ACCT 346 DEVRY (Managerial Accounting) Entire Course - 2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>346</strong> <strong>DEVRY</strong> (<strong>Managerial</strong><br />

<strong>Accounting</strong>) <strong>Entire</strong> <strong>Course</strong> - <strong>2015</strong><br />

IF You Want To Purcahse A+ Work then Click The Link Below For Instant Down Load<br />

http://www.acehomework.net/?download=acc-<strong>346</strong><br />

IF You Face Any Problem Then E Mail Us At JOHNMATE1122@GMAIL.COM<br />

<strong>ACCT</strong> <strong>346</strong> <strong>DEVRY</strong> (<strong>Managerial</strong> <strong>Accounting</strong>) <strong>Entire</strong> <strong>Course</strong> - <strong>2015</strong><br />

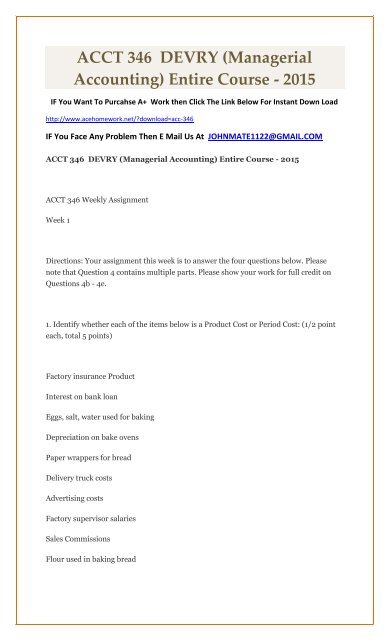

<strong>ACCT</strong> <strong>346</strong> Weekly Assignment<br />

Week 1<br />

Directions: Your assignment this week is to answer the four questions below. Please<br />

note that Question 4 contains multiple parts. Please show your work for full credit on<br />

Questions 4b - 4e.<br />

1. Identify whether each of the items below is a Product Cost or Period Cost: (1/2 point<br />

each, total 5 points)<br />

Factory insurance Product<br />

Interest on bank loan<br />

Eggs, salt, water used for baking<br />

Depreciation on bake ovens<br />

Paper wrappers for bread<br />

Delivery truck costs<br />

Advertising costs<br />

Factory supervisor salaries<br />

Sales Commissions<br />

Flour used in baking bread

2. Identify whether each of the items below is a Direct Cost or Indirect Cost: (1/2 point<br />

each, total 5 points)<br />

Factory insurance Indirect<br />

Baker's wages<br />

Eggs used for baking<br />

Depreciation on bake ovens<br />

Paper wrappers for bread<br />

Cleaning materials for bake ovens<br />

Utilities used in factory<br />

Factory supervisor salaries<br />

Small amount of salt used<br />

Flour used in baking bread<br />

3. Identify whether each of the below is a Fixed Cost or Variable Cost: (1/2 point each,<br />

total 5 points)<br />

Shipping costs for bread Variable<br />

Cost of fuel for delivery truck<br />

Factory rent<br />

Factory insurance<br />

Maintenance on delivery truck<br />

Sales commissions<br />

Hourly wages paid to baker's assistant<br />

Oven depreciation<br />

Cost of fruit for cake topping<br />

Factory utilities

4. Classify each as direct material, direct labor, indirect labor, indirect labor, other<br />

manufacturing overhead or period cost, and then answer the 5 questions below: 4a.<br />

Classify each cost (the first one is done for you): (5 points total)<br />

An airline manufacturer incurred the following costs last month (in thousands of<br />

dollars): Direct Material Direct Labor Indirect Material Indirect Labor Other<br />

