Fintech and the evolving landscape

1VmrhLi

1VmrhLi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The <strong>Fintech</strong> l<strong>and</strong>scape<br />

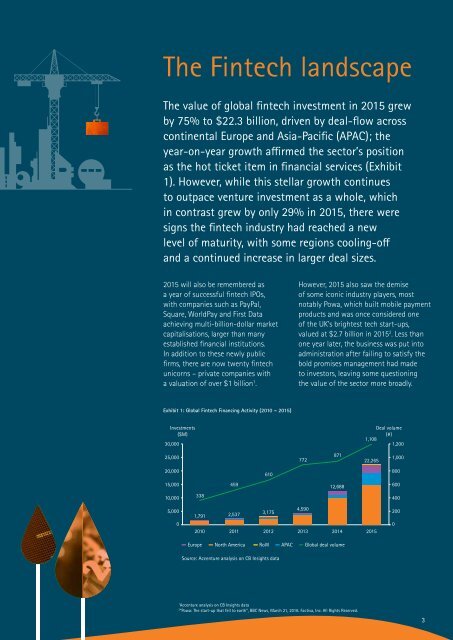

The value of global fintech investment in 2015 grew<br />

by 75% to $22.3 billion, driven by deal-flow across<br />

continental Europe <strong>and</strong> Asia-Pacific (APAC); <strong>the</strong><br />

year-on-year growth affirmed <strong>the</strong> sector’s position<br />

as <strong>the</strong> hot ticket item in financial services (Exhibit<br />

1). However, while this stellar growth continues<br />

to outpace venture investment as a whole, which<br />

in contrast grew by only 29% in 2015, <strong>the</strong>re were<br />

signs <strong>the</strong> fintech industry had reached a new<br />

level of maturity, with some regions cooling-off<br />

<strong>and</strong> a continued increase in larger deal sizes.<br />

2015 will also be remembered as<br />

a year of successful fintech IPOs,<br />

with companies such as PayPal,<br />

Square, WorldPay <strong>and</strong> First Data<br />

achieving multi-billion-dollar market<br />

capitalisations, larger than many<br />

established financial institutions.<br />

In addition to <strong>the</strong>se newly public<br />

firms, <strong>the</strong>re are now twenty fintech<br />

unicorns – private companies with<br />

a valuation of over $1 billion 1 .<br />

However, 2015 also saw <strong>the</strong> demise<br />

of some iconic industry players, most<br />

notably Powa, which built mobile payment<br />

products <strong>and</strong> was once considered one<br />

of <strong>the</strong> UK’s brightest tech start-ups,<br />

valued at $2.7 billion in 2015 2 . Less than<br />

one year later, <strong>the</strong> business was put into<br />

administration after failing to satisfy <strong>the</strong><br />

bold promises management had made<br />

to investors, leaving some questioning<br />

<strong>the</strong> value of <strong>the</strong> sector more broadly.<br />

Exhibit 1: Global <strong>Fintech</strong> Financing Activity (2010 – 2015)<br />

Investments<br />

($M)<br />

30,000<br />

Deal volume<br />

(#)<br />

1,108<br />

1,200<br />

25,000<br />

772<br />

871<br />

22,265<br />

1,000<br />

20,000<br />

610<br />

800<br />

15,000<br />

459<br />

12,688<br />

600<br />

10,000<br />

338<br />

400<br />

5,000<br />

0<br />

1,791<br />

2010<br />

2,537<br />

3,175<br />

4,590<br />

2011 2012 2013 2014 2015<br />

200<br />

0<br />

Europe North America RoW APAC Global deal volume<br />

Source: Accenture analysis on CB Insights data<br />

1<br />

Accenture analysis on CB Insights data<br />

2<br />

“Powa: The start-up that fell to earth”, BBC News, March 21, 2016. Factiva, Inc. All Rights Reserved.<br />

3