FCU-Annual Report-2016

FCU—Frankenmuth Credit Union—Annual Report-February 2016. What's on your horizon. Let us help find the path.

FCU—Frankenmuth Credit Union—Annual Report-February 2016. What's on your horizon. Let us help find the path.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Welcome to Frankenmuth Credit Union’s <strong>Annual</strong> <strong>Report</strong>. This is always an exciting time of year: relaying our previous<br />

year’s goals and achievements, parading our new services, recognizing our staff’s commitment to our members<br />

and revealing our financial growth as an organization. But this year, we have even more to boast about. We had a<br />

ribbon cutting to show off the renovations of our Main Street, Frankenmuth, office which includes 40,000 square<br />

feet of new space, improved, easy-approach and speedy drive-thru services, a welcoming teller lobby and a gardenlevel<br />

conference center for all members to enjoy. We also grew in the community by opening branch locations in<br />

Rockford and Elkton.<br />

And, I am thrilled to announce the success of our emergent Frankenmuth Foundation which has donated over<br />

$480,000 to deserving people with worthy causes in over a dozen surrounding communities.<br />

This year, we embark on our roles with a sense of accomplishment but also with the continued challenge of our<br />

purpose: ‘people helping people.’ Life is a journey. We have dreams and good intentions on our horizon. And, we<br />

believe it is the fidelity to our members that the Frankenmuth Credit Union helps find that path to which they yearn<br />

for. It’s a journey you’ll never have to walk alone when you’re a member of the Frankenmuth Credit Union.<br />