Manufacturing Overhead Period Cost<br />

a. Depreciation on forklifts ........................................................................... $60 $60<br />

b. Property tax on corporate marketing office ............................................. $30<br />

c. Cost of warranty repairs ............................................................................ $220<br />

d. Factory janitors’ wages ............................................................................. $10<br />

e. Cost of designing new plant layout .......................................................... $190<br />

f. Machine operators’ health insurance ....................................................... $40<br />

g. Airplane seats ........................................................................................... $270<br />

h. Depreciation on administrative offices ..................................................... $70<br />

i. Assembly workers’ wages ......................................................................... $670<br />

j. Plant utilities ............................................................................................. $110<br />

k. Production supervisors’ salaries ................................................................ $160<br />

l. Jet engines ................................................................................................ $1,100<br />

m. Machine lubricants .................................................................................... $20<br />

Then, answer the below questions:<br />

4b. How much are total manufacturing overhead costs? (5 points)<br />

4c. How much are total inventoriable product costs? (5 points)<br />

4d. How much are total prime costs? (5 points)<br />

4e. How much are total conversion costs? (5 points)<br />

DeVry University

<strong>ACCT</strong><strong>346</strong> Weekly Assignment<br />

Week 2<br />

Directions: Your assignment this week is to answer the three questions below. Please<br />

note that Question #3 has 2 parts, Part A and Part B. Please show your work for full<br />

credit and use the box provided. Please add more rows or columns to the box if needed.<br />

1. Biltz Company uses a predetermined overhead rate based on direct labor hours to<br />

allocate manufacturing overhead to jobs. During the year, the company actually<br />

incurred manufacturing overhead costs of $582,000 and 135,000 direct labor hours<br />

were worked. The company estimated that it would incur $525,000 of manufacturing<br />

overhead during the year and that 150,000 direct labor hours would be worked.<br />

By how much was manufacturing overhead overallocated or underallocated for the year?<br />

2. The following account balances at the beginning of January were selected from the<br />

general ledger of Ocean City Manufacturing Company:<br />

Work-in-process inventory $0<br />

Raw materials inventory $28,000<br />

Finished goods inventory $40,000<br />

Additional data:<br />

1) Actual manufacturing overhead for January amounted to $62,000.<br />

2) Total direct labor cost for January was $63,000.<br />

3) The predetermined manufacturing overhead rate is based on direct labor cost. The<br />

budget for the year called for $250,000 of direct labor cost and $350,000 of<br />

manufacturing overhead costs.

4) The only job unfinished on January 31 was Job No. 151, for which total direct labor<br />

charges were $5,200 (800 direct labor hours) and total direct material charges were<br />

$14,000.<br />

5) Cost of direct materials placed in production during January totaled $123,000. There<br />

were no indirect material requisitions during January.<br />

6) January 31 balance in raw materials inventory was $35,000.<br />

7) Finished goods inventory balance on January 31 was $34,500.<br />

What is the cost of goods manufactured for January? Show your work for full credit.<br />

3. Vintage Fun reproduces old-fashioned style roller skates and skateboards. The annual<br />

production and sales of roller skates is 950 units, while 1,750 skateboards are produced<br />

and sold. The company has traditionally used direct labor hours to allocate its overhead<br />

to products. Roller skates require 2.5 direct labor hours per unit, while skateboards<br />

require 1.25 direct labor hours per unit. The total estimated overhead for the period is<br />

$114,300. The company is looking at the possibility of changing to an activity-based<br />

costing system for its products. If the company used an activity-based costing system, it<br />

would have the following three activity cost pools:<br />

3a. What is the predetermined overhead allocation rate using the traditional costing<br />

system?<br />

3b. What is the overhead cost per skateboard using an activity-based costing system?<br />

week 3<br />

<strong>ACCT</strong><strong>346</strong>

Weekly Assignment<br />

Week 3<br />

Directions: Your assignment this week is to answer the two questions below. Please note<br />

that Question #2 has 2 parts, Part A and Part B. Please show your work for full credit<br />

and use the box provided. Please add more rows or columns to the box if needed.<br />

