Your Retirement Roadmap - IUL Booklet Report - Ken DuBose

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

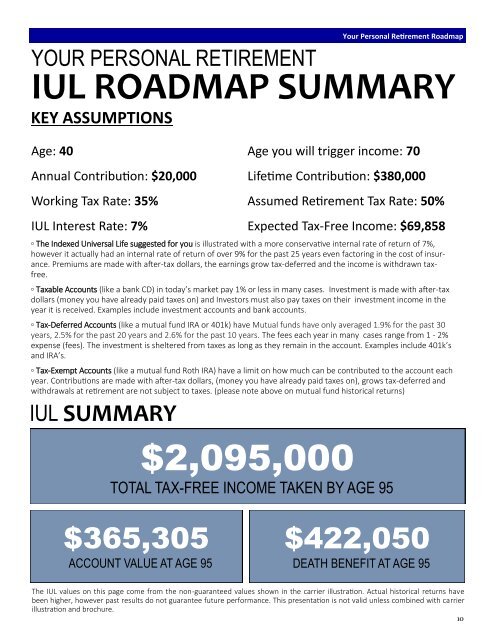

YOUR PERSONAL RETIREMENT<br />

KEY ASSUMPTIONS<br />

<strong>Your</strong> Personal <strong>Retirement</strong> <strong>Roadmap</strong><br />

<strong>IUL</strong> ROADMAP SUMMARY<br />

Age: 40 Age you will trigger income: 70<br />

Annual Contribution: $20,000 Lifetime Contribution: $380,000<br />

Working Tax Rate: 35% Assumed <strong>Retirement</strong> Tax Rate: 50%<br />

<strong>IUL</strong> Interest Rate: 7% Expected Tax-Free Income: $69,858<br />

◦ The Indexed Universal Life suggested for you is illustrated with a more conservative internal rate of return of 7%,<br />

however it actually had an internal rate of return of over 9% for the past 25 years even factoring in the cost of insurance.<br />

Premiums are made with after-tax dollars, the earnings grow tax-deferred and the income is withdrawn taxfree.<br />

◦ Taxable Accounts (like a bank CD) in today’s market pay 1% or less in many cases. Investment is made with after-tax<br />

dollars (money you have already paid taxes on) and Investors must also pay taxes on their investment income in the<br />

year it is received. Examples include investment accounts and bank accounts.<br />

◦ Tax-Deferred Accounts (like a mutual fund IRA or 401k) have Mutual funds have only averaged 1.9% for the past 30<br />

years, 2.5% for the past 20 years and 2.6% for the past 10 years. The fees each year in many cases range from 1 - 2%<br />

expense (fees). The investment is sheltered from taxes as long as they remain in the account. Examples include 401k’s<br />

and IRA’s.<br />

◦ Tax-Exempt Accounts (like a mutual fund Roth IRA) have a limit on how much can be contributed to the account each<br />

year. Contributions are made with after-tax dollars, (money you have already paid taxes on), grows tax-deferred and<br />

withdrawals at retirement are not subject to taxes. (please note above on mutual fund historical returns)<br />

<strong>IUL</strong> SUMMARY<br />

$2,095,000<br />

TOTAL TAX-FREE INCOME TAKEN BY AGE 95<br />

$365,305<br />

ACCOUNT VALUE AT AGE 95<br />

$422,050<br />

DEATH BENEFIT AT AGE 95<br />

The <strong>IUL</strong> values on this page come from the non-guaranteed values shown in the carrier illustration. Actual historical returns have<br />

been higher, however past results do not guarantee future performance. This presentation is not valid unless combined with carrier<br />

illustration and brochure.<br />

10