OFFICES IN<br />

Saginaw Twp. | Essexville | Reese | Birch Run<br />

Richville | Vassar | Frankenmuth | Otisville<br />

Millington | Birch Run Meijer Dr | Freeland<br />

Cass City | City of Saginaw | Rockford | Elkton<br />

www. frankenmuthcu.org<br />

1-800-221-8880 | 989.497.1600<br />

P. 0. Box 209 | Frankenmuth, Ml | 48734<br />

SATELLITE OFFICES IN<br />

Independence Village - Frankenmuth<br />

Frankenmuth High School | Reese High School<br />

Juniata Christian School | Birch Run High School

e s p e c t<br />

In 1964 Frankenmuth Credit Union was organized by the employees of<br />

Carling Brewery. They were looking for an alternative option for their<br />

financial needs. In the beginning only the employees of Carling Brewery,<br />

Zeilinger Beverage, Geyer’s Brewery and Star of<br />

the West Milling could join the credit union—the<br />

brewers and millers. It wasn’t uncommon in those<br />

early days when someone wanted a loan, if the<br />

credit union didn’t have enough in savings,<br />

credit union staff would walk around the<br />

brewery carrying a shiny silver box asking<br />

employees to give additional deposits. People<br />

helping people!<br />

In 1969 Frankenmuth Credit Union had the<br />

forethought to apply, and was granted, to have its charter changed<br />

to a community charter. This meant that people living or working<br />

in a geographical area could now join the credit union, not just the<br />

employees of certain businesses. Over the years our charter has grown<br />

from townships, to counties and today anyone that lives, works, worships<br />

or was educated in the state of Michigan can join Frankenmuth Credit<br />

Union. Even though we have grown, we are still aware of our humble<br />

beginnings ‘people helping people’. We provide good old-fashioned<br />

hometown service coupled with sound financial advise specific for each<br />

of our members situations. We are rooted in the communities we serve<br />

and make an impact through our staff volunteer hours on community<br />

projects and our foundation.<br />

Today, the Frankenmuth Credit Union is over 32,000 members<br />

strong with 188 employees united in 14 communities.<br />

At Frankenmuth Credit Union we know the<br />

importance of kindheartedness and have always<br />

been proud of the active role our staff and<br />

board have played in impacting the communities<br />

we serve through volunteer hours, monetary<br />

contributions and civic group participation.<br />

We believe in ‘people helping people.’ That’s<br />

why the Frankenmuth Credit Union Foundation<br />

was formed, to provide grants to promote the<br />

betterment of local communities, one smile at a<br />

time. The Foundation was launched in April of<br />

2014 and has since positively influenced over<br />

50 different organizations and thousands of<br />

individuals in a dozen different communities.<br />

Over $448,000 funds have been donated to<br />

worthy causes including:<br />

—Child care equipment for local schools<br />

—Google Books for local schools<br />

—Reese scoreboards<br />

—Harvey Kern Pavilion nets and heat<br />

—Millington community pavilion<br />

—Juniata Christian School technology upgrades<br />

—Reese Trinity Lutheran bleachers<br />

—Freeland fire safety bounce house<br />

—Millington Schools technology funds<br />

—Saginaw Valley police K-9 unit equipment<br />

—Vassar and Saginaw Food Pantries<br />

—Children’s winter hats in Tuscola County<br />

—Tuscola and Saginaw County 4-H Grants<br />

—Food for local families in need<br />

—Vassar Junior achievement class in finance<br />

—Warm Blankets for woman and children<br />

—Richland Township Community Pavilion<br />

—Trolley Line Trail North Bike Path<br />

and so many more!<br />

For more information or for a Foundation<br />

grant application, visit frankenmuthcu.org<br />

13

Mike Fassezke<br />

appointed for 3 more years<br />

Mike is employed by Star of<br />

the West Milling Company<br />

Tim Hildner<br />

Tim owns<br />

Hildner Design<br />

and Contracting<br />

Cheryl Loeffler<br />

Cheryl is an attorney<br />

employed by Frankenmuth<br />

Insurance<br />

Pete Bender<br />

Pete is a Partner<br />

at Yeo & Yeo, P.C.<br />

Brian Dixon<br />

Brian is a Partner and<br />

Certified Public Accountant<br />

(CPA) at Yeo & Yeo, P.C.<br />

t r u s t<br />

Richard Reif<br />

appointed for 3 more years<br />

Richard was employed at General<br />

Motors for thirty-four years, and<br />

as an electrician for 11 years<br />

Ann DuRussel<br />

Ann is a public accountant in<br />

the dental profession and at a<br />

local oil & propane company<br />

Amy Zehnder Grossi<br />

Amy is the General Manager<br />

of Frankenmuth Bavarian Inn<br />

Restaurant<br />

Tiffany Lobodzinski<br />

newly appointed for a<br />

3-year term<br />

Tiffany is employed by<br />

Frankenmuth Insurance<br />

as an underwriter<br />

Brian Frederick<br />

Thank you for your time<br />

of Service.<br />

Recently retired from<br />

<strong>FCU</strong> Board<br />

OUR MISSION: Growing trusted relationships by providing personalized financial solutions for our members and financial services that empower our communities.<br />

OUR PROMISE TO OUR MEMBERS AND EACH OTHER:<br />

I will treat you as an honored guest.<br />

I will make it easy to do business with me.<br />

I will identify your financial needs and offer a solution that will improve your financial life.<br />