1. Beginning WIP inventory is 15,500 units, 75% complete for materials. During the<br />

month, 90,000 units were started; 87,000 were finished; and ending WIP was 18,500<br />

units that were 50% complete for materials.<br />

How many equivalent units should be used to allocate costs for materials? (Assume that<br />

the weighted average method is used, not FIFO.)<br />

2. During a period, 38,200 units were completed and 4,200 units were in ending WIP<br />

inventory. Ending WIP was 75% complete for direct materials and 50% complete for<br />

conversion costs.<br />

2a. What are the equivalent units for direct materials?<br />

2b. What are the equivalent units for conversion costs?<br />

week 4<br />

DeVryDeVry University

<strong>ACCT</strong><strong>346</strong> Weekly Assignment<br />

Week 5<br />

Directions: Your assignment this week is to answer the below three questions. Please<br />

note that question #1 has 2 parts, part a and part b and question #2 has 3 parts, part a,<br />

part b and part c. Please show your work for full credit and use the box provided. Please<br />

add more rows or columns to the box if needed.<br />

1. Palmer's Gourmet Chocolates produces and sells assorted boxed chocolates. The unit<br />

selling price is $50, unit variable costs are $25, and total fixed costs are $2,000.<br />

1a. How many boxes of chocolates must Palmer's Gourmet Chocolates sell to breakeven?<br />

1b. What are breakeven sales in dollars?<br />

2. Extreme Sports received a special order for 1,000 units of its extreme motorbike at a<br />

selling price of $250 per motorbike. Extreme Sports has enough extra capacity to accept<br />

the order. No additional selling costs will be incurred. Unit costs to make and sell this<br />

product are as follows: Direct materials, $100; direct labor, $50; variable manufacturing<br />

overhead, $14; fixed manufacturing overhead, $10, and variable selling costs, $2.<br />

2a. List the relevant costs.<br />

2b. What will be the change in operating income if Extreme Sports accepts the special<br />

order?

2c. Should Extreme Sports accept the special order? Why or why not?<br />

3. Totally Technology manufactures Cameras and Video Recorders. The company's<br />

product line income statement follows:<br />

Camera Video Recorder Total<br />

Sales revenue $3,00,000 $1,00,000 $4,00,000<br />

Cost of goods sold<br />

Variable $75,000 $49,000 $1,24,000<br />

Fixed $82,000 $28,000 $1,10,000<br />

Total cost of goods sold $1,57,000 $77,000 $2,34,000<br />

Gross profit $1,43,000 $23,000 $1,66,000<br />

Marketing and administrative expenses<br />

Variable $25,000 $28,000 $53,000<br />

Fixed $32,000 $19,000 $51,000<br />

Total marketing and administrative expenses $57,000 $47,000 $1,04,000<br />

Operating income (loss) $86,000 (24,000) $62,000<br />

Management is considering discontinuing the Video Recorder product line. Accountants<br />

for the company estimate that discontinuing the Video Recorder line will decrease fixed<br />

cost of goods sold by $10,000 and fixed marketing and administrative expenses by<br />

$4,000.<br />

Prepare an analysis supporting your opinion about whether or not the Video Recorder<br />

product line should be discontinued.<br />

UniversiDeVry University

<strong>ACCT</strong><strong>346</strong> Weekly Assignment<br />

Week 6<br />

Directions: Your assignment this week is to answer the two questions below. Please note<br />

that Question #2 has 2 parts, Part A and Part B. Please show your work for full credit<br />

and use the box provided. Please add more rows or columns to the box if needed.<br />

1. Cave Hardware's forecasted sales for April, May, June, and July are $200,000,<br />

$230,000, $190,000, and $240,000, respectively. Sales are 65% cash and 35% credit<br />

with all accounts receivables collected in the month following the sale. Cost of goods<br />

sold is 75% of sales and ending inventory is maintained at $60,000 plus 10% of the<br />

following month's cost of goods sold. All inventory purchases are paid 22% in the month<br />

of purchase and 78% in the following month.<br />

What are the cash collections budgeted for June?<br />

2. Madden Corporation manufactures t-shirts, which is its only product. The standards<br />

for t-shirts are as follows:<br />

Standard direct labor cost per hour $17<br />

Standard direct labor hours per t-shirt 0.6<br />

During the month of January, the company produced 1,250 t-shirts. Related production<br />

data for the month is as follows:<br />

Actual direct labor hours 770<br />

Actual direct labor cost incurred $13,000

2a. What is the direct labor rate variance for the month? Is it favorable or unfavorable?<br />

