Retailer

4MvT4lKRK

4MvT4lKRK

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

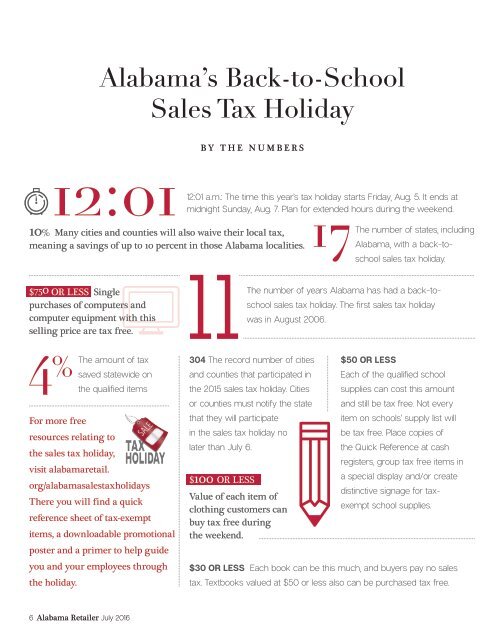

Alabama’s Back-to-School<br />

Sales Tax Holiday<br />

BY THE NUMBERS<br />

12:01<br />

10% Many cities and counties will also waive their local tax,<br />

meaning a savings of up to 10 percent in those Alabama localities.<br />

12:01 a.m.: The time this year’s tax holiday starts Friday, Aug. 5. It ends at<br />

midnight Sunday, Aug. 7. Plan for extended hours during the weekend.<br />

17The number of states, including<br />

Alabama, with a back-toschool<br />

sales tax holiday.<br />

$750 OR LESS Single<br />

purchases of computers and<br />

computer equipment with this<br />

selling price are tax free.<br />

11<br />

The number of years Alabama has had a back-toschool<br />

sales tax holiday. The first sales tax holiday<br />

was in August 2006.<br />

The amount of tax<br />

saved statewide on<br />

the qualified items<br />

For more free<br />

resources relating to<br />

the sales tax holiday,<br />

visit alabamaretail.<br />

org/alabamasalestaxholidays<br />

There you will find a quick<br />

reference sheet of tax-exempt<br />

items, a downloadable promotional<br />

poster and a primer to help guide<br />

you and your employees through<br />

the holiday.<br />

304 The record number of cities<br />

and counties that participated in<br />

the 2015 sales tax holiday. Cities<br />

or counties must notify the state<br />

that they will participate<br />

in the sales tax holiday no<br />

later than July 6.<br />

$100 OR LESS<br />

Value of each item of<br />

clothing customers can<br />

buy tax free during<br />

the weekend.<br />

$50 OR LESS<br />

Each of the qualified school<br />

supplies can cost this amount<br />

and still be tax free. Not every<br />

item on schools’ supply list will<br />

be tax free. Place copies of<br />

the Quick Reference at cash<br />

registers, group tax free items in<br />

a special display and/or create<br />

distinctive signage for taxexempt<br />

school supplies.<br />

$30 OR LESS Each book can be this much, and buyers pay no sales<br />

tax. Textbooks valued at $50 or less also can be purchased tax free.<br />

6 Alabama <strong>Retailer</strong> July 2016