I will provide you with ‘extra mile’ service.<br />

I will strive to deliver 100% accuracy.<br />

I will treat you with the highest standards of professionalism.<br />

I will address you by name.<br />

I will thank you for your business.<br />

<strong>FCU</strong> partners with local schools in Vassar,<br />

Birch Run, Reese and Frankenmuth to offer an<br />

educational experience like no other—a<br />

real-world experience on how to run a<br />

successful business. Frankenmuth Credit<br />

Union’s student-run branches are coupled<br />

most often with a business or finance class<br />

where students are taught how to manage<br />

the day-to-day operations of a Credit Union<br />

Branch. Students are responsible for tellering,<br />

marketing and promoting their branch and<br />

staying within budget.<br />

What’s better than a reality check on financing? How<br />

about a reality fair that teaches students the skill of<br />

budgeting and money management? <strong>FCU</strong> staff visited<br />

St. Lorenz School in Frankenmuth and asked students<br />

to choose a career complete with the income and<br />

student loan debt that accompanied that profession.<br />

The students then had to make life-style decisions<br />

for housing, transportation, food, clothing, pets,<br />

phone bills, etc. Participants left the event with an<br />

appreciation for the everyday responsibility their<br />

parents have when budgeting their own household.<br />

Every Spring, <strong>FCU</strong> gives mini educator grants<br />

to teachers in the communities we serve to<br />

buy necessary supplies needed to enrich the<br />

student’s learning experience.<br />

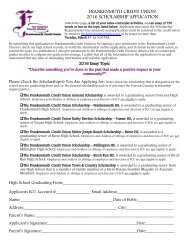

Every year Frankenmuth Credit Union gives<br />

seven $2,000 scholarships to <strong>FCU</strong> members<br />

graduating from High School and pursuing a<br />

higher-education degree.<br />

For a scholarship application,<br />

visit frankenmuthcu.org<br />

15

KASASA CASH BACK ® Save more of everything — money, time, and energy — automatically with a free Kasasa Cash Back ® checking account.<br />

Every time you use your debit card, you earn 1% back on your purchases, up to $10 a month! Saving is easy — that is, when you have an account that does<br />

the heavy lifting for you. Do you Kasasa? ® For more information, visit frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

<strong>FCU</strong> APP Download our new app for the smartphone or tablet to give you all<br />

the banking information you need right at your fingertips. The easy-to-use navigation<br />

includes many mobile banking options, including: eDeposit, bill pay, loan calculators,<br />

account details, account balance and more. Use the app to map <strong>FCU</strong> branch and ATM<br />

locations, loan calculators, mobile banking and more. Download the Frankenmuth<br />

Credit Union app from iTunes ® or Google Play ® .<br />

v a l u e<br />

NEW ON-LINE BILL PAY Save Time - Save Money - Enjoy Peace of Mind.<br />

We are launching an all-new Bill Pay platform on February 25, <strong>2016</strong>, within your It’s<br />

Me 247 login. This updated service promises to save you time because it is quick and<br />

easy to use. It will save you money because you no longer need stamps or have late<br />

fees from forgotten bills you’ve misplaced. Get peace of mind knowing your bills can<br />

be set-up to be paid when you want to pay them and for the amount you want to pay.<br />

For more information on Bill Pay, visit our website frankenmuthcu.org or stop by your<br />

local <strong>FCU</strong> branch.<br />

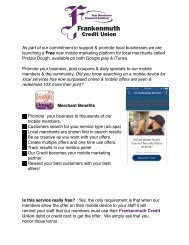

NEW! PRETZEL DOUGH SHOPPING APP Save some dough when<br />

you shop with the <strong>FCU</strong>’s new Pretzel Dough App. Now you can have access to upto-date<br />

coupons from over 900+ national chain merchants and—coming soon—local<br />

retailers too. The Pretzel Dough is a smart app that predicts shopping choices and<br />

behavior for members by relying on relevant actions, geo-location and use. Download<br />

the free Pretzel Dough app from iTunes ® or Google Play ® .<br />

NEW VIRTUAL STRONGBOX Think of it as an online safe deposit box,<br />

accessed directly from within your It’s Me 247 login. Conveniently save and share<br />

important documents, such as wills, mortgages, tax and loan forms—all safely and<br />

securely. All members get 10mb of free storage. To get started, visit our website<br />

frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

KASASA® CASH CHECKING What’s better than free checking? Kasasa Cash ® is free checking that pays high rates each month. Plus, there is<br />

no minimum balance. With Kasasa ® we will refund your ATM fees, nationwide*. This allows you to withdraw cash when you need it. No more searching for a<br />

“free” ATM, when you’re on the road. Do you Kasasa ® ? For more information, visit frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

KASASA ® TUNES SAVER Turn up your free checking account with <strong>FCU</strong> Kasasa Tunes ® – free checking that rewards you with cash to spend<br />

online! Just do simple things you do anyway, like use your debit card rather than write a check. Then, we will refund up to $10 iTunes ® , Google Play ® or<br />

Amazon ® purchases each month – that’s a $10 minimum reward every month you qualify. Plus, we will refund your ATM fees, nationwide. Do you Kasasa ® ?<br />

For more information, visit frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

Account approval, qualifications, limits and other requirements apply. See Frankenmuth Credit Union for details. iTunes® is a registered trademark of Apple Inc. and Amazon.com® is a registered<br />

trademark of Amazon, Inc. Apple Inc. and Amazon, Inc. are not participants in or sponsors of this program. ATM fees incurred during qualification cycle will be reimbursed<br />

up to $25 if qualifications are met within monthly qualification cycle. Limit 1 account per SSN.<br />