2b. What is the direct labor efficiency variance for the month? Is it favorable or<br />

unfavorable?<br />

ty<br />

<strong>ACCT</strong><strong>346</strong> Weekly Assignment<br />

Week 4<br />

Directions: Your assignment this week is to answer the question below which has four<br />

parts. Please show your work for full credit and use the boxes provided. Please add more<br />

rows or columns to the box if needed.<br />

1. MountainAir Company has the following selected data for the past year:<br />

Units sold during year 30,000<br />

Units produced during year 45,000<br />

Units in ending inventory 15,000<br />

Variable manufacturing cost per unit $4.50<br />

Fixed manufacturing overhead (in total) $20,250<br />

Selling price per unit $12.00<br />

Variable selling and administrative expense per unit $1.00<br />

Fixed selling and administrative expenses (in total) $4,000<br />

There were no units in beginning inventory.<br />

Required:

1a. Prepare an income statement for last year using absorption costing.<br />

1b. Calculate the value of the ending inventory using absorption costing.<br />

1c. Prepare an income statement for last year using variable costing.<br />

1d. Calculate the value of the ending inventory using variable costing.<br />

week 6<br />

DeVry University<br />

<strong>ACCT</strong><strong>346</strong> Weekly Assignment<br />

Week 6<br />

Directions: Your assignment this week is to answer the two questions below. Please note<br />

that Question #2 has 2 parts, Part A and Part B. Please show your work for full credit<br />

and use the box provided. Please add more rows or columns to the box if needed.<br />

1. Cave Hardware's forecasted sales for April, May, June, and July are $200,000,<br />

$230,000, $190,000, and $240,000, respectively. Sales are 65% cash and 35% credit<br />

with all accounts receivables collected in the month following the sale. Cost of goods<br />

sold is 75% of sales and ending inventory is maintained at $60,000 plus 10% of the<br />

following month's cost of goods sold. All inventory purchases are paid 22% in the month<br />

of purchase and 78% in the following month.<br />

What are the cash collections budgeted for June?

2. Madden Corporation manufactures t-shirts, which is its only product. The standards<br />

for t-shirts are as follows:<br />

Standard direct labor cost per hour $17<br />

Standard direct labor hours per t-shirt 0.6<br />

During the month of January, the company produced 1,250 t-shirts. Related production<br />

data for the month is as follows:<br />

Actual direct labor hours 770<br />

Actual direct labor cost incurred $13,000<br />

2a. What is the direct labor rate variance for the month? Is it favorable or unfavorable?<br />

2b. What is the direct labor efficiency variance for the month? Is it favorable or<br />

unfavorable?<br />

week 7<br />

DeVry University<br />

<strong>ACCT</strong><strong>346</strong> Weekly Assignment

Week 7<br />

Directions: Your assignment this week is to answer the four questions below. Please<br />

note that Question #1 has 2 parts, Part A and Part B. Please show your work for full<br />

credit and use the box provided. Please add more rows or columns to the box if needed.<br />

1. Gomez Corporation is considering two alternative investment proposals with the<br />

following data:<br />

Proposal X Proposal Y<br />

Investment $8,50,000 $4,68,000<br />

Useful life 8 years 8 years<br />

Estimated annual net $1,25,000 $78,000<br />

cash inflows for 8 years<br />

Residual value $40,000 $ -<br />

Depreciation method Straight-line Straight-line<br />

Required rate of return 14% 10%<br />

1a. How long is the payback period for Proposal X?<br />

1b. What is the accounting rate of return for Proposal Y?<br />

2. You have been awarded a scholarship that will pay you $500 per semester at the end<br />

of each of the next 8 semesters that you earn a GPA of 3.5 or better. You are a very<br />

serious student and you anticipate receiving the scholarship every semester. Using a<br />

discount rate of 3% per semester, which of the following is the correct calculation for

determining the present value of the scholarship? PLEASE STATE WHY YOU CHOSE<br />

