990-PF - The Getty

990-PF - The Getty

990-PF - The Getty

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

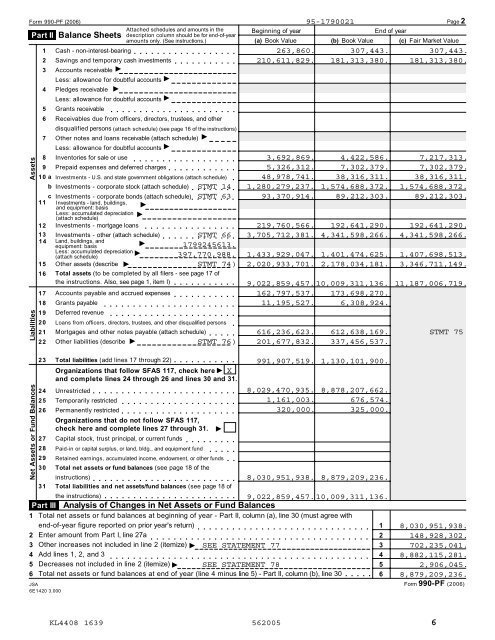

Form <strong>990</strong>-<strong>PF</strong> (2006)<br />

Attached schedules and amounts in the<br />

Part II Balance Sheets description column should be for end-of-year<br />

amounts only. (See instructions.)<br />

1 Cash - non-interest-bearing mmmmmmmmmmmmmmmmmm<br />

2 Savings and temporary cash investments mmmmmmmmmmm<br />

3 Accounts receivable<br />

Assets<br />

Liabilities<br />

Net Assets or Fund Balances<br />

I<br />

I<br />

Less: allowance for doubtful accounts<br />

4 Pledges receivable<br />

Less: allowance for doubtful accounts<br />

5 Grants receivable mmmmmmmmmmmmmmmmmmmmmm<br />

6 Receivables due from officers, directors, trustees, and other<br />

disqualified persons (attach schedule) (see page 16 of the instructions)<br />

7 Other notes and loans receivable (attach schedule) I<br />

Less: allowance for doubtful accounts I<br />

8 Inventories for sale or use mmmmmmmmmmmmmmmmmm<br />

9 Prepaid expenses and deferred charges mmmmmmmmmmmm<br />

10 a Investments - U.S. and state government obligations (attach schedule) m<br />

b Investments - corporate stock (attach schedule) mmmmmmmm STMT 14<br />

c Investments - corporate bonds (attach schedule)m STMT mmmmmmm 63<br />

11 Investments - land, buildings,<br />

and equipment: basis I<br />

Less: accumulated depreciation<br />

(attach schedule) I<br />

Investments - mortgage loans<br />

17 Accounts payable and accrued expenses mmmmmmmmmmm<br />

18 Grants payable mmmmmmmmmmmmmmmmmmmmmmm<br />

19 Deferred revenue mmmmmmmmmmmmmmmmmmmmmm<br />

20 Loans from officers, directors, trustees, and other disqualified persons m<br />

21 Mortgages and other notes payable (attach schedule) mmmmm<br />

22 Other liabilities (describe I<br />

STMT 76 )<br />

2 3 Total liabilities (add lines 17 through 22) mmmmmmmmmmm<br />

I<br />

I<br />

Organizations that follow SFAS 117, check hereI<br />

24<br />

25<br />

26<br />

and complete lines 24 through 26 and lines 30 and 31.<br />

Unrestricted mmmmmmmmmmmmmmmmmmmmmmmmm<br />

Temporarily restricted mmmmmmmmmmmmmmmmmmmm<br />

Permanently restrictedmmmmmmmmmmmmmmmmmmmm 27<br />

28<br />

29<br />

Organizations that do not follow SFAS 117,<br />

check here and complete lines 27 through 31. I<br />

Capital stock, trust principal, or current funds mmmmmmmmm<br />

Paid-in or capital surplus, or land, bldg., and equipment fund mmmmm<br />

Retained earnings, accumulated income, endowment, or other funds mm<br />

30 Total net assets or fund balances (see page 18 of the<br />

mmmmmmmmmmmmmmmmmmmmmmmmm<br />

instructions)<br />

8,030,951,938. 8,879,209,236.<br />

31 Total liabilities and net assets/fund balances (see page 18 of<br />

the instructions) mmmmmmmmmmmmmmmmmmmmmmm 9,022,859,457. 10,009,311,136.<br />

Part III Analysis of Changes in Net Assets or Fund Balances<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

Total net assets or fund balances at beginning of year - Part II, column (a), line 30 (must agree with<br />

end-of-year figure reported on prior year's return) mmmmmmmmmmmmmmmmmmmmmmmmmmmmmm 1<br />

Enter amount from Part I, line 27a mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm 2<br />

Other increases not included in line 2 (itemize) I SEE STATEMENT 77<br />

3<br />

Add lines 1, 2, and 3 mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm 4<br />

Decreases not included in line 2 (itemize) I SEE STATEMENT 78<br />

5<br />

Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30 mmmmm 6<br />

JSA<br />

6E1420 3.000<br />

KL4408 1639 562005<br />

X<br />

95-1790021<br />

Page 2<br />

Beginning of year End of year<br />

(a) Book Value (b) Book Value (c) Fair Market Value<br />

263,860. 307,443. 307,443.<br />

210,611,829. 181,313,380. 181,313,380.<br />

3,692,869.<br />

5,326,312.<br />

48,978,741.<br />

1,280,279,237.<br />

93,370,914.<br />

616,236,623.<br />

201,677,832.<br />

991,907,519.<br />

8,029,470,935.<br />

1,161,003.<br />

320,000.<br />

4,422,586. 7,217,313.<br />

7,302,379. 7,302,379.<br />

38,316,311. 38,316,311.<br />

1,574,688,372. 1,574,688,372.<br />

89,212,303. 89,212,303.<br />

12 mmmmmmmmmmmmmmmm<br />

13 Investments - other (attach schedule) mmmmmmmmmmmmm STMT 66<br />

14 Land, buildings, and<br />

equipment: basis I 1799245613.<br />

Less: accumulated depreciationI<br />

(attach schedule)<br />

397,770,988.<br />

15 Other assets (describe I<br />

STMT 74 )<br />

16 Total assets (to be completed by all filers - see page 17 of<br />

the instructions. Also, see page 1, item I) mmmmmmmmmmm<br />

219,760,566. 192,641,290.<br />

3,705,712,381. 4,341,598,266.<br />

1,433,929,047. 1,401,474,625.<br />

2,020,933,701. 2,178,034,181.<br />

9,022,859,457. 10,009,311,136.<br />

192,641,290.<br />

4,341,598,266.<br />

1,407,698,513.<br />

3,346,711,149.<br />

11,187,006,719.<br />

162,797,537. 173,698,270.<br />

11,195,527. 6,308,924.<br />

612,638,169.<br />

337,456,537.<br />

1,130,101,900.<br />

8,878,207,662.<br />

676,574.<br />

325,000.<br />

STMT 75<br />

8,030,951,938.<br />

148,928,302.<br />

702,235,041.<br />

8,882,115,281.<br />

2,906,045.<br />

8,879,209,236.<br />

Form <strong>990</strong>-<strong>PF</strong> (2006)<br />

6