DEVRY ACCT 555 Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

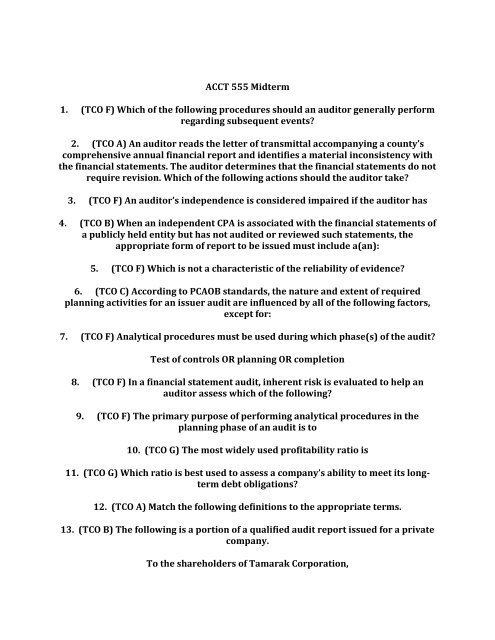

<strong>ACCT</strong> <strong>555</strong> Midterm<br />

1. (TCO F) Which of the following procedures should an auditor generally perform<br />

regarding subsequent events?<br />

2. (TCO A) An auditor reads the letter of transmittal accompanying a county’s<br />

comprehensive annual financial report and identifies a material inconsistency with<br />

the financial statements. The auditor determines that the financial statements do not<br />

require revision. Which of the following actions should the auditor take?<br />

3. (TCO F) An auditor’s independence is considered impaired if the auditor has<br />

4. (TCO B) When an independent CPA is associated with the financial statements of<br />

a publicly held entity but has not audited or reviewed such statements, the<br />

appropriate form of report to be issued must include a(an):<br />

5. (TCO F) Which is not a characteristic of the reliability of evidence?<br />

6. (TCO C) According to PCAOB standards, the nature and extent of required<br />

planning activities for an issuer audit are influenced by all of the following factors,<br />

except for:<br />

7. (TCO F) Analytical procedures must be used during which phase(s) of the audit?<br />

Test of controls OR planning OR completion<br />

8. (TCO F) In a financial statement audit, inherent risk is evaluated to help an<br />

auditor assess which of the following?<br />

9. (TCO F) The primary purpose of performing analytical procedures in the<br />

planning phase of an audit is to<br />

10. (TCO G) The most widely used profitability ratio is<br />

11. (TCO G) Which ratio is best used to assess a company’s ability to meet its longterm<br />

debt obligations?<br />

12. (TCO A) Match the following definitions to the appropriate terms.<br />

13. (TCO B) The following is a portion of a qualified audit report issued for a private<br />

company.<br />

To the shareholders of Tamarak Corporation,