THE ANSWER THAT YOU DID.<br />

A) PV = $500 × 3% × 8<br />

B) PV = $500 × (Annuity PV factor, i = 3%, n = 8)<br />

C) PV = $500 × (Annuity FV factor, i = 6%, n = 4)<br />

D) PV = $1,000 × (PV factor, i = 3%, n = 4)<br />

3. Maersk Metal Stamping is analyzing a special investment project. The project will<br />

require the purchase of two machines for $30,000 and $8,000 (both machines are<br />

required). The total residual value at the end of the project is $1,500. The project will<br />

generate cash inflows of $11,000 per year over its 8-year life.<br />

If Maersk requires a 6% return, what is the net present value (NPV) of this project? (Use<br />

present value tables or Excel.)<br />

4. Hincapie Manufacturing is evaluating investing in a new metal stamping machine<br />

costing $30,924. Hincapie estimates that it will realize $12,000 in annual cash inflows<br />

for each year of the machine's 3-year useful life.<br />

Approximately, what is the the internal rate of return (IRR) for the machine? (Use<br />

present value tables or Excel.<br />

<strong>ACCT</strong> <strong>346</strong> All Discussions - Latest <strong>2015</strong><br />

<strong>ACCT</strong> <strong>346</strong> Week 1 DQ 1 Ethics and Ethical Behavior<br />

<strong>ACCT</strong> <strong>346</strong> Week 1 DQ 2 <strong>Managerial</strong> and Financial <strong>Accounting</strong><br />

<strong>ACCT</strong> <strong>346</strong> Week 2 DQ 1 Job-Order Costing<br />

<strong>ACCT</strong> <strong>346</strong> Week 2 DQ 2 Process Costing

<strong>ACCT</strong> <strong>346</strong> Week 3 DQ 1 Cost-Volume-Profit Analysis<br />

<strong>ACCT</strong> <strong>346</strong> Week 3 DQ 2 Variable Costing and Full Costing<br />

<strong>ACCT</strong> <strong>346</strong> Week 4 DQ 1 Activity-Based Costing<br />

<strong>ACCT</strong> <strong>346</strong> Week 4 DQ 2 Incremental Cost Analysis<br />

<strong>ACCT</strong> <strong>346</strong> Week 5 DQ 1 Pricing Techniques<br />

<strong>ACCT</strong> <strong>346</strong> Week 5 DQ 2 Capital Budgeting Techniques<br />

<strong>ACCT</strong> <strong>346</strong> Week 6 DQ 1 Budgeting<br />

<strong>ACCT</strong> <strong>346</strong> Week 6 DQ 2 Standard Costs and Variance Analysis<br />

<strong>ACCT</strong> <strong>346</strong> Week 7 DQ 1 Responsibility Centers<br />

<strong>ACCT</strong> <strong>346</strong> Week 7 DQ 2 Financial Statement Analysis<br />

<strong>ACCT</strong> <strong>346</strong> Project Bravo Baking Company<br />

<strong>ACCT</strong> <strong>346</strong> Quiz Week 3<br />

<strong>ACCT</strong> <strong>346</strong> Quiz Week 6<br />

<strong>ACCT</strong> <strong>346</strong> Midterm New-Updated<br />

<strong>ACCT</strong> <strong>346</strong> Final Exam - LATEST<br />

Question 1.1. (TCO 1) How does managerial and financial accounting differ<br />

in terms of the amount of detail presented and nonmonetary and monetary<br />

information? (Points : 15)