Federally Insured by<br />

17

V.I.P. REWARDS We value our members, the services they use and the balances they keep with <strong>FCU</strong>. Because of this, we offer the V.I.P. (Value In<br />

Participation) Rewards program. Our V.I.P. Rewards Program reviews the amount of <strong>FCU</strong> products and services members use and assigns points for that<br />

usage. The more services you use with Frankenmuth Credit Union the higher your level and reward. Lifetime points are your V.I.P. Rewards points that<br />

accumulate from month to month. These points can be redeemed over time for merchandise, better rates, fee waivers and other service offerings.<br />

In 2015 V.I.P Rewards paid $324,846 in loan interest rebates and $86,381 in higher CD dividend benefits! For more information on V.I.P. Rewards, email<br />

ccenter@frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

o p p o r t u n i t i e s<br />

SAVE TO WIN Save To Win is a 12-month CD that earns a competitive rate of return and only requires $25 at opening. Every time you deposit<br />

to this CD, in $25 increments, you earn an entry into a monthly drawing where you could win cash rewards from $15 to $5000. Why gamble? With Save<br />

To Win all of the money you deposit is still yours, you earn a great rate of return and you could win money! For a complete list of prizes and rules visit<br />

frankenmuthcu.org.<br />

DIAMOND CASH BACK<br />

Frankenmuth Credit Union, your hometown financial solution, offers credit cards even better than the big<br />

banks. Plus, your dollars stay local. Our Diamond MasterCard offers low rates, earns 1.5% Cash Back on all purchases, flexible repayment options, 24/7 fraud<br />

monitoring and you can upload your own design for the card. For more information, visit frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

ID PROTECT | CELL PHONE COVERAGE Your identity protection is our highest priority. <strong>FCU</strong> members with consumer checking accounts<br />

and their family will receive identity theft protection powered by IDProtect, for a low monthly security fee of $2. <strong>FCU</strong> members who qualify also receive up<br />

to $10,000 in identity fraud expense reimbursement coverage for expenses associated with restoring your identity. Members who have ID Protect receive up<br />

to $300 of coverage to reimburse the cost of replacing or repairing your eligible cell phones. This includes the primary line and up to two additional lines.<br />

For more information, visit frankenmuthcu.org or stop by your local <strong>FCU</strong> branch.<br />

