – if you’re saving<br />

for retirement...<br />

Mr. Tan (age 45 on his next birthday, non-smoker) is planning<br />

for his retirement when he reaches 60. He is able to set aside<br />

an annual premium of S$12,322 14 for the next 5 years,<br />

wishes to have a policy term of 15 years and plans to receive<br />

his maturity payout in one lump sum.<br />

Policy Term Annual Premium Projected Amount Receivable at Maturity<br />

(Years) (Payable for 5 years) Guaranteed Non-Guaranteed 10 Total 10<br />

15 S$12,322 (S$34 a day) 11 S$63,500 S$30,477 S$93,977<br />

At the end of 15 years, the total projected maturity benefit<br />

is S$93,977 10 .<br />

And for as little as S$0.56 11,15 a day, Mr. Tan can add<br />

Crisis Waiver III to his PRUsave limited pay policy that ensures<br />

his retirement plan will not be jeopardised, should he be<br />

diagnosed with any of the 35 listed Critical Illnesses.<br />

Call your Prudential Financial Consultant or our<br />

PruCustomer Line at 1800 333 0333 today, or visit<br />

www.prudential.com.sg