Question 2.2. (TCO 2) What is an indirect labor cost? What is an example of<br />

an indirect labor cost? (Points : 15)<br />

Question 3.3. (TCO 3) What is the difference between job order and process<br />

costing? (Points : 15)<br />

Question 4.4. (TCO 4) What is a fixed cost? What is an example of a fixed<br />

cost? (Points : 15)<br />

Question 1.1. (TCO 5) What is full costing? How does it differ from variable<br />

costing? (Points : 15)<br />

Question 2.2. (TCO 6) What is the first step in the cost allocation process?<br />

What is done in this step? (Points : 15)<br />

Question 3.3. (TCO 7) What is an incremental cost? What is an example of<br />

one? (Points : 15)<br />

Question 4.4. (TCO 8) What is activity-based pricing? How is the price<br />

determined? (Points : 15)<br />

Question 1.1. (TCO 6) Name the steps in the ABC approach. Describe each<br />

of them. Which do you think is the most important step? Why? (Points : 30)<br />

Question 2.2. (TCO 7) Products Kappa and Sigma are joint products. The<br />

joint production cost of the products is $800. Kappa has a market value of<br />

$450 at the split-off point. If Kappa is further processed at an additional<br />

cost of $600, its market value is $1,400. Product Sigma has a market value<br />

of $1,150 at the split-off point. If Product Sigma is further processed at an<br />

additional cost of $300, its market value is $1,400. Using the relative sales<br />

value method, calculate the joint product cost that would be allocated to<br />

Kappa and Sigma. How do you know if one of the products should be<br />

further processed?<br />

(Points : 30)

Question 3.3. (TCO 8) A company must incur annual fixed costs of<br />

$4,000,000 and variable costs of $400 per unit and estimates that it can<br />

sell 40,000 pumps annually and marks up cost by 30 percent. Using costplus<br />

pricing, what is the cost per unit and the price? What are advantages<br />

and disadvantages of cost-plus pricing?(Points : 30)<br />

Question 1.1. (TCO 9) A project will require an initial investment of<br />

$250,000 and will return $50,000 each year for seven years. If taxes are<br />

ignored and the required rate of return is 9%, what is the project's net<br />

present value? Based on this analysis, should the company proceed with the<br />

project? (Points : 30)<br />

Question 2.2. (TCO 10) Why does a company perform ratio analysis? What<br />

are the debt-related ratios? Describe the formula for one debt-related ratio<br />

and explain how to interpret the ratio. (Points : 30)<br />

Question 1. Question :<br />

(TCO 1) Who are the users of managerial accounting<br />

information? How does their use of accounting information<br />

differ from the users of financial accounting information?<br />

(TCO 2) What is an indirect labor cost? What is an example of an indirect<br />

labor cost?<br />

TCO 3) What is job-order costing? What type of company would us joborder<br />

costing?<br />

(TCO 4) What is a variable cost? What is an example of a variable cost?<br />

(TCO 5) What is full costing? How does it differ from variable costing?

(TCO 6) Explain why companies might choose to allocate the costs of their service<br />

departments (ie. Human Resources, Maintenance, Mailroom, etc...) to their production<br />

departments. Also describe some typical bases companies use to base their allocations<br />

on. Last, what should a company be mindful of when analyzing the profitability of<br />

segments that have allocated costs.<br />

(TCO 7) What is an incremental cost? What is an example of one?<br />

(TCO 8) What is cost plus pricing? How does the company determine the profit level?<br />

Gina's Boutique makes custom jewelry. One item, the guru necklace, is a best seller and<br />

sales in units for the first quarter are as follows:<br />

Acme Fireworks uses a traditional overhead allocation based on direct labor hours. For<br />

the current year overhead is estimated at $1,000,000 and direct labor hours are budgeted at<br />

200,000 hours. Actual hours worked were 195,000 and actual overhead was $978,000.<br />

Question :<br />

(TCO 9) A project will require an initial investment of<br />

$300,000 and will return $75,000 each year for eight years. If<br />

taxes are ignored and the required rate of return is 9%, what is<br />

the project's net present value? Based on this analysis, should<br />

the company proceed with the project?