NEW! APPLE PAY<br />

<strong>FCU</strong> members with an iPhone ® 6 and the iPad<br />

Air ® 2 and iPad mini ® 3 can now use their <strong>FCU</strong><br />

debit cards on Apple Pay. We call it pocket<br />

charm. Apple Pay users no longer have to carry<br />

their wallet, but will instead load their <strong>FCU</strong> debit<br />

cards in to their Apple device. Users must have<br />

an iTunes ® account and use either Wallet or<br />

Passbook applications. For more information, visit<br />

frankenmuthcu.org or applepay.com. Coming this<br />

Fall, you will be able to upload your <strong>FCU</strong> credit<br />

cards to Apple Pay.<br />

NEW! CARD NAV APP<br />

Manage and protect your debit card with ease.<br />

Control how, when and where your debit card may<br />

be used with CardNav. CardNav is rich with tools to<br />

protect your card if it is lost or stolen. And, it shows<br />

you balances and recent transactions - including<br />

purchases, ATM withdrawals and even attempted<br />

transactions. Establish controls on the merchants<br />

you use, dollar limits and location of use. Download<br />

the Free Card Nav app from itunes ® or Google Play ® .<br />

Coming this Fall, you will be able to control your<br />

<strong>FCU</strong> credit cards, too.<br />

NEW! E-DEPOSIT<br />

Deposit your paper check with this safe and secure<br />

e-Deposit. e-Deposit allows you to make deposits to<br />

your <strong>FCU</strong> account by taking a picture of your check<br />

and filling out the JotForm with your account number<br />

and account details. You can also use eDeposit to<br />

send pictures of other items, like your picture ID or<br />

loan documents. It’s as easy as point, click, deposit.<br />

For more information, visit frankenmuthcu.org or<br />

stop by your local <strong>FCU</strong> branch.<br />

19

l o y a l t y<br />

STEVE MASKER<br />

—10 YEARS—<br />

JENNY BICKEL<br />

—25 YEARS—<br />

CASSY NITZ<br />

—10 YEARS—<br />

DEBBIE BAUER<br />

—25 YEARS—<br />

LINDSAY KAUFMAN<br />

—5 YEARS—<br />

ANGIE ENGELHARDT<br />

—20 YEARS—<br />

SIERRA CHIESA<br />

—5 YEARS—<br />

SHERYL BILLS<br />

—15 YEARS—<br />

TIM CHRISTENSEN<br />

—5 YEARS—<br />

HOLLIE BRITTON<br />

—10 YEARS—<br />

HOPE POCKET Our commitment to our members goes beyond what <strong>FCU</strong> does as an organization. It lives in the<br />

hearts...and pockets of our staff. It’s about ‘people helping people’ and we call it Hope Pocket.<br />

CINDY RINESS<br />

—5 YEARS—<br />

Hope Pocket is a program created by staff to donate from each payroll to help our members when disaster strikes. Through<br />

this initiative, we have provided clothes to families who have lost everything in a fire, delivered care-packages to families when<br />

a loved one is in the hospital, refurbished a house for a family of five who were in a financial hardship, given backpacks filled<br />

with school supplies to students in need, provided Thanksgiving dinners and so much more. <strong>FCU</strong> staff volunteers time through<br />

initiatives such as our annual Rake and Run program (doing yard work for those physically unable). Staff also generously<br />

donates their time to work at soup kitchens in Saginaw, Bay City & Flint every year.<br />

First, let’s talk about probability. I’m sure you recall the highest-ever<br />

Powerball jackpot of $1.5 Billion in January. I wouldn’t be surprised<br />

that many of you, if not almost everyone reading this, purchased a ticket.<br />

I know I did! What I don’t understand are the reports of some<br />

individuals buying $100, $500, and even $5000 worth of tickets.<br />

The odds are truly stacked against you no matter how many tickets<br />

you buy. Each ticket was reported to have a 1 in 292 million chance<br />

of winning. Keep in mind, the US population is somewhere in the<br />

range of 320 million. Those are pretty poor odds, but why would we<br />

do something we’re less likely to do than golfing two straight hole in<br />

ones? The thought that someone has to win and dreaming it could<br />

be you. I guess we can all keep on dreaming.<br />

One of the few things less likely to happen than winning the<br />

Powerball is also sports-related. The odds to pick a perfect March<br />

Madness bracket are a staggering 1 in 128 Billion. Good Luck to all<br />

of you vying for that perfect bracket this March!<br />

Now, a little about volatility. While the stock market may look a little<br />

scary right now, the long-term picture still remains positive. As oil<br />

prices have continued to decline, gas prices have followed, which<br />

translates to more money in your pocket. But what does that mean<br />

for your 401(k) and other investments?<br />

As stated in the referenced MFS piece, “Maintaining a long-term time<br />

horizon and sticking to a disciplined, well diversified strategy may help<br />

weather this volatility.” So the recommendation is to stay the course,<br />

or even consider increasing your contributions. Bear markets may actually<br />

be considered a buying opportunity as they have historically been much<br />

shorter than bull markets. As the market cycle continues, this could be an<br />

opportunity to buy on the cheap.<br />

For those of you approaching or already in retirement, we tend to move<br />

toward more conservative investments. The Member Investment Center<br />

also offers a number of investment and insurance options that are not<br />

invested in the market.<br />

BUY LOW, SELL WHY?<br />

No matter which category you fall into, you probably won’t be winning the<br />

Volatility is inevitable. While historically bear markets have been relatively short, they can be<br />

damaging. Maintaining lottery a anytime long-term soon. horizon and Instead, sticking to a disciplined, visit the well Member diversified Investment Center, we are<br />

strategy may help weather this volatility.<br />

here to help you plan for your future.<br />

Historically, bull markets have been prolonged, while bear markets have been relatively short.<br />

No matter what the market is doing or what the headlines read, don’t let your emotions drive your decisions.<br />

