Resource Manual on Integrated Production and Pest ... - julitoaligaen

Resource Manual on Integrated Production and Pest ... - julitoaligaen

Resource Manual on Integrated Production and Pest ... - julitoaligaen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<str<strong>on</strong>g>Resource</str<strong>on</strong>g> <str<strong>on</strong>g>Manual</str<strong>on</strong>g> <strong>on</strong> IPPM in Vegetable<br />

World Educati<strong>on</strong> Philippines, Inc.<br />

c) Sum-of-the-years digit method<br />

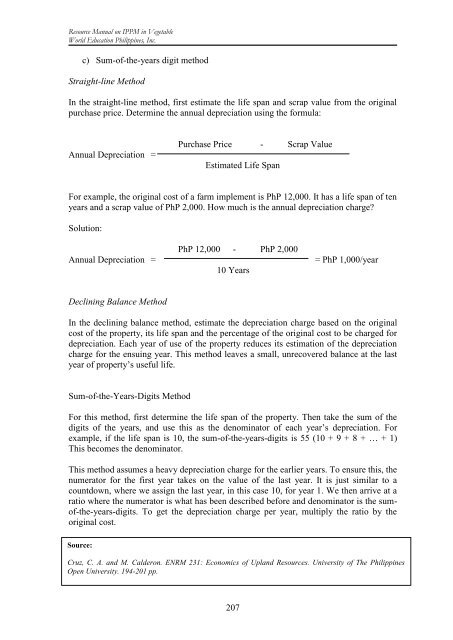

Straight-line Method<br />

In the straight-line method, first estimate the life span <strong>and</strong> scrap value from the original<br />

purchase price. Determine the annual depreciati<strong>on</strong> using the formula:<br />

Annual Depreciati<strong>on</strong> =<br />

Purchase Price - Scrap Value<br />

Estimated Life Span<br />

For example, the original cost of a farm implement is PhP 12,000. It has a life span of ten<br />

years <strong>and</strong> a scrap value of PhP 2,000. How much is the annual depreciati<strong>on</strong> charge?<br />

Soluti<strong>on</strong>:<br />

PhP 12,000 - PhP 2,000<br />

Annual Depreciati<strong>on</strong> = = PhP 1,000/year<br />

10 Years<br />

Declining Balance Method<br />

In the declining balance method, estimate the depreciati<strong>on</strong> charge based <strong>on</strong> the original<br />

cost of the property, its life span <strong>and</strong> the percentage of the original cost to be charged for<br />

depreciati<strong>on</strong>. Each year of use of the property reduces its estimati<strong>on</strong> of the depreciati<strong>on</strong><br />

charge for the ensuing year. This method leaves a small, unrecovered balance at the last<br />

year of property’s useful life.<br />

Sum-of-the-Years-Digits Method<br />

For this method, first determine the life span of the property. Then take the sum of the<br />

digits of the years, <strong>and</strong> use this as the denominator of each year’s depreciati<strong>on</strong>. For<br />

example, if the life span is 10, the sum-of-the-years-digits is 55 (10 + 9 + 8 + … + 1)<br />

This becomes the denominator.<br />

This method assumes a heavy depreciati<strong>on</strong> charge for the earlier years. To ensure this, the<br />

numerator for the first year takes <strong>on</strong> the value of the last year. It is just similar to a<br />

countdown, where we assign the last year, in this case 10, for year 1. We then arrive at a<br />

ratio where the numerator is what has been described before <strong>and</strong> denominator is the sumof-the-years-digits.<br />

To get the depreciati<strong>on</strong> charge per year, multiply the ratio by the<br />

original cost.<br />

Source:<br />

Cruz, C. A. <strong>and</strong> M. Calder<strong>on</strong>. ENRM 231: Ec<strong>on</strong>omics of Upl<strong>and</strong> <str<strong>on</strong>g>Resource</str<strong>on</strong>g>s. University of The Philippines<br />

Open University. 194-201 pp.<br />

207