Cyber Threats Targeting Mergers and Acquisitions

10sG0c

10sG0c

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3. Steps of the Merger/Acquisition Process<br />

While evidence shows that corporate espionage is alive <strong>and</strong> well, <strong>and</strong> that actors have been<br />

successful in infiltrating many organizations with novel <strong>and</strong> indirect approaches, it’s important to<br />

underst<strong>and</strong> where in the st<strong>and</strong>ard M&A process attacks can occur, <strong>and</strong> why.<br />

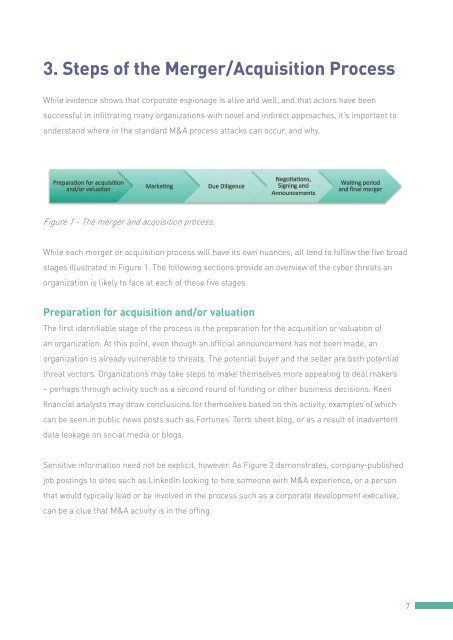

Figure 1 - The merger <strong>and</strong> acquisition process.<br />

While each merger or acquisition process will have its own nuances, all tend to follow the five broad<br />

stages illustrated in Figure 1. The following sections provide an overview of the cyber threats an<br />

organization is likely to face at each of these five stages.<br />

Preparation for acquisition <strong>and</strong>/or valuation<br />

The first identifiable stage of the process is the preparation for the acquisition or valuation of<br />

an organization. At this point, even though an official announcement has not been made, an<br />

organization is already vulnerable to threats. The potential buyer <strong>and</strong> the seller are both potential<br />

threat vectors. Organizations may take steps to make themselves more appealing to deal makers<br />

– perhaps through activity such as a second round of funding or other business decisions. Keen<br />

financial analysts may draw conclusions for themselves based on this activity, examples of which<br />

can be seen in public news posts such as Fortunes’ Term sheet blog, or as a result of inadvertent<br />

data leakage on social media or blogs.<br />

Sensitive information need not be explicit, however. As Figure 2 demonstrates, company-published<br />

job postings to sites such as LinkedIn looking to hire someone with M&A experience, or a person<br />

that would typically lead or be involved in the process such as a corporate development executive,<br />

can be a clue that M&A activity is in the offing.<br />

7