Counter with a sound investment plan and a good financial coach. Whenever you have questions, concerns,<br />

or ideas, talk and work with your advisor. He or she may best be able to help you pursue your long term goals.<br />

100,000<br />

10,000<br />

1,000<br />

100<br />

10<br />

4/28/42<br />

5/29/46<br />

128.7%<br />

Bull-market gain<br />

6/13/49<br />

-24.0%<br />

Bear-market drop<br />

12/13/61<br />

354.8%<br />

6/26/62<br />

-27.1%<br />

2/9/66<br />

85.7%<br />

12/3/68<br />

32.4%<br />

10/7/66<br />

-25.2%<br />

5/26/70<br />

-35.9%<br />

1/11/73<br />

66.6%<br />

9/21/76<br />

75.7%<br />

12/6/74<br />

-45.1%<br />

2/28/78<br />

-26.9%<br />

4/27/81<br />

38.0%<br />

8/12/82<br />

-24.1%<br />

8/25/87<br />

250.4%<br />

10/19/87<br />

-36.1%<br />

7/16/90<br />

72.5%<br />

10/11/90<br />

-21.2%<br />

1/14/00<br />

395.7%<br />

3/19/02<br />

29.1%<br />

10/9/02<br />

-31.5%<br />

9/21/01<br />

-29.7%<br />

10/9/07<br />

94.4%<br />

3/9/09<br />

-53.8%<br />

1940 1950 1960 1970 1980 1990 2000 2010 2015<br />

Source: MFS.<br />

Returns are shown based on price only.<br />

The Dow Jones Industrial Average (DJIA) measures the US stock market.<br />

Past performance is no guarantee of future results.<br />

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE<br />

3/31/15<br />

171.5%<br />

so far<br />

Comments concerning past performance are not intended to be forward looking and should not<br />

be viewed as an indication of future results. Past performance does not indicate future results.<br />

Diversification does not ensure a profit or guarantee against loss; it is a method used to manage risk.<br />

Representatives are registered and securities are offered through Sigma Financial Corporation, member<br />

FINRA/SIPC, 300 Parkland Plaza, Ann Arbor, MI 48103. Non-deposit investment products are not<br />

federally insured, involve investment risk, may lose value, and are not obligations of or guaranteed<br />

by the credit union. Member Investment Center and Frankenmuth Credit Union are not affiliated with<br />

Sigma Financial Corporation. Member Investment Center mailing address is 580 N. Main St., PO Box<br />

209, Frankenmuth, MI 48734.<br />

1.“Buy Low, Sell Why?” MFS Fund Distributors, Inc, Boston, MA. Web. May 2015.<br />

See other side for important information.<br />

11

a c c u r a c y<br />

Board Members present: Pete Bender, Brian Dixon, Brian Frederick, Amy<br />

Zehnder-Grossi, Ann DuRussel, Cheryl Loeffler, Rich Reif, Mike Fassezke, and<br />

Tim Hildner.<br />

Others present: Vickie Schmitzer, Dana Reif, Kari Schmitzer, Joanne Frederick,<br />

Jeff Schmitzer, Danika Schmitzer, Doug Anderson, Hollie Britton, and Janet Reif.<br />

The meeting was called to order at 6:02pm by Chairman of the Board Pete<br />

Bender. Rich Reif presented the Secretary’s report. A motion was made to<br />

approve 2014’s annual meeting minutes as presented by Brian Frederick,<br />

supported by Brian Dixon. Motion carried. Brian Dixon gave the Treasurer’s<br />

<strong>Report</strong>, found on page 9 of the 2015 Hometown Times. A motion was made by<br />

Tim Hildner, supported by Rich Reif to approve as presented. Motion carried.<br />

Hollie Britton delivered the Credit Committee report, found on page 8 of the<br />

2015 Hometown Times. A motion was made by Rich Reif and supported by<br />

Ann DuRussel to approve report as presented. Motion carried. Brian Dixon<br />

presented the audit report, found on page 8 of the 2015 Hometown Times.<br />

A motion was made by Brian Frederick, supported by Amy Zehnder-Grossi to<br />

approve as presented. Motion carried.<br />

By-Law changes were reviewed by Dana Reif. The first change was on the<br />

expanded Field of Membership (statewide) wording. Another change was<br />

wording that was removed due to a contradiction to the Credit Union Act.<br />

February 3, <strong>2016</strong><br />

Board of Directors<br />

Frankenmuth Credit Union<br />

Frankenmuth, Michigan<br />

At your request, we have completed the Comprehensive <strong>Annual</strong> Audit of<br />

