Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Economic</strong><br />

Commentary<br />

<strong>Economic</strong> <strong>Insight</strong><br />

June 17, 2016<br />

Surface Optimism<br />

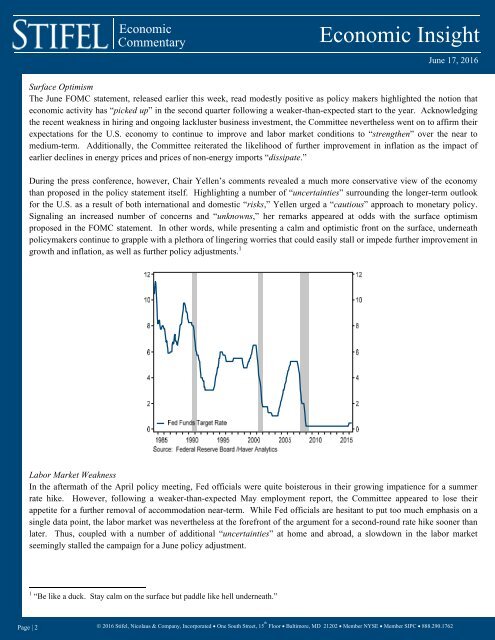

The June FOMC statement, released earlier this week, read modestly positive as policy makers highlighted the notion that<br />

economic activity has “picked up” in the second quarter following a weaker-than-expected start to the year. Acknowledging<br />

the recent weakness in hiring and ongoing lackluster business investment, the Committee nevertheless went on to affirm their<br />

expectations for the U.S. economy to continue to improve and labor market conditions to “strengthen” over the near to<br />

medium-term. Additionally, the Committee reiterated the likelihood of further improvement in inflation as the impact of<br />

earlier declines in energy prices and prices of non-energy imports “dissipate.”<br />

During the press conference, however, Chair Yellen’s comments revealed a much more conservative view of the economy<br />

than proposed in the policy statement itself. Highlighting a number of “uncertainties” surrounding the longer-term outlook<br />

for the U.S. as a result of both international and domestic “risks,” Yellen urged a “cautious” approach to monetary policy.<br />

Signaling an increased number of concerns and “unknowns,” her remarks appeared at odds with the surface optimism<br />

proposed in the FOMC statement. In other words, while presenting a calm and optimistic front on the surface, underneath<br />

policymakers continue to grapple with a plethora of lingering worries that could easily stall or impede further improvement in<br />

growth and inflation, as well as further policy adjustments. 1<br />

Labor Market Weakness<br />

In the aftermath of the April policy meeting, Fed officials were quite boisterous in their growing impatience for a summer<br />

rate hike. However, following a weaker-than-expected May employment report, the Committee appeared to lose their<br />

appetite for a further removal of accommodation near-term. While Fed officials are hesitant to put too much emphasis on a<br />

single data point, the labor market was nevertheless at the forefront of the argument for a second-round rate hike sooner than<br />

later. Thus, coupled with a number of additional “uncertainties” at home and abroad, a slowdown in the labor market<br />

seemingly stalled the campaign for a June policy adjustment.<br />

1 “Be like a duck. Stay calm on the surface but paddle like hell underneath.”<br />

Page | 2<br />

2016 Stifel, Nicolaus & Company, Incorporated One South Street, 15 th Floor Baltimore, MD 21202 Member NYSE Member SIPC 888.290.1762