Frankenmuth Credit Union for the years ended December 31, 2015 and<br />

December 31, 2014.<br />

Our examination of the Statements of Financial Condition, Statements of<br />

Income, Comprehensive Income, Changes in Members’ Equity, and Cash Flows<br />

was conducted in accordance with auditing standards generally accepted in<br />

the United States of America. Our full report, which includes an unmodified<br />

opinion of the financial statements,<br />

Sincerely,<br />

has been submitted to the<br />

Board of Directors.<br />

Cindrich, Mahalak & Co., P.C.<br />

The third was adding Bethel’s field of membership into ours. A motion was<br />

made to approve as presented by Brian Dixon, supported by Rich Reif. Motion<br />

carried.<br />

Old Business - None. New Business – None.<br />

Vickie Schmitzer presented the CEO report. Welcome C. Douglas Anderson,<br />

our former Board member. Thank you for your service. We are celebrating<br />

our 50th anniversary this year. 2014 was a year of growth. We opened<br />

a new branch in Cass City in 2014, and we are looking to open a satellite<br />

branch in 2015 in the Rockford area. Bethel AME CU joined us in 2014 as<br />

well. We purchased and have an agreement to sell the 111 N. Main Street<br />

property in 2014, which turned into a win-win for our community. The<br />

Main office renovation is scheduled to be done in fall of 2015. There was an<br />

announcement of a new formation of a CUSO, owned by Frankenmuth Credit<br />

Union and Emil Rummel Agency that will offer insurance services to members.<br />

Thanks to our dedicated staff, engaged and educated Board members, spouses,<br />

and our members.<br />

Nominating Committee – Tim Hildner – There were no others running for<br />

office, so the 3 incumbents will continue to serve another term and they are<br />

Amy Zehnder-Grossi, Brian Frederick, and Cheryl Loeffler.<br />

A motion was made by Mike Fassezke and supported by Cheryl Loeffler to<br />

adjourn at 6:17pm. Motion carried.<br />

The Credit Committee is an employee group of Loan Officers. They meet every<br />

day to approve or deny loan requests. These requests are outside of the lending<br />

authority of individual Loan Officers.<br />

During 2015, we processed 7,697 loans totaling $118,134,890.40.<br />

Have you heard about our new Diamond Cashback MasterCard? It offers a<br />

competitive rate AND members earn 1.5% Cashback on all purchases. The<br />

Diamond MasterCard also offers a flexible repayment option, no fee for cash<br />

advances or balance transfers, 24/7 fraud monitoring, and you can create your<br />

own custom card. Stop in to one of our branches or apply online today.<br />

Respectfully submitted,<br />

<strong>FCU</strong> Credit Committee<br />

Frankenmuth Credit Union<br />

had a financially successful<br />

year in 2015. There was<br />

growth in loans to our<br />

members and increases in<br />

deposits from our members.<br />

Services that our members<br />

use and electronic delivery<br />

channels also grew. Assets<br />

increased to just over $410<br />

million which was a 19%<br />

increase in just one year.<br />

What an accomplishment!<br />

In reviewing the Income<br />

Statement, <strong>FCU</strong> had strong<br />

earnings coming from<br />

loan income, income from<br />

operations and income from<br />

investments. Overall return<br />

for the credit union was<br />

in excess of $6 million of<br />

earnings. This includes the<br />

sale of the Frankenmuth bank<br />

building that was purchased<br />

for use during the Main Office<br />

remodeling project. This<br />

return also includes the annual<br />

deposit to the Frankenmuth<br />

Community Foundation for<br />

our Communities. This year<br />

$250,000 was set aside for<br />

this worthy cause. What a<br />

privilege for the credit union<br />

to be able to reinvest dollars<br />

of this magnitude back to the<br />

communities we so proudly<br />

serve.<br />

13